RPC (RES) Acquires Oilfield Service Player Spinnaker for $79.5M

RPC, Inc. RES announced that it acquired Spinnaker Oilwell Services, LLC, expanding its oilfield cementing service business.

Per the deal, RPC paid $79.5 million for Spinnaker’s equity. The purchasing price comprised $77 million in cash, the assumption of $500,000 of capital lease liabilities and a $2-million payoff. The acquisition will be in effect from Jul 1, 2023.

Based in Oklahoma City, OK, Spinnaker is a leading oilfield cementing service provider in the Permian and Mid-Continent basins. Spinnaker, which mainly specializes in cementing operations in wells of all types, provides services to all major oil plays around Oklahoma, Kansas, Arkansas, Texas and New Mexico.

Spinnaker operates two facilities, which are situated in El Reno, OK and Hobbs, NM. Spinnaker maintains 18 full-service cementing spreads across the Permian Basin and the Midcontinent.

RPC provides specialized oilfield services and equipment primarily to independent and major oilfield companies engaged in the exploration, production and development of oil and gas properties throughout the United States.

RPC’s business mainly focuses on services to customers during the completion stage of a well. More than 85% of the company’s revenues are directed toward unconventional completions. The latest acquisition will significantly enhance RPC’s cementing business from its presence in South Texas to the basins in which it currently provides other services.

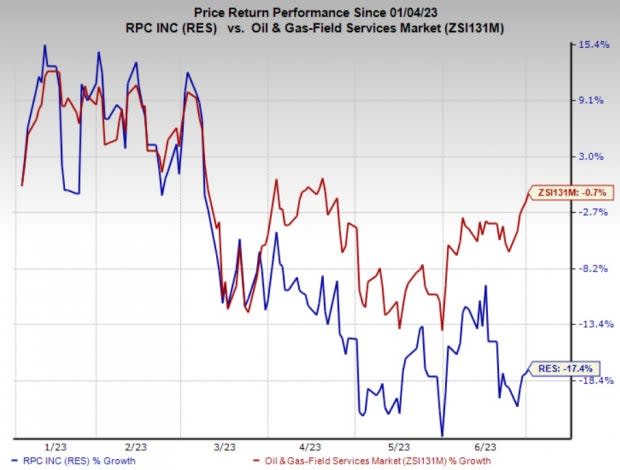

Price Performance

Shares of RES have underperformed the industry in the past six months. The stock has lost 17.4% compared with the industry’s 0.7% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

RPC currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are Seadrill Limited SDRL, Evolution Petroleum Corporation EPM and PHX Minerals Inc. PHX. SDRL and EPM currently sport a Zacks Rank of 1 (Strong Buy), and PHX carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Seadrill is a market-leading international driller with strong exposure in key strategic basins like the U.S. Gulf of Mexico, Brazil and Angola. SDRL reported first-quarter 2023 earnings of 83 cents per share, beating the Zacks Consensus Estimate of earnings of 55 cents per share.

Seadrill has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for SDRL’s 2023 and 2024 earnings is pegged at $2.93 per share and $4.01 per share, respectively.

Evolution Petroleum is an independent energy company. EPM reported first-quarter 2023 earnings of 42 cents per share, beating the Zacks Consensus Estimate of earnings of 17 cents per share.

Evolution Petroleum has a Zacks Style Score of A for Growth, and B for Value and Momentum. The consensus estimate for EPM’s 2024 earnings is pegged at $1.11 per share.

PHX Minerals is an oil and natural gas mineral company. The company posted first-quarter 2023 earnings of 11 cents per share, beating the Zacks Consensus Estimate of earnings of 7 cents per share.

PHX has witnessed upward earnings estimate revisions for 2024 in the past 60 days. The consensus estimate for the company’s 2023 and 2024 earnings per share is pegged at 28 cents and 45 cents, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Seadrill Limited (SDRL) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

PHX Minerals Inc. (PHX) : Free Stock Analysis Report