Rumble Inc (RUM) Reports Full Year Revenue Surge Amidst Rising Costs

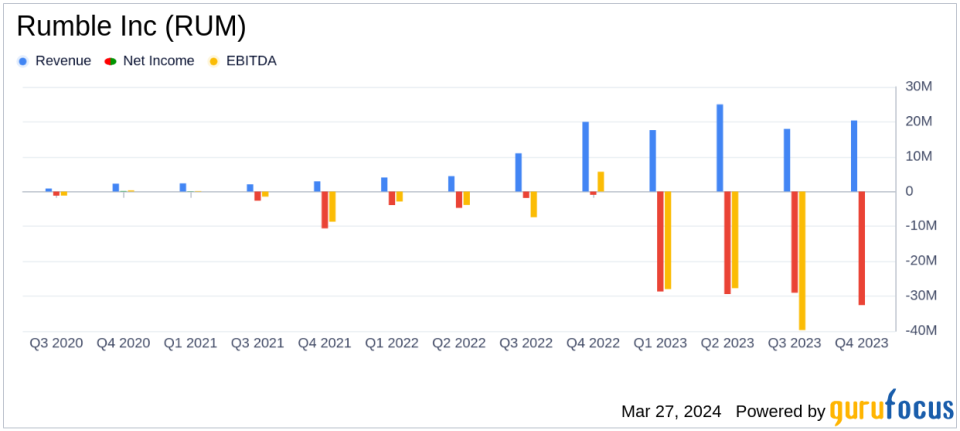

Full Year Revenue: Increased by 106% to $81.0 million in 2023.

Q4 Revenue: Slight increase of 2% to $20.4 million compared to the previous year's quarter.

Monthly Active Users: Grew by 16% to 67 million in the fourth quarter.

Cost of Services: Jumped by 68% to $39.5 million in Q4 due to higher content and hosting expenses.

Net Loss: Widened to $29.3 million in Q4, and $116.4 million for the full year.

Liquidity: Cash, cash equivalents, and marketable securities stood at approximately $219.5 million as of December 31, 2023.

Outlook: Rumble Inc anticipates revenue growth starting Q2 of 2024, moving towards breakeven in 2025.

Rumble Inc (NASDAQ:RUM) released its 8-K filing on March 27, 2024, unveiling a significant increase in full-year revenue for 2023, although the company's net losses also widened. Rumble Inc is a video-sharing platform that has seen a surge in user engagement, with a 16% sequential increase in average monthly active users reaching 67 million in the fourth quarter.

Financial Performance and Challenges

Rumble's financial achievements in 2023 include a remarkable 106% increase in annual revenue, which reached $81.0 million. This growth reflects the platform's expanding user base and the successful launch of Rumble Cloud, a major milestone for the company. However, the company also faced challenges, with a significant increase in costs of services, primarily due to programming and content costs, which rose by 68% to $39.5 million in the fourth quarter. This has contributed to a net loss of $29.3 million for the same period.

The importance of these financial achievements lies in Rumble's ability to scale its operations and invest in product development, which is critical for technology and software companies to maintain competitiveness. However, the rising costs underscore the need for careful management of expenses to ensure long-term sustainability.

Key Financial Metrics

Despite the increase in revenue, Rumble Inc reported a net loss of $116.4 million for the full year, compared to a net loss of $11.4 million in the previous year. The company's balance sheet remains strong with $218.3 million in cash and cash equivalents, and $1.1 million in marketable securities as of December 31, 2023.

General and administrative expenses slightly decreased by 3% to $9.6 million in Q4, while research and development expenses increased by 39% to $3.6 million, reflecting the company's continued investment in innovation. Sales and marketing expenses also increased by 18% to $3.2 million as the company seeks to expand its user base and market presence.

"Looking ahead, with our functioning products now online, we expect clarity on the performance of our assets beginning in the second quarter, leading to a stronger topline in the second half of the year," said Chris Pavlovski, Chairman and CEO of Rumble.

Analysis of Company's Performance

Rumble's strategy to prioritize infrastructure and product development has paid off in terms of user growth and revenue. However, the company's path to profitability is still a work in progress, with significant investments leading to a larger net loss. The management's outlook is optimistic, with a focus on monetization and a trajectory towards breakeven by 2025.

For value investors, Rumble's strong cash position and aggressive growth strategy are points of interest. However, the widening net loss may raise concerns about the company's expense management and the timeline for achieving profitability. The company's future performance will be closely watched, particularly its ability to leverage its suite of products for revenue growth and cost optimization.

For more detailed insights and financial analysis, investors are encouraged to review the full earnings report and listen to the conference call webcast, which provides additional context and commentary from the company's management.

Stay tuned to GuruFocus.com for ongoing coverage of Rumble Inc's financial developments and other key market news.

Explore the complete 8-K earnings release (here) from Rumble Inc for further details.

This article first appeared on GuruFocus.