RS Group PLC's Dividend Analysis

Understanding the Dividend Prospects of RS Group PLC

RS Group PLC (EENEF) recently announced a dividend of $0.08 per share, payable on 2024-01-05, with the ex-dividend date set for 2023-11-24. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into RS Group PLC's dividend performance and assess its sustainability.

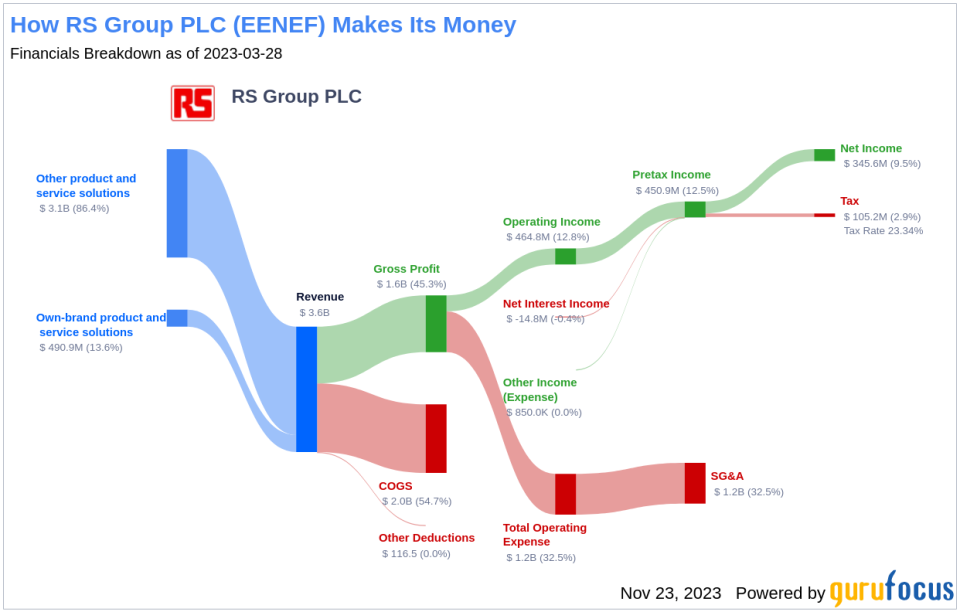

What Does RS Group PLC Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

RS Group PLC is a distributor of electronics and industrial products. The company provides semiconductors; interconnect, passives, and electromechanical components; automation and control products; and consumables through its two brands: RS and Allied Electronics. The main customer groups are electronic design engineers, machine and panel builders, and maintenance engineers. Electrocomponents' largest distribution channel is online through e-commerce. Other channels include catalogs, trade counters, and an international field sales network.

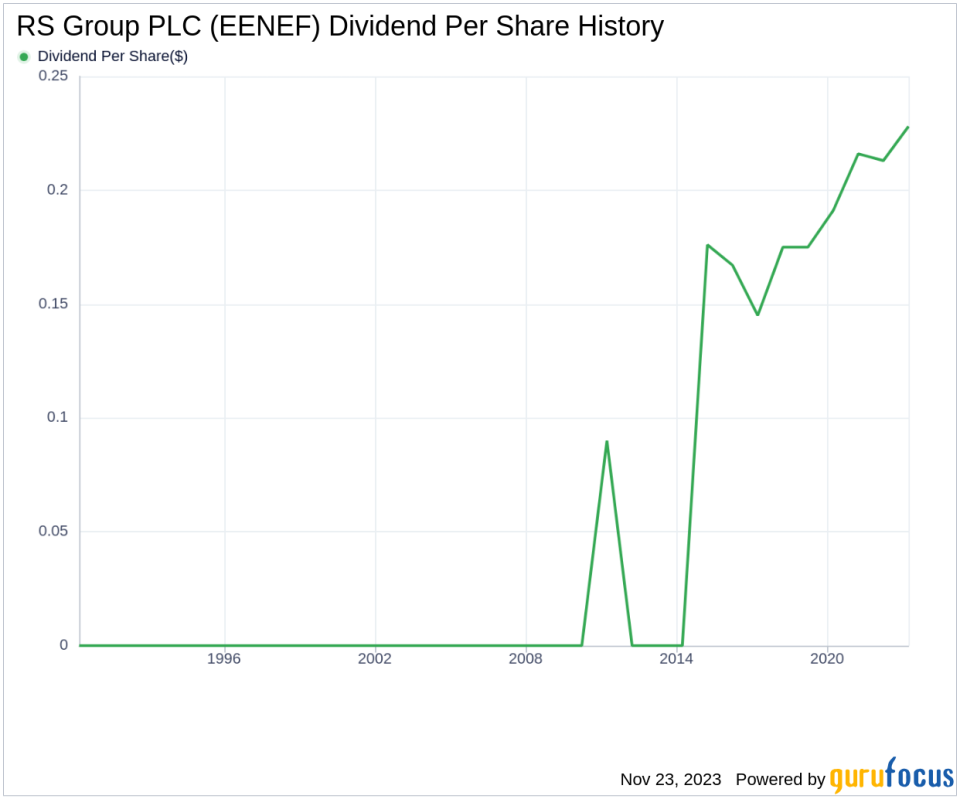

A Glimpse at RS Group PLC's Dividend History

RS Group PLC has maintained a consistent dividend payment record since 2014. Dividends are currently distributed on a bi-annually basis. Below is a chart showing annual Dividends Per Share for tracking historical trends.

