RTX Secures $30.6M Contract for Radar Interface Unit Lite

RTX Corporation RTX recently secured a contract involving the Radar Interface Unit lite. The Army Contracting Command, Redstone Arsenal, AL, has awarded the deal.

Valued at $30.6 million, the contract is scheduled to be completed by Mar 31, 2028. The work related to the deal will be carried out in Andover, MD, and Huntsville, AL.

What’s Favoring RTX?

Growing tensions and conflicts are driving nations to bolster their defense capabilities to deter potential war threats. This has led to increased investments in technologically advanced arms and ammunition that boast features required to meet the emerging needs of current military missions.

In this context, amplified spending has been witnessed on military radars that ensure effective surveillance and reconnaissance for identifying potential security threats. Radars encourage sharing real-time data with other military assets, improving data and coordination times.

Such augmented spending tends to benefit RTX as the company enjoys a prominent position in manufacturing and developing radar systems. Its wide expertise in radar technology applies to a vast range of advanced radar systems for various applications, including air defense, missile defense, maritime surveillance and a few more.

Its proven radar portfolio, which includes AN-SPY 6, AN-TPY-2, APG-79, APG-82 and a few more, enjoys significant order demand. Apart from this, the company also enjoys an order inflow for other parts in radar technology, like the latest one. This bolsters RTX’s revenues from the radar business.

Growth Prospects

Per the reports from the Markets and Markets firm, the global radar market is expected to witness a CAGR of 4.7% from 2022 to 2027. This stands to benefit RTX, given its expertise in radar technology that contributes to national defense surveillance and safety in various domains. Other defense contractors that are likely to benefit from the growth opportunities offered by the aforementioned market are as follows:

Northrop Grumman NOC: It is a pioneer in Active Electronically Scanned Array (“AESA”) radars and has been at the forefront of AESA innovations for more than 60 years. The company’s broad portfolio of products comprises radars like AN/APG-83 scalable, agile beam radar and AN/ASQ-236 Dragon’s eye radar pod. It also includes AN/APG-81 and AN/APG-71 for F-35 and F-22 jets, respectively.

Northrop has a long-term earnings growth rate of 3.7%. Its investors have gained 12.1% in the past month.

Lockheed Martin LMT: The company has broad and deep experience developing and delivering high-performing, high-reliability ground-based, naval and airborne radar solutions. Its product portfolio includes AN/APY-9 radar, AN/TPQ-53 counterfire radar, FPS-117 and a few more.

Lockheed has a long-term earnings growth rate of 8.4%. Its investors have gained 7.6% in the past month.

L3Harris Technologies, Inc. LHX: L3Harris manufactures the AN/SPS-48G naval radar, Symphony Airfield Radar Systems, Tactical Air Surveillance radars and a few more.

L3Harris’ long-term earnings growth rate is pegged at 2.9%. Shares of LHX have returned 2.3% value to its investors in the past month.

Price Movement

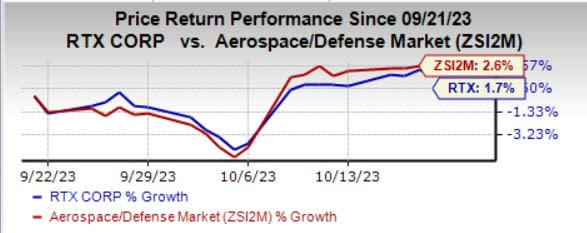

In the past month, shares of RTX Corp. have increased 1.7% compared with the industry’s growth of 2.6%.

Image Source: Zacks Investment Research

Zacks Rank

RTX Corp. currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report