RPM International (RPM) Q2 Earnings & Sales Miss, Stock Down

RPM International Inc. RPM reported second-quarter fiscal 2024 (ended Nov 30, 2023) results, with earnings and sales missing the Zacks Consensus Estimate.

Shares of RPM lost 4.8% following the earnings release on Jan 4, 2024.

Inside the Headlines

RPM reported adjusted earnings per share (EPS) of $1.22. The figure lagged the consensus mark of $1.23 by 0.8% but increased 10.9% from the year-ago quarter’s profit of $1.10 per share.

Net sales of $1.79 billion missed the consensus mark of $1.83 billion by 2.1%. The quarterly figure almost remained unchanged from the prior year’s level. In the fiscal second quarter, two out of four segments achieved higher sales.

The most significant increase in volume occurred in enterprises strategically catering to robust demands in infrastructure, reshoring, and high-performance construction projects through engineered solutions. However, this growth was counterbalanced by reduced consumer purchases in do-it-yourself (DIY) segments at retail outlets and subdued demand from specialized original equipment manufacturer (OEM) markets.

Organic sales declined 0.2%, and foreign currency translation positively impacted sales by 0.5%. Again, a 0.2% decline from divestitures (net of acquisitions) also impacted sales growth.

From a geographical perspective, markets beyond the United States experienced the most robust sales growth. A newly established management team and a targeted sales approach in Europe contributed to an 8.9% increase. In addition, enhanced coordination under PCG management led to a 13.0% sales growth in Africa/Middle East and 6.4% growth in Asia/Pacific.

Adjusted EBIT increased 10.4% year over year to $236.9 million. Adjusted EBIT margin improved 320 basis points year over year, attributable to MAP 2025 initiatives, including the commodity cycle, a positive mix from shifting toward higher margin products and services, and improved fixed-cost leverage at businesses with volume growth.

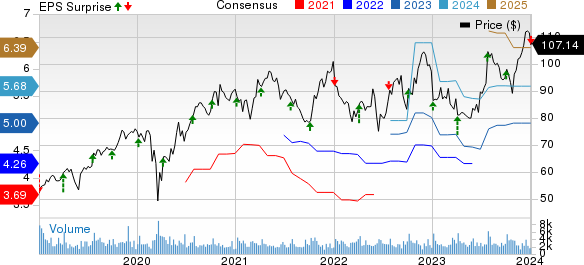

RPM International Inc. Price, Consensus and EPS Surprise

RPM International Inc. price-consensus-eps-surprise-chart | RPM International Inc. Quote

Segmental Details

Construction Products Group or CPG: In the reported quarter, segment sales increased 8.1% from a year ago to $661.8 million, owing to a 6.1% organic growth and 0.6% contribution from buyouts. Foreign currency translation also contributed 1.4% to sales growth. CPG attained its highest-ever sales in the second quarter, driven by the success of concrete admixtures and repair products. This was propelled by heightened demand for engineered solutions catering to infrastructure projects and reshoring initiatives, along with notable gains in market share.

The sectors involved in high-performance building construction and renovation also demonstrated strong performance. Robust demand in international markets, particularly in Latin America due to infrastructure-related needs, and an enhanced sales strategy in Europe played pivotal roles in this achievement.

Adjusted EBIT of $99.6 million was up 26% year over year due to volume growth, which resulted in improved fixed-cost utilization and benefits from the MAP 2025 initiative.

Performance Coatings Group: Segment sales increased 5.1% year over year to $374.9 million, owing to a 5.6% rise in organic sales and a 0.5% decline from divestitures (net of acquisitions). The increase in sales was primarily propelled by growth in engineered turnkey flooring systems serving reshoring capital projects and market share gains. On a geographical scale, strong growth in Asia/Pacific and Africa/Middle East added to the positives.

Adjusted EBIT increased 28% on a year-over-year basis to $60.9 million. The growth was driven by sales growth and MAP 2025 benefits.

Consumer Group: Sales in the segment declined 5.2% year over year to $578.7 million, owing to a decrease in consumer purchases for DIY items at retail stores. This downturn was influenced by a slump in housing turnover, with consumers redirecting their expenditures toward travel and entertainment. Additionally, some retailers engaged in destocking inventories, contributing to the overall decline in sales. Organic sales declined 5.1%. Unfavorable foreign currency translation impacted sales by 0.1%.

The segment’s adjusted EBIT rose 2.3% from the prior year’s level to $96.4 million, driven by MAP 2025 operational initiatives and strength in international markets.

Specialty Products Group (SPG): The segment’s sales totaled $177 million, down 16.6% on a year-over-year basis, owing to a 14.6% decline in organic sales. Also, foreign currency translation contributed to 0.7% sales growth. Divestitures (net of acquisitions) reduced sales by 2.7%.

Adjusted EBIT for the quarter totaled $17 million, down 43.5% from the prior-year level. Adjusted EBIT was negatively impacted by the sales decline and unfavorable fixed-cost leverage.

Balance Sheet

As of Nov 30, 2023, RPM International had a total liquidity of $1.51 billion. This includes cash and cash equivalents of $262.7 million compared with $215.8 million at the fiscal 2023-end.

Long-term debt (excluding current maturities) at the second-quarter end was $2.25 billion compared with $2.51 billion at the fiscal 2023-end. Cash provided by operations amounted to $767.8 million for the first six months of 2024, up from $190.9 million in the year-ago period.

Fiscal 2024 Outlook

For the fiscal third quarter, the company expects sales growth to be flat year over year and adjusted EBIT growth between 25% and 35%.

For fiscal 2024, the company anticipates consolidated sales to grow by a low-single-digit percentage from a year ago. Furthermore, it expects consolidated adjusted EBIT to grow in the low-double-digit to mid-teen percentage range. This growth is expected to be more pronounced in the second half of the fiscal year, provided that there is no economic recession.

Zacks Rank

RPM International currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Zacks Construction sector are:

Fluor Corporation FLR sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 37.5%, on average. Shares of FLR have gained 16.4% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FLR’s 2024 sales and EPS suggests growth of 9.3% and 11.1%, respectively, from the year-ago period’s levels.

M-tron Industries, Inc. MPTI currently sports a Zacks Rank of 1. MPTI delivered a trailing four-quarter earnings surprise of 35.6%, on average. The stock has surged 311.7% in the past year.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates growth of 12.5% and 13.4%, respectively, from the previous year’s levels.

AECOM ACM carries a Zacks Rank of 2 (Buy). It has a trailing four-quarter earnings surprise of 2.1%, on average. Shares of ACM have rallied 9.8% in the past year.

The Zacks Consensus Estimate for ACM’s 2024 sales and EPS indicates an increase of 4.5% and 17.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

RPM International Inc. (RPM) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report