Roper Technologies Inc (ROP) Reports Strong Revenue and EBITDA Growth in Q4 and Full Year 2023

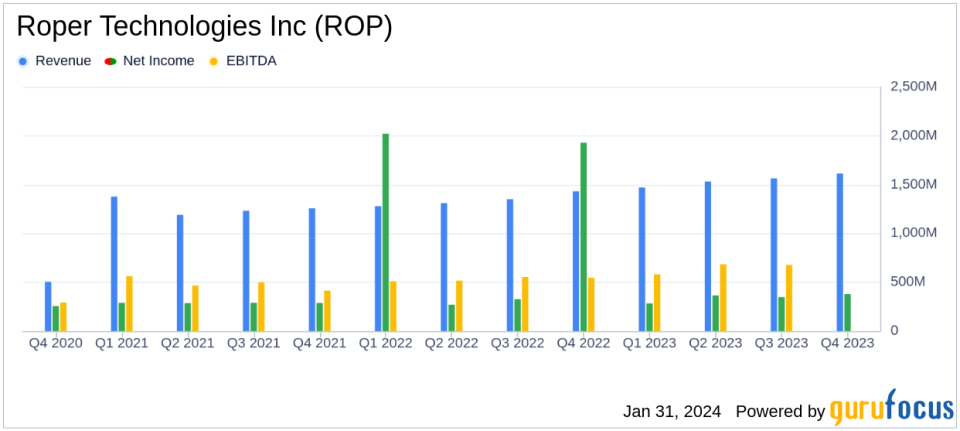

Revenue Growth: ROP reported a 13% increase in Q4 revenue and a 15% increase for the full year.

Adjusted EBITDA: Adjusted EBITDA rose by 11% in Q4 and 16% for the full year, reflecting strong operational performance.

GAAP and Adjusted DEPS: GAAP DEPS surged by 51% in Q4, while adjusted DEPS grew by 11%. Full year GAAP DEPS increased by 38%, with adjusted DEPS up by 17%.

Operating Cash Flow: GAAP operating cash flow reached $622 million in Q4, with an adjusted operating cash flow increase of 34%.

2024 Guidance: ROP expects adjusted DEPS of $17.85 - $18.15 for the full year 2024, with total revenue growth projected at 11-12%.

On January 31, 2024, Roper Technologies Inc (NASDAQ:ROP) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a diversified technology firm known for its application software, network software and systems, and technology-enabled products, has continued to transition its business towards technology software in mature, niche markets.

Financial Performance Highlights

Roper Technologies Inc (NASDAQ:ROP) reported a robust increase in revenue for the fourth quarter of 2023, with a 13% rise to $1.61 billion, and an 8% increase in organic revenue. The full year saw a similar trend, with revenue climbing 15% to $6.18 billion and organic growth also at 8%. Adjusted EBITDA for the quarter increased by 11% to $659 million, and for the full year, it rose by 16% to $2.51 billion.

GAAP net earnings for the quarter were reported at $378 million, and for the full year, $1.37 billion. GAAP Diluted Earnings Per Share (DEPS) increased significantly by 51% to $3.50 in Q4, and by 38% to $12.74 for the full year. Adjusted DEPS, which excludes certain non-GAAP adjustments, increased by 11% to $4.37 for the quarter and by 17% to $16.71 for the full year.

Operational and Strategic Developments

Neil Hunn, President and CEO of Roper Technologies, highlighted the company's operational execution and capital deployment strategy as key drivers of the 2023 success. Hunn noted the strategic investments made during the year, including the $2.1 billion allocated toward vertical software acquisitions, such as the combination of Syntellis Performance Solutions with Strata Decision Technology.

"Roper had a terrific 2023, both in terms of our operational execution and our capital deployment strategy. Financially, 2023 is highlighted by having 15% total revenue growth, 8% organic revenue growth, 16% EBITDA growth, and a 32% free cash flow margin," said Neil Hunn, Roper Technologies President and CEO.

Looking ahead to 2024, Roper Technologies anticipates continued positive momentum, driven by the expansion of its recurring revenue base and demand for its mission-critical solutions. The company expects full-year 2024 adjusted DEPS of $17.85 - $18.15, with total revenue growth of 11-12% and organic revenue growth of 5-6%. This guidance includes the impact of the acquisition of Procare Solutions, a leading software provider for the childcare market, expected to close in the first quarter of 2024.

Financial Metrics and Analysis

The company's financial achievements are particularly important given its focus on high-quality acquisitions and the transition towards a software-centric portfolio. The increase in adjusted EBITDA and DEPS reflects the company's ability to grow its core operations while maintaining profitability. The strong operating cash flow performance underscores Roper's efficient capital management and its potential for reinvestment in strategic growth initiatives.

Roper Technologies Inc (NASDAQ:ROP) continues to manage its diverse portfolio effectively, as evidenced by the solid financial results and the strategic acquisitions that align with its long-term growth objectives. The company's disciplined approach to capital deployment and its focus on niche markets with recurring revenue streams position it well for sustained financial performance.

For a more detailed analysis of Roper Technologies Inc (NASDAQ:ROP)'s financial results and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Stay tuned to GuruFocus.com for the latest financial news and expert analysis on Roper Technologies Inc (NASDAQ:ROP) and other value investment opportunities.

Explore the complete 8-K earnings release (here) from Roper Technologies Inc for further details.

This article first appeared on GuruFocus.