Royal Bank of Canada: One of the Best-Run Banks

- By Nathan Parsh

Royal Bank of Canada (NYSE:RY), commonly known as RBC, has engaged in a very quick turnaround from the depths of the pandemic. The company produced excellent results in the most recent quarter, which is noteworthy because the same period in the prior year was not as impacted by Covid-19 as other quarters in 2020. Nearly every business segment saw an improvement in the prior year, with especially strong results in the Capital Market segment.

Given the strong results, the efficient management and the bank's size andvantage, could it be a buy even with the higher valuation? Let's take a look.

Recent financial results

RBC reported impressive first-quarter fiscal 2021 results on Feb. 24. Revenue grew 6.5% to $10.4 billion, topping Wall Street analysts' expectations by $1.1 billion. Adjusted earnings per share of $2.15 was a 30 cents (16.2%) improvement from the previous year and 35 cents above estimates.

And these numbers aren't coming off easy comparable figures. RBC's first-quarter in fiscal year 2020 was the best for adjusted earnings per share and second best for revenue last year.

Provisions for credit losses greatly improved, declining 74% both sequentially and year-over-year. PCLs totaled just 0.07% of RBC's total loan portfolio. As of the first-quarter, PCLs are now below pre-pandemic levels, an impressive feat given the difficult environment last year.

Net income for the Personal and Commercial Banking segment increased 6%. Deposits grew 19% while loans were higher by 6% for the Canadian Banking business. Lower PCLs also contributed to growth. RBC accounts for at least 20% market share in every product category that it offers, led by long-term mutual funds (32.3% of market share), credit cards (28.2%) and business loans of $0 to $25 million (26.9%).

The company's efficiency ratio was 41.9% for the first-quarter compared to peer averages that are in the upper 40% range, showing that RBC is much better at controlling its overhead expenses even as staff costs increased during the quarter.

Wealth Management had a 4% improvement in net income, due primarily to an increase in loan growth and higher average fee-based client assets. Assets under administration grew almost 7% while assets under management were up more than 12%. This segment has a nearly even split between retail and institutional client assets.

RBC is the largest retail mutual fund company in Canada, with nearly 33% market share amongst its peers. The company also sees a much higher amount of fee-based assets per advisor than the competition, with a ratio of 1.7 times peers, allowing RBC to capture a large amount of income from its asset base.

Insurance net income was higher by 11%. Lower new longevity reinsurance contracts and weaker international volumes were more than offset by gains in claims and investments. Premiums and deposits did decline 6.4%, mostly on the Canadian side of the business. RBC has the top spot in individual disability, with 32% market share, and the number two spot in individual net new sales, with 27% market share.

Investors and Treasury Services was the lone segment to decline during the quarter as net income fell 14%. Not surprising, results were impacted by the low interest rate environment, though average deposits were up 17%. On the positive side, net income was up 35% from the fourth-quarter of 2020 due to money market activity and increased asset services revenue.

With a 21% increase in net income, Capital Markets was the best performing segment. Higher equity trading in U.S. markets provided much of the lift. Total average assets grew 4%. Merger and acquisitions revenue was down from the prior year, but this is somewhat misleading as the first-quarter of 2020 was RBC's best ever for M&A activity. The most recent quarter happens to be the second-best total ever. Lower PCLs were also a contributor. RBC is the 11th largest investment bank by fees, which means the company has the potential to move up in this area.

RBC's loan portfolio offers diversification protection. Just over half of all loans are residential mortgages. Commercial loans make up a third of the remaining portfolio, with personal loans accounting for 13% and credit cards 2%. Almost 80% of loans come from Canada, but only one region, Ontario, makes up more than 17% of total loans.

RBC also offers a compelling dividend yield of 3.5% at the moment, almost 200 basis points above the average yield of the S&P 500 index. The company didn't cut its dividend in the last recession, unlike the majority of its U.S. peers. In Canadian currency, RBC has raised its dividend every year for a decade.

Valuation

Analysts expect that RBC will produce earnings per share of $7.83 in 2021, which would be a 29% increase from last year's results. Of course, 2020 results were greatly impacted by the pandemic, so the comparisons are coming off a low base. That said, analysts expect that RBC will earn $8.17 in 2022, a 4% improvement from projected results for the current year. While the market expects much of the pandemic recovery will take place this year, analysts do see growth after that as well. Only twice in the last 10 years (2015 and 2020) has RBC failed to grow its bottom-line from the prior year.

Using the current share price of $94 and analysts' estimates for 2021, RBC trades with a forward price-earnings ratio of 12. Shares aren't as cheap as they were last year, but this multiple is in-line with the stock's long-term average. Even with all of the positives going for the bank, the price-earnings ratio remains reasonable.

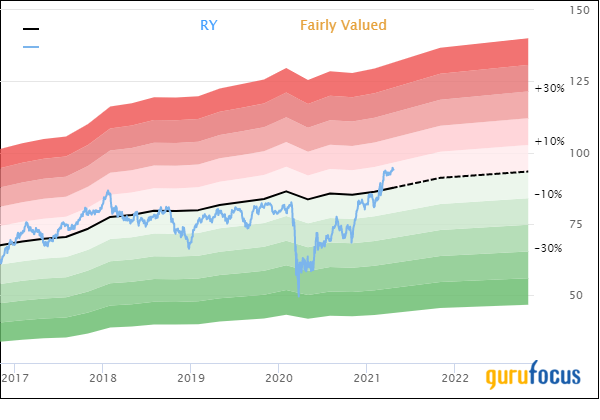

RBC is trading slightly above its intrinsic value as calculated by GuruFocus:

Shares have a GF Value of $87.72, giving RBC a price-to-GF-Value ratio of 1.07. The stock has a rating of fairly valued from GuruFocus.

Final thoughts

RBC maintains a leadership position in nearly every aspect of its business and yet still manages to grow its dominance, an appealing characteristic for the largest financial institution in Canada.

Shares of RBC aren't trading with a discount earnings multiple compared to the historical average, but nor are they expensive in my opinion. The stock is trading 7% above its intrinsic value, but the company has demonstrated strength over the last year that cannot be ignored.

I don't mind overpaying for quality, and RBC is among the best run banks in the market. Even at the premium to its intrinsic value, I rate RBC as a buy due to its market leadership and business model.

Author disclosure: the author has no position in any stock mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.