Ross Stores (ROST) Trends Up on Favorable Demand: What's Ahead?

Ross Stores, Inc. ROST has been gaining from positive consumer responses to its merchandise despite the competitive environment and digital growth. The company has been witnessing positive trends at its dd’s DISCOUNTS chain driven by better merchandise and moderating inflation.

The off-price model offers a strong value proposition and micro merchandising that drive better product allocation and margins. Also, it stands to gain from lower supply-chain costs from the prior year as ocean and domestic freight costs ease. However, low-to-moderate-income customers continue to reel under higher costs.

In third-quarter fiscal 2023, comparable store sales jumped 5%, backed by improved traffic. Total sales and earnings rose 7.9% and 33% year over year, respectively, and surpassed the Zacks Consensus Estimate. This marked the second straight quarter of top and bottom-line beat.

At Ross, the company witnessed strength in cosmetic, accessories and shoes categories, with broad-based growth across all geographic areas. At dd’s DISCOUNTS, performance was driven by favorable customer response to its value offerings.

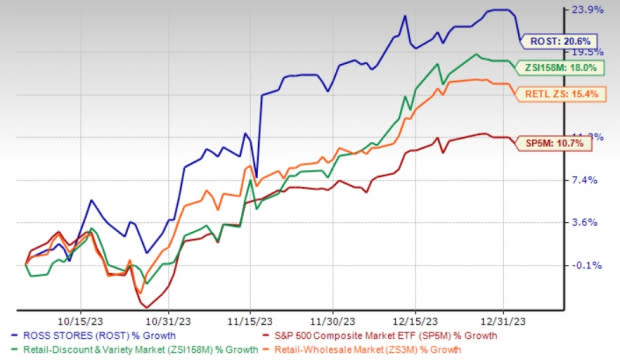

The company’s positive business momentum has been well reflected in its share price, with the stock outperforming the industry. Shares of this Zacks Rank #3 (Hold) company have rallied 20.6% in the past three months compared with the industry’s growth of 18%. The stock has also outpaced the sector and the S&P 500’s rise of 15.4% and 10.7%, respectively, in the same period.

Further optimism on the stock is reflected by its forward estimates, which suggest notable growth. The Zacks Consensus Estimate for ROST’s fiscal 2023 sales and earnings suggests growth of 7.5% and 22.4%, respectively, from the year-ago numbers.

Image Source: Zacks Investment Research

What’s Driving the Stock?

Ross Stores stays focused on delivering the most compelling bargains going forward, as customer demand for the best-branded values remains high amid prolonged inflation woes. Moreover, it has been judiciously managing its expenses and inventory to maximize its potential for sales and earnings growth.

Overall, gains at the core business demonstrated consumers' continued focus on value and ROST’s ability to deliver value bargains to customers. Over the long term, the company expects the rigorous execution of its off-price business models to enable it to consistently deliver solid results.

Ross Stores has been benefiting from higher merchandise margin as well as lower distribution expense, domestic freight and occupancy expense due to the easing of supply-chain headwinds. This led to 260 bps decline in cost of goods sold, as a percentage of revenues, which boosted operating margin. Merchandise margins increased 235 bps year over year, resulting from lower ocean freight costs.

Additionally, it witnessed a decline of 45 bps in distribution expenses and a 40 bps in domestic freight. ROST recorded a 25 bps leverage from occupancy costs.

Ross Stores has been consistent with the execution of its store expansion plans over the years. Its store expansion efforts are focused on continually increasing penetration in the existing as well as new markets.

Given the large retail closures and bankruptcies over the past several years, Ross Stores earlier raised its long-term store expansion targets. The company expects to expand “Ross Dress for Less” to 2,900 stores and dd’s DISCOUNTS to 700 stores. This represents a 20% increase in potential store growth targets, bringing it to 3,600 stores. This indicates a significant growth from its store count of 1,923 at the end of fiscal 2021.

Hurdles on the Way

Ross Stores has been witnessing higher costs due to ongoing macroeconomic volatility, rising inflation and geopolitical uncertainty. Also, rising incentive costs led to increased SG&A expense in the third quarter.

Stocks to Consider

Some better-ranked companies in the Retail-Wholesale sector are Abercrombie & Fitch ANF, Hibbett Sports HIBB and Deckers Outdoor DECK.

Abercrombie, which operates as a specialty retailer of premium, high-quality casual apparel for men, women and kids, currently flaunts a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for ANF’s current fiscal-year sales suggests growth of 13.3% from the year-ago number. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus mark for Abercrombie’s earnings is pegged at $5.74 per share, suggesting a significant growth from the year-ago figure of 25 cents. ANF has a trailing four-quarter earnings surprise of 713%, on average.

Hibbett, which provides products for individual as well as team sports across stores and online, currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for HIBB’s fiscal 2023 sales indicates 1.7% growth from the prior-year levels. It has a trailing four-quarter earnings surprise of 24.2%, on average.

Deckers, a leading designer, producer and brand manager of innovative, niche footwear and accessories developed for outdoor sports and other lifestyle-related activities, currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Deckers’ current financial-year sales and earnings implies growth of 11.7% and 21.9%, respectively, from the year-ago period’s actuals. DECK has a trailing four-quarter earnings surprise of 26.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Hibbett, Inc. (HIBB) : Free Stock Analysis Report