RPM International Inc's Dividend Analysis

Assessing the Sustainability and Growth of RPM International Inc's Dividends

RPM International Inc (NYSE:RPM) recently announced a dividend of $0.46 per share, payable on 2024-01-31, with the ex-dividend date set for 2024-01-18. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into RPM International Inc's dividend performance and assess its sustainability.

Understanding RPM International Inc's Business

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

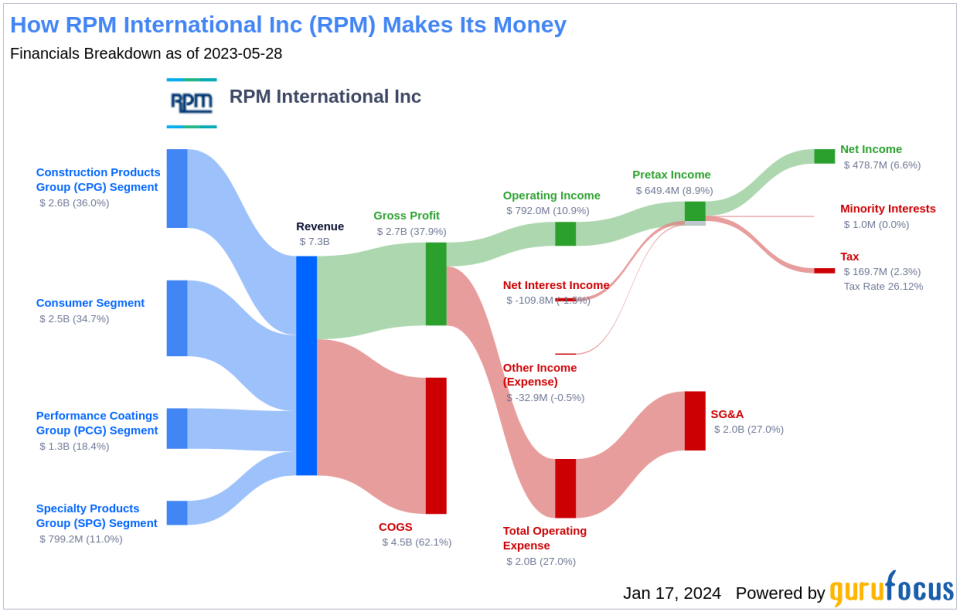

RPM International Inc is a key player in the manufacturing and distribution of paints, coatings, and adhesives. The company operates through four segments, each serving a specific market niche. The construction products group offers a range of products for building maintenance, including coatings and roofing materials. The performance coatings group caters to industrial applications with products designed for floorings and corrosion control. For the individual consumer, RPM International Inc's consumer group provides paints and finishes available in retail stores. The specialty products group encompasses an eclectic mix of items, from marine finishes to food colorings, with a primary market in North America.

RPM International Inc's Dividend Track Record

RPM International Inc has been a consistent dividend payer since 1975, with quarterly distributions to shareholders. The company's commitment to increasing dividends annually has earned it the prestigious title of a dividend aristocrat. This accolade is reserved for companies that have a history of raising their dividends for at least 49 consecutive years, highlighting RPM International Inc's financial stability and shareholder-friendly approach.

Below is a chart that illustrates the historical trend of RPM International Inc's annual Dividends Per Share.

