Ross Stores Inc (ROST) Posts Strong Q4 and Fiscal 2023 Results; Announces Stock Buyback and ...

Earnings Per Share (EPS): Q4 EPS increased to $1.82 from $1.31 in the prior year.

Net Income: Rose to $610 million in Q4, up from $447 million last year.

Sales: Q4 sales grew to $6.0 billion, with a 7% increase in comparable store sales.

Fiscal Year Performance: Fiscal 2023 EPS grew to $5.56, with net earnings of $1.9 billion on sales of $20.4 billion.

Stock Repurchase and Dividend: Announced a new two-year $2.1 billion stock repurchase and a 10% increase in quarterly cash dividend to $0.3675 per share.

Fiscal 2024 Guidance: Projects a 2-3% increase in same store sales and an EPS of $5.64 to $5.89.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Ross Stores Inc (NASDAQ:ROST) released its 8-K filing on March 5, 2024, detailing a robust performance for the fourth quarter and the full fiscal year of 2023. The off-price apparel and accessories retailer, known for its Ross Dress for Less banner, has outperformed expectations with significant growth in earnings, net income, and sales.

Financial Highlights and Company Overview

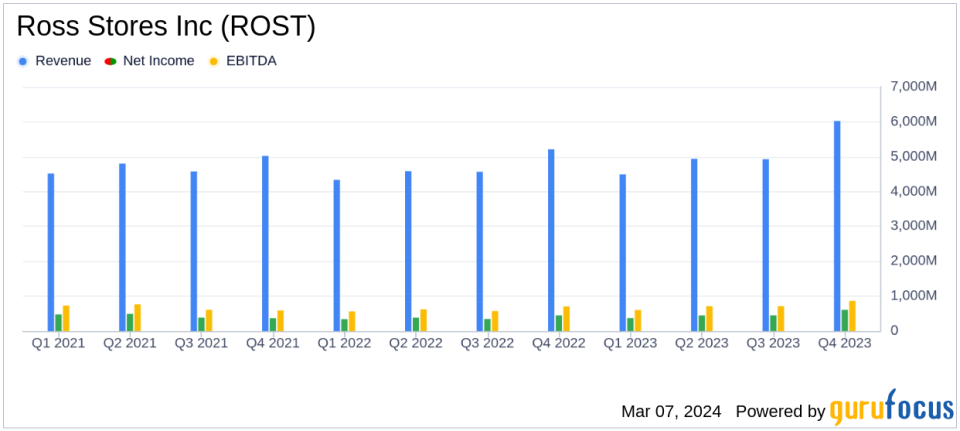

For the 14 weeks ended February 3, 2024, ROST reported a notable increase in earnings per share to $1.82, up from $1.31 per share for the comparable 13-week period last year. Net income for the quarter rose impressively to $610 million compared to $447 million in the previous year. Sales for the quarter grew to $6.0 billion, bolstered by a 7% increase in comparable store sales.

For the fiscal year 2023, ROST's earnings per share climbed to $5.56, up from $4.38 in the previous 52-week fiscal year. Net earnings reached $1.9 billion on sales of $20.4 billion, an increase from net earnings of $1.5 billion on sales of $18.7 billion in fiscal 2022. The company's comparable store sales grew by a solid 5% for the 52 weeks ended January 27, 2024.

Ross Stores operates as an off-price apparel and accessories retailer, primarily under the Ross Dress for Less banner, serving middle-income consumers with more than 1,750 stores. The company also operates nearly 350 DD's Discounts chains targeting lower-income shoppers.

Strategic Financial Moves and Future Outlook

During the fourth quarter, ROST repurchased 1.9 million shares for $247 million, completing its two-year stock repurchase program. The Board of Directors approved a new two-year $2.1 billion stock repurchase authorization for fiscal 2024 and 2025, an 11% increase over the prior repurchase program. Additionally, the Board authorized a 10% increase in the quarterly cash dividend to $0.3675 per share.

Despite the positive performance, CEO Barbara Rentler expressed caution due to ongoing macroeconomic and geopolitical uncertainties. For fiscal 2024, ROST is planning for a 2-3% growth in same store sales on top of the 5% gain in 2023. Earnings per share for fiscal 2024 are projected to be between $5.64 and $5.89.

We are pleased with our fourth quarter sales and earnings results that were well ahead of our expectations. Our above-plan sales were driven by customers positive response to our improved assortments of quality branded bargains throughout our stores," said Barbara Rentler, CEO of Ross Stores.

Financial Statements Summary

The income statement reflects the company's strong performance, with a significant increase in net earnings and sales. The balance sheet shows a healthy cash and cash equivalents position of $4.87 billion, and total assets amounting to $14.3 billion. The cash flow statement indicates robust operating cash flows of $2.51 billion for the twelve months ended February 3, 2024.

Overall, Ross Stores Inc (NASDAQ:ROST) has demonstrated a strong fiscal 2023 performance, with strategic initiatives to enhance shareholder value. The company's focus on delivering quality branded bargains positions it well for continued market share gains in the competitive retail sector.

Explore the complete 8-K earnings release (here) from Ross Stores Inc for further details.

This article first appeared on GuruFocus.