Running on Ice: How cold can you go?

All thawed out

How cold can you go? That’s a question Schott Pharma is asking. It just revealed its Everic freeze vials, which are designed for ultracold storage of messenger RNA and gene therapy drugs. How cold are these vials built for? Minus 80 C. Apparently the problem with some of the other vials is casual cracking and breakage on thawing, which ruins the contents of the vial.

A Glass International article notes, “In 2023, there were, for example, 11 mRNA drugs and 10 gene therapy drugs commercially available, which required deep-cold storage, and over 100 mRNA and 45 gene therapy drugs in clinical trials.”

Having a dedicated solution for these trials to increase efficiency and speed along research on countless diseases and conditions could be a game-changer — not to mention that the amount of wasted product will dramatically decrease.

Temperature checks

Heading over to the food acquisition space, Seviroli Foods, a frozen pasta manufacturer and importer of specialty goods, has acquired a portfolio of Italian food productions from Ajinomoto Foods North America. This acquisition will enhance Seviroli’s frozen pasta product offering. Seviroli is a portfolio company of Mill Point Capital.

Ajinomoto is calling it a win. Hiroshi Kaho, CEO and president of Ajinomoto, said in a news release, “The sale of our Italian frozen pasta business will allow us to shift our priority on growing our core products, such as gyozas and potstickers, for continued long-term success.”

Any deal that results in more pasta readily available is a good deal to me — not to mention more gyozas and potstickers. There truly could not be a better way to start 2024.

Food and drugs

Predictions for 2024 have come from every corner of the internet. One worth noting for the cold chain side of things are emerging trends regarding frozen food. That’s according to Conagra Brands, which published its inaugural “comprehensive, data-driven report” taking a deep dive into the $78 billion industry. The report sought to find out how and why people want to enjoy frozen food.

Some of the findings, published in a news release, were:

Global cuisine: Moving away from the Americanized “meat and potatoes” and toward more bold flavors — anything from Asian-inspired foods to Indian and Korean BBQ.

Frozen food and breakfast: The “most important meal of the day” is increasingly becoming a hot time of the day for frozen food consumption. Frozen croissant sandwiches, breakfast burritos and biscuit sandwiches are among the most popular items driving growth.

The return of the hors d’oeuvres: Consumers are looking for small bites but big flavor, aka the rise of the frozen snack. Consumers’ growing desire for smaller portions and healthier options has brought finger foods back to the forefront.

Kids’ meals: Frozen foods that kids enjoy and are easy for parents to prepare have seen significant growth. Kid-friendly frozen food now generates more than $248 million in annual sales.

The rise of the air fryer: The number of frozen foods with air-frying instructions has jumped 90% in the past four years. Air-fryer preparation often saves time, can be a healthier food prep option and emits less heat for year-round cooking.

The full report can be found here on Conagra’s website.

Cold chain lanes

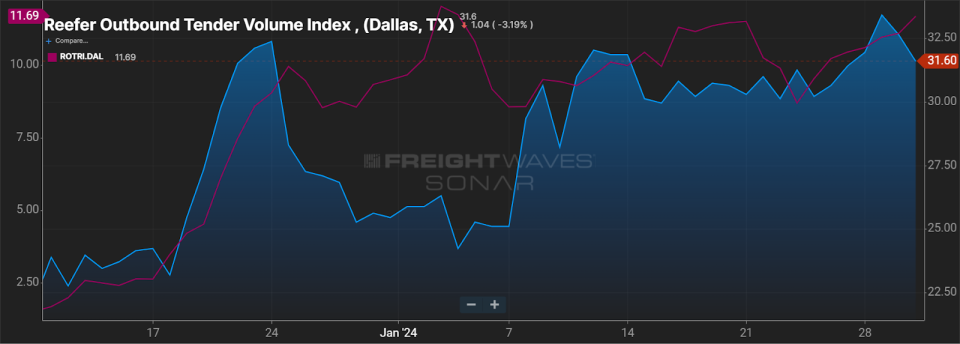

There seems to be no end in sight for the Dallas market as it continues to buck the slow January trend. Reefer outbound tender volumes have started falling, down 5.72% week over week, but levels are still up from where the year started. One thing that hasn’t taken a dive is reefer outbound tender rejections; they have risen to 11.7%, a 38-basis-point increase w/w.

Rejections that are above 10% are a sign that there are inflated spot rates in that market. Shippers can rest easy, for now, that outbound tender lead times don’t need to increase. It’s actually trending the opposite way, where lead times are coming under three days out. It’s important to watch closely as spot rates continue to rise and Dallas has anything but a calm January.

Is SONAR for you? Check it out with a demo!

Shelf life

Cadbury launches world-first Creme Egg frozen treat — in Australia

InspiraFarms secures $1.09 million funding for off-grid energy cold storage projects in Africa

Applications open for grants to strengthen Minnesota’s food supply chain

SONAR is kicking off the new year with new developments

Ryder buys Cardinal Logistics, significantly growing its dedicated business

Wanna chat in the cooler? Shoot me an email with comments, questions or story ideas at moconnell@freightwaves.com.

See you on the internet.

Mary

The post Running on Ice: How cold can you go? appeared first on FreightWaves.