Royal Bank of Canada (RY) Q1 Earnings Fall on Higher Provisions

Royal Bank of Canada’s RY fiscal first-quarter and 2024 (ended Jan 31) adjusted net income of C$4.06 billion ($3.01 billion) decreased 5% from the prior-year quarter.

Results were adversely impacted by higher expenses and provisions. However, a rise in revenues and solid capital ratios acted as undermining factors.

Revenues Improve, Expenses Rise

Total revenues were C$13.49 billion ($9.99 billion), up almost 1% year over year.

Net interest income (NII) was C$6.33 billion ($4.69 billion), growing 2.1% from the prior-year quarter. Non-interest income was C$7.15 billion ($5.29 billion), relatively stable.

Non-interest expenses were C$8.32 billion ($6.16 billion), up 9.7% year over year.

The company’s provision for credit losses was C$813 million ($601.83 million), up 52.8%.

As of Jan 31, 2024, Royal Bank of Canada’s total loans were C$863.62 billion ($643.8 billion), marginally up from the prior quarter. Deposits totaled C$1.24 trillion ($0.9 trillion), up almost 1%. Total assets were C$1.97 trillion ($1.5 trillion), down 1.6%.

Capital Ratios Improve

As of Jan 31, 2023, Royal Bank of Canada’s Tier 1 capital ratio was 16.3%, up from the prior-year quarter’s 13.9%. Total capital ratio was 18.1%, up from 15.7%.

The company’s Common Equity Tier 1 ratio was 14.9%, up from 12.7% in the prior-year quarter.

Our View

Solid loan balances, higher rates and a diversified product mix will likely keep driving Royal Bank of Canada’s organic growth. However, higher provisions on the uncertain economic outlook are major near-term concerns.

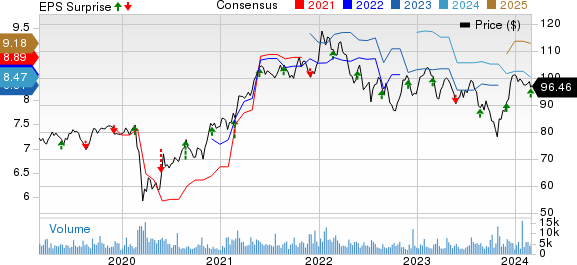

Royal Bank Of Canada Price, Consensus and EPS Surprise

Royal Bank Of Canada price-consensus-eps-surprise-chart | Royal Bank Of Canada Quote

Royal Bank of Canada currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

Bank of Montreal’s BMO first-quarter fiscal 2024 (ended Jan 31) adjusted earnings per share of C$2.56 declined 16.3% year over year.

A significant rise in provision for credit losses, along with higher adjusted expenses, primarily hurt the results. However, increases in NII and non-interest income acted as tailwinds for BMO.

HSBC Holdings HSBC reported a fourth-quarter 2023 pre-tax profit of $1 billion, down substantially from $5.1 billion in the prior-year quarter. The reported quarter included a $2 billion impairment charge relating to the planned sale of its retail banking operations in France and an impairment charge of $3 billion relating to its investment in China’s Bank of Communications Co., Limited.

Results reflected lower expenses driven by cost savings efforts. However, a decline in revenues and higher stable expected credit losses and other credit impairment charges acted as headwinds for HSBC.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report