Dissecting RPM International Inc's Dividend Yield and Growth

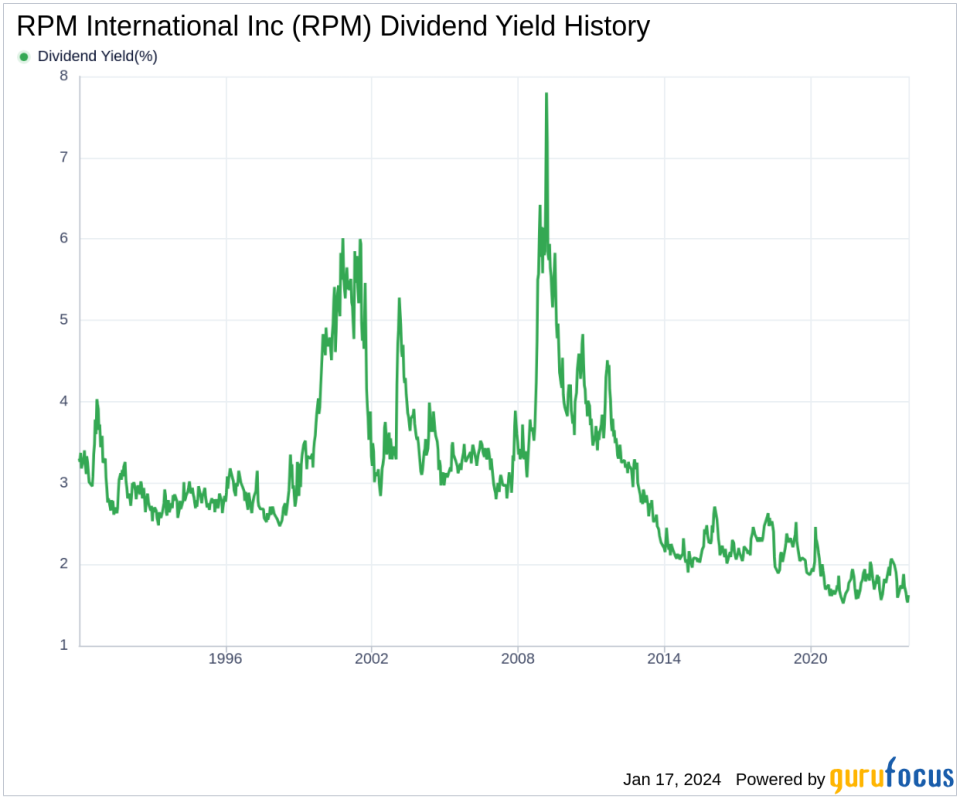

RPM International Inc boasts a 12-month trailing dividend yield of 1.60% and a forward dividend yield of 1.72%, indicating anticipated dividend increases in the coming year. However, with a yield close to a 10-year low and below the industry average, RPM International Inc may not be the most attractive option for those seeking high income from dividends.

The company has demonstrated a solid dividend growth rate over various time frames: 5.10% over three years, 5.40% over five years, and an impressive 6.60% over the past decade. This consistent growth translates into a 5-year yield on cost of approximately 2.08% for RPM International Inc's investors.

Evaluating the Sustainability of RPM International Inc's Dividends

The dividend payout ratio is a critical metric for assessing dividend sustainability. RPM International Inc's payout ratio stands at 0.42, suggesting a balanced approach between distributing earnings to shareholders and retaining funds for future growth. Alongside a strong payout ratio, RPM International Inc's profitability rank is an impressive 9 out of 10, reflecting its ability to generate earnings effectively when compared to its industry peers.

RPM International Inc's Growth Prospects and Dividend Viability

Future dividend sustainability is also dependent on a company's growth. RPM International Inc's robust growth rank of 9 out of 10 bodes well for its continued expansion. The company's revenue per share growth, 3-year revenue growth rate, 3-year EPS growth rate, and 5-year EBITDA growth rate all outperform a significant portion of global competitors, indicating a strong foundation for ongoing dividend payments.

Conclusion: RPM International Inc's Dividend Outlook

RPM International Inc's dedication to dividend growth, combined with its prudent payout ratio and robust profitability and growth metrics, positions it as a potentially reliable dividend payer for the foreseeable future. For investors seeking to expand their income-generating portfolio, RPM International Inc presents a compelling case, backed by a history of consistent dividend increases and a solid financial foundation. Value investors may consider this as an opportunity to partake in the company's ongoing success, while keeping an eye on the broader industry trends and RPM International Inc's strategic initiatives to maintain its competitive edge.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener to find similar investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.