Royalty Pharma PLC (RPRX): A Strategic SWOT Insight

Robust market share with a 58% stake in biopharmaceutical royalty transactions from 2012 through 2023.

Portfolio includes royalties on 15 therapies with end-market sales exceeding $1 billion each in 2023.

Strategic growth through diversified investments in both approved products and development-stage candidates.

Competitive landscape intensifies with the emergence of generics and biosimilars, posing a threat to royalty revenues.

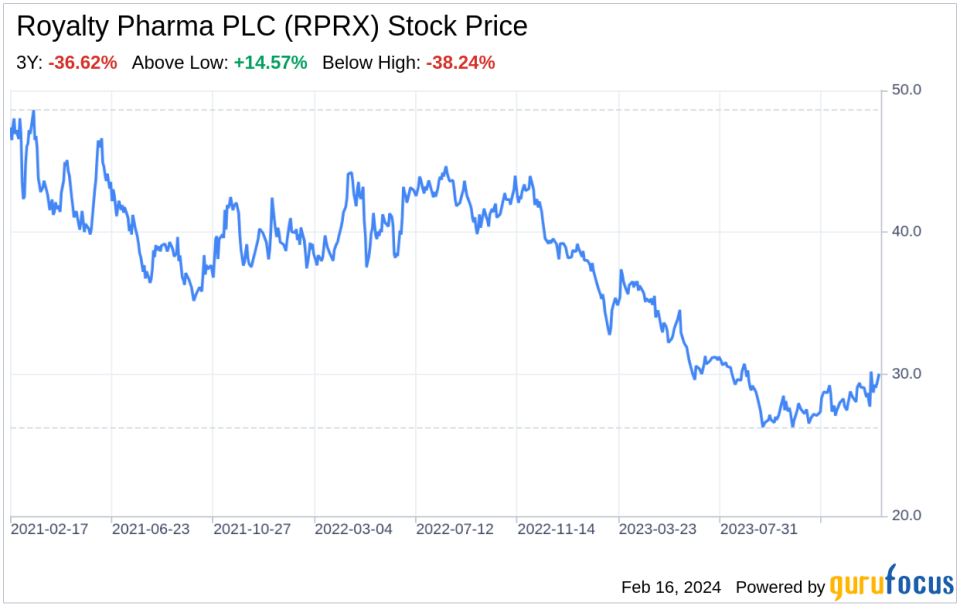

On February 15, 2024, Royalty Pharma PLC (NASDAQ:RPRX), the preeminent acquirer of biopharmaceutical royalties, filed its 10-K report, revealing a financial tableau reflective of its strategic positioning in the market. With a portfolio that boasts royalties on over 35 commercial products, Royalty Pharma PLC (NASDAQ:RPRX) has established itself as a pivotal player in the biopharmaceutical industry. The company's financials for the year 2023 showcase Portfolio Receipts of $3.0 billion, with a strategic deployment of $2.2 billion in cash for royalty acquisitions, milestones, and other contractual receipts. The firm's commitment to shareholder value is further evidenced by dividends totaling $358.3 million and share repurchases amounting to $304.8 million. This financial overview sets the stage for a comprehensive SWOT analysis, providing investors with a clear picture of the company's operational and strategic prowess.

Strengths

Market Leadership and Portfolio Diversification: Royalty Pharma PLC (NASDAQ:RPRX) stands out with an estimated 58% market share in biopharmaceutical royalty transactions from 2012 through 2023, dwarfing its nearest competitor's 8% share. The company's dominance is particularly pronounced in large transactions, where it holds an 85% market share for deals over $500 million. This market leadership is underpinned by a diversified portfolio that includes royalties on 15 therapies with end-market sales exceeding $1 billion each in 2023, ensuring a stable and robust revenue stream.

Strategic Acquisitions and Long Patent Lives: The company's strategic growth is fueled by diversified investments in both approved products and development-stage candidates. Royalty Pharma PLC (NASDAQ:RPRX) has demonstrated a 76% success rate in its development-stage investments, with $6.3 billion of the $8.3 billion deployed since 2012 resulting in approved products. The portfolio's weighted average duration of approximately 13 years, bolstered by long patent lives, such as Vertex's cystic fibrosis franchise patents extending through 2037, provides a long-term horizon for revenue generation.

Weaknesses

Dependence on Top Products: Despite a diversified portfolio, Royalty Pharma PLC (NASDAQ:RPRX) still relies significantly on its top products. In 2023, no individual product accounted for more than 23% of Portfolio Receipts, but this concentration still poses a risk should any of these key products face market challenges or competition from new therapies.

Operational Risks and Market Competition: The company's success hinges on the continued performance of the products within its portfolio. Intense competition in the biopharmaceutical industry and the potential for products to become obsolete due to new treatments or regulatory actions could impact royalty revenues. Additionally, Royalty Pharma PLC (NASDAQ:RPRX) faces competition from other financing options available to biopharmaceutical companies, which could limit its ability to acquire new assets and grow its business.

Opportunities

Expanding Biopharmaceutical Market: The biopharmaceutical industry is experiencing rapid growth, driven by factors such as increased R&D investments and an acceleration of medical research. Royalty Pharma PLC (NASDAQ:RPRX) is well-positioned to capitalize on this expansion, with the market for biopharmaceutical royalties reaching $7.4 billion in transaction value in 2023.

Innovative Funding Solutions: Royalty Pharma PLC (NASDAQ:RPRX) offers a range of funding solutions tailored to the needs of its partners, including third-party royalties, synthetic royalties, and launch and development capital. These innovative structures allow the company to partner with various industry participants, fostering growth and expanding its portfolio.

Threats

Emergence of Generics and Biosimilars: The availability of lower-cost generics or biosimilars poses a significant threat to Royalty Pharma PLC (NASDAQ:RPRX)'s royalty revenues. As patents expire and market exclusivity diminishes, the company's portfolio may be impacted by reduced royalty payments from these competing products.

Regulatory and Policy Changes: The biopharmaceutical industry is subject to stringent regulatory oversight, and changes in healthcare policy, including price caps and insurance reimbursement policies, could adversely affect the market position and success of the products in Royalty Pharma PLC (NASDAQ:RPRX)'s portfolio. Such developments could lead to decreased royalty revenues and impact the company's financial performance.

In conclusion, Royalty Pharma PLC (NASDAQ:RPRX) exhibits a strong market presence and a diversified portfolio that positions it favorably in the biopharmaceutical industry. The company's strategic acquisitions and long patent lives of its key products offer a stable revenue outlook. However, its reliance on top products and the competitive nature of the market present challenges that must be navigated carefully. Opportunities for growth lie in the expanding biopharmaceutical market and the company's innovative funding solutions. Nonetheless, the threats posed by the emergence of generics, biosimilars, and potential regulatory changes require vigilant management and strategic planning to ensure sustained success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.