Rush Enterprises Inc (RUSHA) Reports Mixed 2023 Results and Declares Dividend

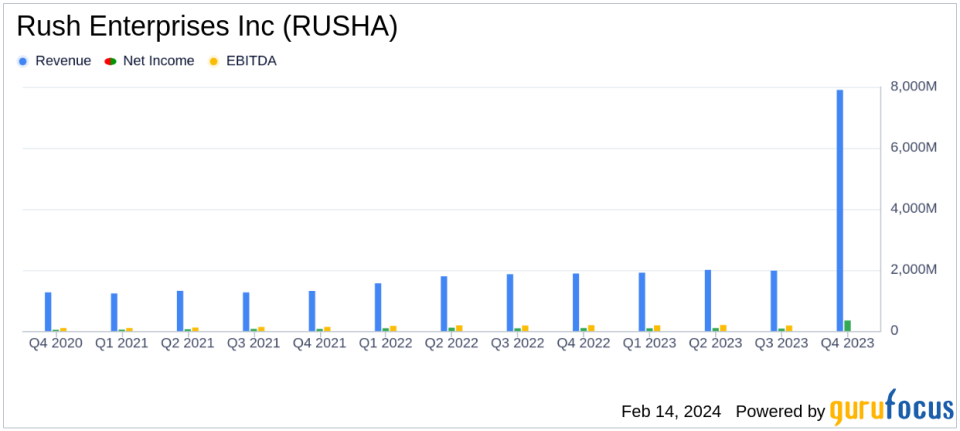

Revenue: Increased to $7.9 billion in 2023 from $7.1 billion in 2022.

Net Income: Declined to $347.1 million in 2023 from $391.4 million in 2022, with adjusted net income of $372.0 million in 2022.

Earnings Per Share (EPS): Decreased to $4.15 per diluted share in 2023 from $4.57 per diluted share in 2022.

Dividend: Declared a cash dividend of $0.17 per share, payable on March 18, 2024.

Aftermarket Growth: Aftermarket products and services revenues grew by 8.0% to $2.6 billion in 2023.

Commercial Vehicle Sales: New Class 8 truck sales increased by 4.0%, and Class 4-7 truck sales outpaced the market with a 20.3% increase.

Stock Repurchase: $211.7 million of common stock repurchased in 2023, with a new $150 million authorization through December 31, 2024.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On February 13, 2024, Rush Enterprises Inc (NASDAQ:RUSHA) released its 8-K filing, announcing financial results for the fourth quarter and year-end of 2023. The company, known for its extensive network of commercial vehicle dealerships under the Rush Truck Centers brand, reported a year of mixed financial outcomes, with a notable increase in revenue but a decrease in net income compared to the previous year.

Company Overview

Rush Enterprises Inc operates in the Truck Segment, offering a one-stop service for commercial vehicle customers. This includes retail sales of new and used commercial vehicles, aftermarket parts sales, service and repair facilities, financing, leasing, rental, and insurance products. The company's business is concentrated in the United States commercial vehicle markets and related aftermarkets.

Financial Performance and Challenges

The company's revenue for 2023 was $7.9 billion, up from $7.1 billion in 2022. However, net income for the year was $347.1 million, or $4.15 per diluted share, a decrease from $391.4 million, or $4.57 per diluted share, in the previous year. This decline in net income was partly due to the absence of one-time gains experienced in 2022 from equity interest transactions. Despite these challenges, Rush Enterprises Inc achieved growth in aftermarket revenues, driven by strong demand across various customer segments.

Aftermarket Products and Services

Aftermarket products and services accounted for approximately 59.5% of the company's total gross profits in 2023, with revenues reaching $2.6 billion, an 8.0% increase compared to 2022. The company's annual absorption ratio was 135.3% in 2023, slightly down from 136.6% in 2022. This growth in aftermarket revenues is significant as it indicates a robust and recurring revenue stream that is less dependent on new vehicle sales, which can be cyclical.

Commercial Vehicle Sales

Rush Enterprises Inc reported an increase in new Class 8 truck sales by 4.0% and significantly outpaced the market in Class 4-7 truck sales with a 20.3% increase. This performance is particularly important as it demonstrates the company's ability to capture market share and grow sales even in a challenging market environment.

Dividend and Share Repurchase

The Board of Directors declared a cash dividend of $0.17 per share, underscoring the company's commitment to returning value to shareholders. Additionally, the company repurchased $211.7 million of its common stock in 2023 and announced a new $150 million share repurchase authorization, highlighting its strong balance sheet and confidence in its business strategy.

Outlook and Strategic Focus

Looking ahead to 2024, Rush Enterprises Inc anticipates a decline in new Class 8 truck sales but expects the demand for medium-duty commercial vehicles to remain consistent with 2023 levels. The company plans to continue focusing on strategic initiatives such as expanding its service technician workforce and mobile service offerings to support large fleet customers and gain market share.

The company's performance in 2023, despite the challenges posed by economic conditions, demonstrates its resilience and the effectiveness of its diversified business model. With a strong focus on aftermarket services and strategic initiatives aimed at growth, Rush Enterprises Inc is well-positioned to navigate the evolving commercial vehicle market.

For more detailed information, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Rush Enterprises Inc for further details.

This article first appeared on GuruFocus.