Royal Gold (RGLD) Gives Updates on Brazil Mine Royalty Purchase

Royal Gold, Inc. RGLD announced that ACG Acquisition Company Ltd. provided an update on the transaction of the acquisition of Serrote and Santa Rita mines from Appian Capital Advisory LLP.

The company has stated that the acquisition agreement is yet to be revised. Appian, which owns both mines, and ACG are currently in talks.

The acquisition agreement may be terminated at any time as the long stop date of Aug 18, 2023, has now passed. ACG has 12 months from the date of its initial public offering (i.e., until Oct 12, 2023) to complete an acquisition. This is subject to two three-month extensions if shareholder approval is not obtained.

Previously, on Jun 12, Royal Gold announced that it entered an agreement with ACG to acquire new royalty interests on the producing Serrote and Santa Rita mines in Brazil. The deal was fixed at a cash consideration of $250 million, subject to closing conditions.

Royal Gold will get gold royalties from the Serrote mine, while the Santa Rita mine will provide it with gold, platinum and palladium. The company will also receive royalties for copper and nickel from both locations.

Royal Gold has been benefiting from its acquisitions and strong business model. Despite persistent inflationary pressures in the broader economy, the company has been maintaining high margins. It is poised to gain from its solid streaming agreements.

The company reported adjusted earnings per share of 96 cents in first-quarter 2023, beating the Zacks Consensus Estimate of 94 cents. The bottom line, however, declined 3% year over year.

The company generated revenues of $170 million, reflecting year-over-year growth of 4.9%. The upbeat performance can be attributed to higher gold and copper sales at Mount Milligan, a rise in silver sales at Khoemacau, increased gold production at Cortez and contribution from the newly-acquired royalties.

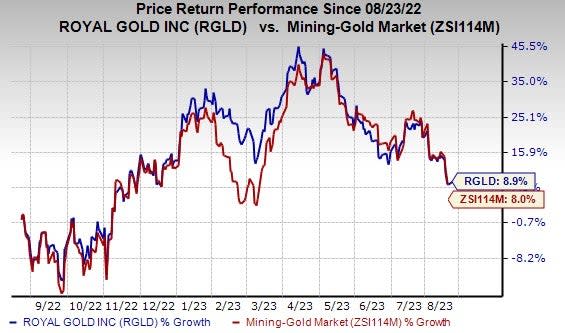

Price Performance

In the past year, shares of Royal Gold have gained 8.9% compared with the industry’s growth of 8%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Royal Gold currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the basic materials space are Hawkins, Inc. HWKN, PPG Industries, Inc. PPG and L.B. Foster Company FSTR. HWKN and PPG sport a Zacks Rank #1 (Strong Buy) at present, and FSTR has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has an average trailing four-quarter earnings surprise of 25.5%. The Zacks Consensus Estimate for HWKN’s fiscal 2024 earnings is pegged at $3.40 per share. The consensus estimate for 2024 earnings has moved 38% north in the past 60 days. Its shares gained 30.6% in the last year.

The Zacks Consensus Estimate for PPG Industries’ fiscal 2023 earnings per share is pegged at $7.47, indicating growth of 23.5% from the prior-year actual. Earnings estimates have moved 3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 7.3%. PPG’s shares have gained 9.7% in the past year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares gained 30.1% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report