Royce Funds Commentary: Jay Kaplan on How to Win by Losing Less

What drove Total Return outperforming its index over the last 12 months?

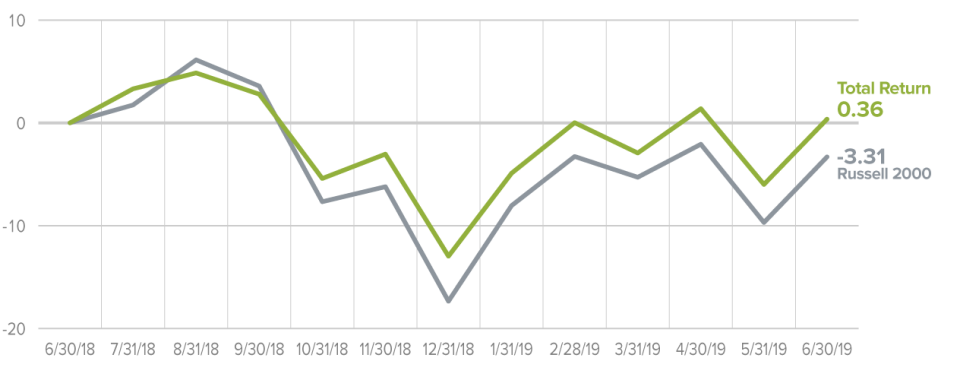

We're very pleased about the last 12 months in the Total Return Fund. The Russell 2000 was down around 3%. We were up a little bit. So outperformance in a down market has been a hallmark of what we've been trying to accomplish and we feel really, really good about that.

See the video here.

It was really apparent in the fourth quarter of 2018, when the Russell was down 20%, we were down around 15. That 500 basis points of outperformance during really a horrific quarter I think proves out the point that our low volatility strategy can work when times get tough.

Winning by Losing Less

Total Return & Russell 2000 Cumulative Returns (%) 6/30/18 to 6/30/19

We've been talking for a long time about down-market performance and what could happen, and we feel like we were vindicated a little bit this time around. And we've often talked about how we're going to lag a little bit in the up markets and hopefully do less bad in the down. And in the last 12 months, we really did that this time.

How do you participate in technology with a dividend strategy?

Some people think it's difficult to buy small-cap dividend paying tech stocks, but that's not really true. There are some areas where you can, and some areas where you can't. You can divide the technology world into tangible technology companies and intangible technology companies. And by that, I mean companies who make things you can put in your hand and companies that don't. And in the don't category, I'd think about software companies and internet companies, and those are the companies where we're kind of absent.

So you can find us in things capital equipment and components and distribution, plenty of technology companies with dividends that participate when technology does work. The non-dividend paying technology areas tend to be the more volatile stocks, so in our strategy where we're trying to keep volatility down; we think we're really not missing that much when we avoid software and internet companies.

Where are you finding value today?

The value in today's market I think is in more cyclical areas. The market is worried about a recession and has really heavily discounted those companies that have some cyclicality. So some of the more interesting but contrarian areas today would be financial services, particularly banks, some consumer stocks, particularly in the shoe area and many, many industrials. They could be in human capital, could be in airlines, it could be in trucks and truck part related areas, but all companies that could get hurt if there's an imminent recession, but the evidence today doesn't look like we're going to have a recession any time soon.

So there are many opportunities in cyclical areas, and if the market is wrong about the recession and it doesn't come soon, the multiples should go higher and the stocks should work very, very well.

Important Disclosure Information

All performance information reflects past performance, is presented on a total return basis, reflects the reinvestment of distributions, and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate, so that shares may be worth more or less than their original cost when redeemed. Shares redeemed within 30 days of purchase may be subject to a 1% redemption fee, payable to the Fund, which is not reflected in the performance shown above; if it were, performance would be lower. Current month-end performance may be higher or lower than performance quoted and may be obtained at www.roycefunds.com. Operating expenses reflect the Fund's total annual operating expenses for the Investment Class as of the Fund's most current prospectus and include management fees, other expenses, and acquired fund fees and expenses. Acquired fund fees and expenses reflect the estimated amount of the fees and expenses incurred indirectly by the Fund through its investments in mutual funds, hedge funds, private equity funds, and other investment companies.

The thoughts and opinions expressed in the video are solely those of the persons speaking as of July 10, 2019 and may differ from those of other Royce investment professionals, or the firm as a whole. There can be no assurance with regard to future market movements.

The performance data and trends outlined in this presentation are presented for illustrative purposes only. Past performance is no guarantee of future results. Historical market trends are not necessarily indicative of future market movements.

This material is not authorized for distribution unless preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing or sending money. Smaller-cap stocks may involve considerably more risk than larger-cap stocks. (Please see "Primary Risks for Fund Investors" in the prospectus.)

This article first appeared on GuruFocus.