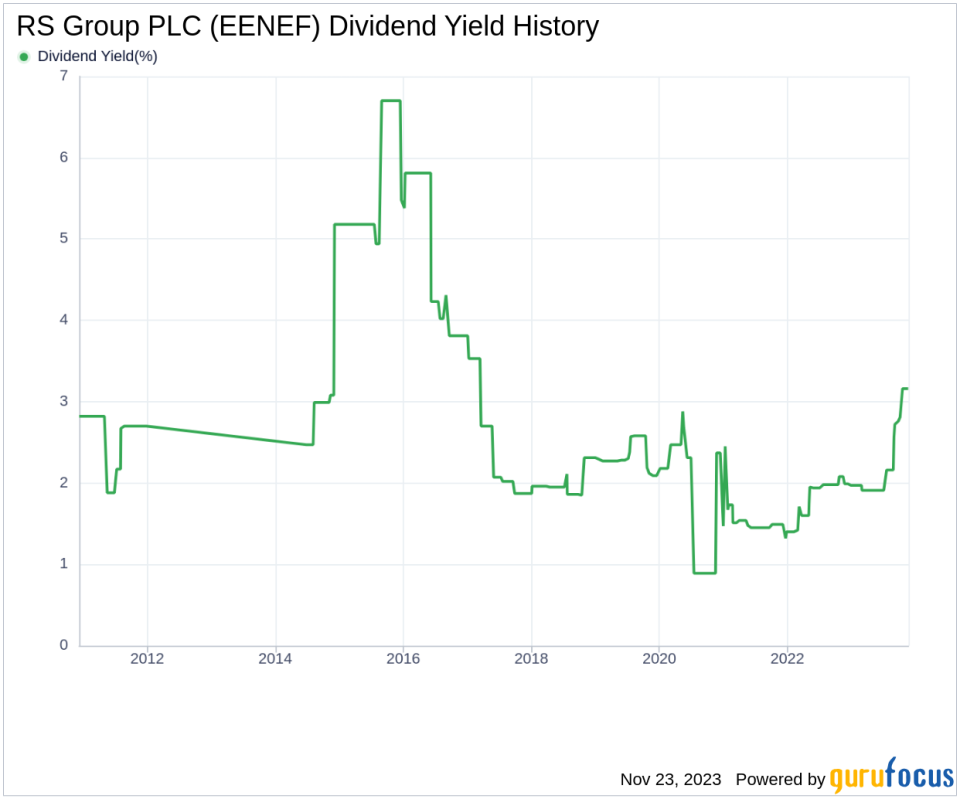

Breaking Down RS Group PLC's Dividend Yield and Growth

As of today, RS Group PLC currently has a 12-month trailing dividend yield of 3.22% and a 12-month forward dividend yield of 3.43%. This suggests an expectation of increased dividend payments over the next 12 months.

Over the past three years, RS Group PLC's annual dividend growth rate was 6.90%. Extended to a five-year horizon, this rate increased to 7.70% per year. And over the past decade, RS Group PLC's annual dividends per share growth rate stands at 4.70%.

Based on RS Group PLC's dividend yield and five-year growth rate, the 5-year yield on cost of RS Group PLC stock as of today is approximately 4.67%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-09-30, RS Group PLC's dividend payout ratio is 0.42.

RS Group PLC's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks RS Group PLC's profitability 9 out of 10 as of 2023-09-30, suggesting good profitability prospects. The company has reported positive net income for each year over the past decade, further solidifying its high profitability.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. RS Group PLC's growth rank of 9 out of 10 suggests that the company's growth trajectory is good relative to its competitors.

Revenue is the lifeblood of any company, and RS Group PLC's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. RS Group PLC's revenue has increased by approximately 13.00% per year on average, a rate that outperforms approximately 69.29% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, RS Group PLC's earnings increased by approximately 19.00% per year on average, a rate that outperforms approximately 52.59% of global competitors.

Lastly, the company's 5-year EBITDA growth rate of 14.90%, which outperforms approximately 49.41% of global competitors.

Next Steps

In conclusion, RS Group PLC's forthcoming dividend payment, alongside its historical dividend consistency, presents an attractive proposition for income-focused investors. The company's solid dividend growth rate, sustainable payout ratio, strong profitability, and robust growth metrics collectively indicate that RS Group PLC is well-positioned to continue rewarding shareholders with dividends. Investors seeking to diversify their portfolio with dividend-paying stocks should consider RS Group PLC's financial health and growth prospects as part of their investment decision. Will RS Group PLC maintain its dividend growth trajectory in the years to come? Only time will tell, but the signals are promising.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.