Rover Group Inc CEO Aaron Easterly Sells 265,800 Shares

Aaron Easterly, the CEO of Rover Group Inc (NASDAQ:ROVR), sold 265,800 shares of the company on February 5, 2024, according to a recent SEC filing. Rover Group Inc is a technology-driven platform that connects pet owners with pet care providers for services such as dog boarding, pet sitting, dog walking, and daycare.

The transaction was executed at an average price of $10.94 per share, resulting in a total value of $2,908,052. The insider's sale has altered the holding by a significant amount, considering the market cap of Rover Group Inc stands at $1.99 billion.

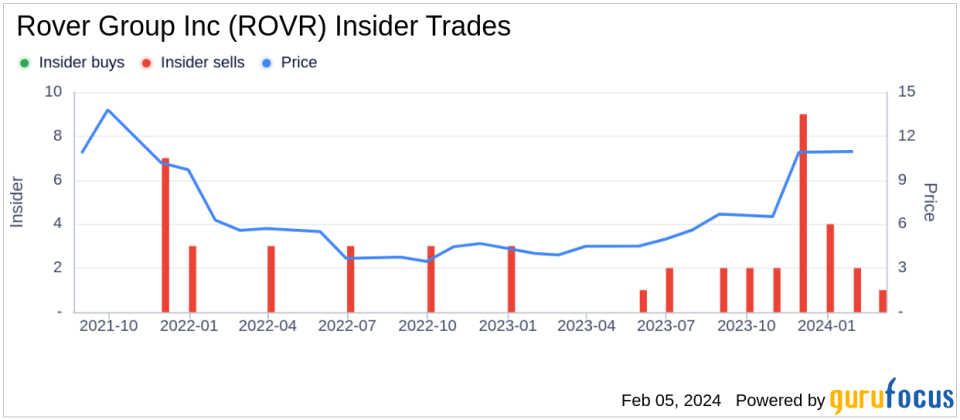

Over the past year, the insider has sold a total of 1,200,000 shares of Rover Group Inc and has not made any purchases of the stock. This latest transaction continues a trend observed over the past year, where there have been no insider buys but a total of 25 insider sells for the company.

The valuation metrics indicate that Rover Group Inc's shares are trading at a price-earnings ratio of 223.47. This figure is substantially higher than the industry median of 20.875 and also exceeds the companys historical median price-earnings ratio. Such a high price-earnings ratio suggests a premium valuation compared to the broader industry.

Investors often monitor insider selling as it can provide insights into an insider's perspective on the value of the stock. While insider selling is not necessarily indicative of a company's future performance, it can provide context for the stock's current valuation and potential future movements.

For more detailed information on insider transactions and stock performance for Rover Group Inc, interested parties can refer to the full SEC filings and additional market analysis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.