RumbleON Inc (RMBL) Faces Revenue Decline and Net Loss in Q4; Unveils Vision 2026 Strategic Plan

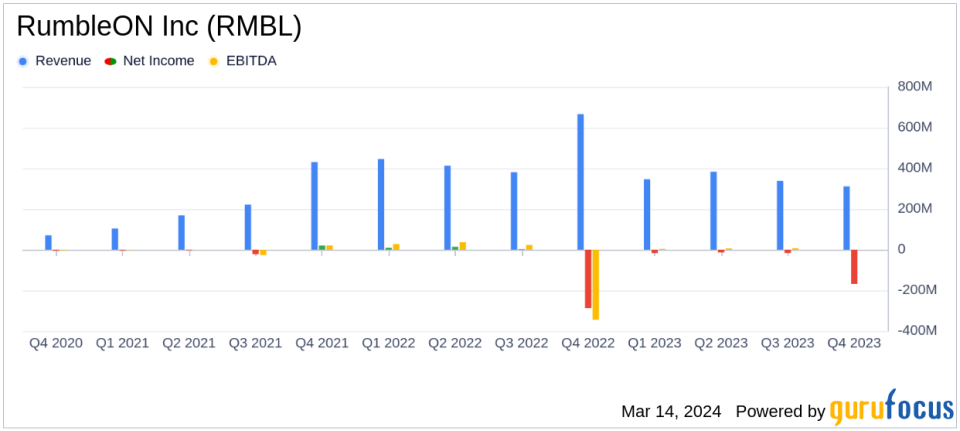

Total Revenue: Decreased by 6.2% to $311.1 million in Q4, and by 6.3% to $1.366 billion for the full year.

Gross Profit: Dropped by $21.2 million to $71.2 million in Q4, with a year-over-year decrease of 18.5%.

Net Loss: Loss from Continuing Operations reached $168.4 million in Q4, with a diluted loss per share of $7.81.

Adjusted EBITDA: Fell to $3.1 million in Q4, a significant decrease from $19.7 million in the same quarter last year.

Debt Reduction: Paid down $50 million of long-term debt in Q4, part of a larger $111.7 million reduction for the year.

Liquidity: Total available liquidity stood at $212.6 million as of December 31, 2023.

Strategic Plan: Introduced Vision 2026 with targets for annual revenue, Adjusted EBITDA, and Adjusted Free Cash Flow.

RumbleON Inc (NASDAQ:RMBL) released its 8-K filing on March 14, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading online retailer in the powersports market, experienced a decrease in total revenue and gross profit, alongside a significant net loss for the quarter. Despite these challenges, RumbleON managed to reduce its long-term debt and introduced its Vision 2026 strategic plan, aiming for improved financial performance in the coming years.

Company Overview

RumbleON Inc operates primarily through its powersports segment, which includes the distribution of new and pre-owned motorcycles and other vehicles. The company also offers vehicle logistics and transportation services. With a majority of its revenue derived from the powersports segment, RumbleON's performance in this area is crucial to its overall financial health.

Financial Performance and Challenges

The company's total revenue for Q4 was $311.1 million, a 6.2% decrease from the prior year's quarter. The full-year revenue also saw a decline of 6.3%, totaling $1.366 billion. This downturn was attributed to lower selling prices on powersports vehicles. Gross profit for Q4 fell to $71.2 million, down $21.2 million from the previous year, with a significant portion of this decrease due to a pre-owned inventory adjustment. The total gross margin for the quarter was 22.9%, a decrease from 27.9% in the prior year's quarter.

Adjusted EBITDA for Q4 was $3.1 million, a stark contrast to the $19.7 million reported in the same quarter of the previous year. The company's loss from continuing operations was substantial, with a diluted loss per share of $7.81 for Q4 and $12.09 for the full year.

Debt Reduction and Liquidity

RumbleON's efforts to strengthen its balance sheet were evident in its debt reduction initiatives. The company paid down $50 million of its long-term debt during Q4, thanks to a $100 million rights offering completed in December. As of February 29, 2024, the company's non-vehicle net debt stood at $218.5 million.

The total available liquidity as of December 31, 2023, was $212.6 million, which included unrestricted cash, restricted cash, and availability under Powersports inventory financing credit facilities.

Vision 2026 Strategic Plan

CEO Michael W. Kennedy highlighted the company's capital and balance sheet initiatives, expressing confidence in the foundation built for future growth. The Vision 2026 plan sets ambitious targets for annual revenue, Adjusted EBITDA, and Adjusted Free Cash Flow. However, RumbleON has decided to cease the practice of giving annual guidance, withdrawing its previous guidance for 2024.

"Today we are introducing our 3-year operating plan called Vision 2026, which is the result of the work by our team over the last few months. We expect the following to be achieved by calendar year 2026, while maintaining a healthy balance sheet within our target ratio of 1.5x to 2.5x net debt/Adjusted EBITDA: Annual revenue in excess of $1.7 billion, Annual Adjusted EBITDA of greater than $150 million, and Annual Adjusted Free Cash Flow of $90 million or more."

Analysis of Performance

RumbleON's Q4 performance reflects the ongoing challenges in the powersports market, including inventory adjustments and compressed margins. The company's proactive measures to reduce debt and improve liquidity are positive steps, but the significant net loss underscores the need for a strategic turnaround. The introduction of Vision 2026 indicates a clear direction for the company, with a focus on long-term growth and shareholder value.

For value investors and potential GuruFocus.com members, RumbleON's current financial state presents both challenges and opportunities. The company's strategic initiatives and targets for the next few years will be critical to monitor as they may signal a potential recovery and growth trajectory.

RumbleON will host a conference call to discuss its Q4 2023 results and further details can be found on the company's website.

For a more detailed analysis and up-to-date information, readers are encouraged to visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from RumbleON Inc for further details.

This article first appeared on GuruFocus.