Runway Growth Finance Corp Reports Solid Earnings Amidst Market Challenges

Total Investment Income: Reached $39.2 million in Q4 and $164.2 million for the fiscal year.

Net Investment Income: Reported at $18.3 million, or $0.45 per share in Q4, and $78.3 million, or $1.93 per share for the fiscal year.

Net Asset Value (NAV): Closed the year at $13.50 per share, with total net assets of $547.1 million.

Investment Portfolio: Grew to $1.0 billion at fair value by year-end, excluding US Treasury Bills.

Dividends: Announced a regular quarterly dividend of $0.40 per share and a supplemental dividend of $0.07 per share for Q1 2024.

Liquidity and Capital Resources: Ended the year with approximately $281.0 million in available liquidity.

Share Repurchase Program: Board approved a program to repurchase up to $25.0 million of outstanding common stock.

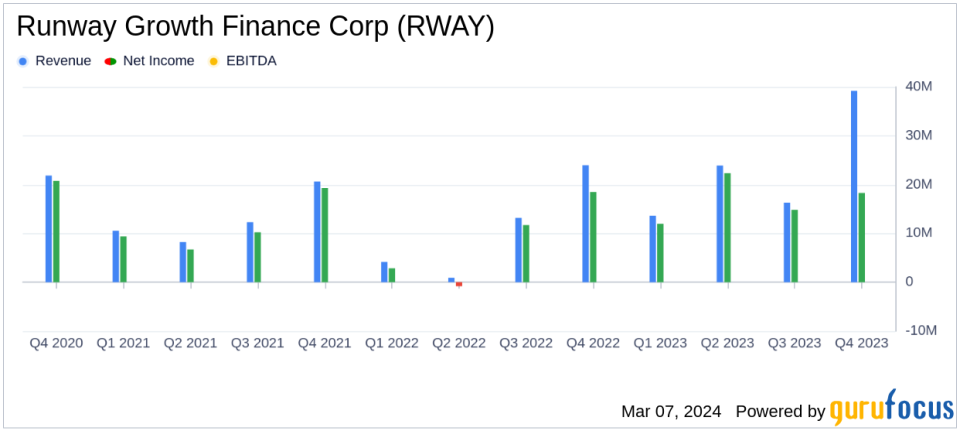

On March 7, 2024, Runway Growth Finance Corp (NASDAQ:RWAY) released its 8-K filing, detailing the financial results for the fourth quarter and the fiscal year ended December 31, 2023. The company, a specialty finance entity providing senior secured loans to high-growth potential companies, reported a robust total investment income of $39.2 million for the quarter and $164.2 million for the fiscal year.

Runway Growth Finance Corp's net investment income stood at $18.3 million, or $0.45 per share for the quarter, maintaining the same per-share figure year-over-year despite a slight decrease from $18.4 million in the previous year's quarter. For the fiscal year, the net investment income reached $78.3 million, or $1.93 per share. The company's net asset value per share ended the year at $13.50, with total net assets amounting to $547.1 million, a decrease from the previous year's $576.1 million.

Financial Achievements and Portfolio Growth

Runway Growth Finance Corp's investment portfolio showcased significant growth, reaching approximately $1.0 billion at fair value by the end of 2023, excluding US Treasury Bills. The portfolio was primarily composed of senior secured loans, reflecting the company's strategic focus on credit quality and risk management. The company's low credit loss ratio, averaging 14 basis points per year on a gross basis and 11 basis points on a net basis since inception, underscores its prudent investment approach.

The company's financial achievements are particularly noteworthy given the backdrop of higher interest rates and increased financing expenses, which drove total operating expenses up to $20.9 million for the quarter, compared to $18.1 million in the same period last year. Despite these challenges, Runway Growth Finance Corp managed to complete eight investments in new and existing portfolio companies, totaling $154.6 million in funded loans during the fourth quarter.

Challenges and Strategic Management

While Runway Growth Finance Corp navigated a complex market environment, it faced challenges such as a net realized loss on investments of $17.2 million for the quarter and a net change in unrealized loss on investments of $5.9 million. These figures contrast with the prior year's net realized loss of $2.0 million and a net change in unrealized gain of $2.1 million, reflecting the volatility and risk inherent in investment activities.

Despite these setbacks, the company's strategic management and disciplined investment approach have been highlighted by Acting CEO Greg Greifeld, who stated,

In 2023, Runway Growth drove shareholder return while taking a measured approach to portfolio management as we preserved industry-leading credit quality."

Greifeld also emphasized the company's commitment to generating shareholder value through consistent dividends and supplemental distributions.

Liquidity, Capital Resources, and Future Outlook

Runway Growth Finance Corp's liquidity position remained strong, with approximately $281.0 million in available liquidity, including unrestricted cash and cash equivalents and available borrowing capacity under the company's credit facility. The company's core leverage ratio stood at approximately 95%, up from 79% in the previous quarter, reflecting its strategic use of leverage to drive shareholder returns.

Looking ahead, the company has declared dividends for the first quarter of 2024 and has initiated a Share Repurchase Program, signaling confidence in its financial stability and commitment to enhancing shareholder value. Additionally, the company has entered into a Joint Venture with Cadma Capital Partners LLC, which is expected to further diversify its investment activities.

Runway Growth Finance Corp's performance in the fourth quarter and throughout the fiscal year of 2023 demonstrates its resilience and strategic acumen in navigating a challenging financial landscape, positioning it well for continued success in the year ahead.

Explore the complete 8-K earnings release (here) from Runway Growth Finance Corp for further details.

This article first appeared on GuruFocus.