Rush Street Interactive Inc Reports Revenue Growth and Narrowed Net Loss in 2023

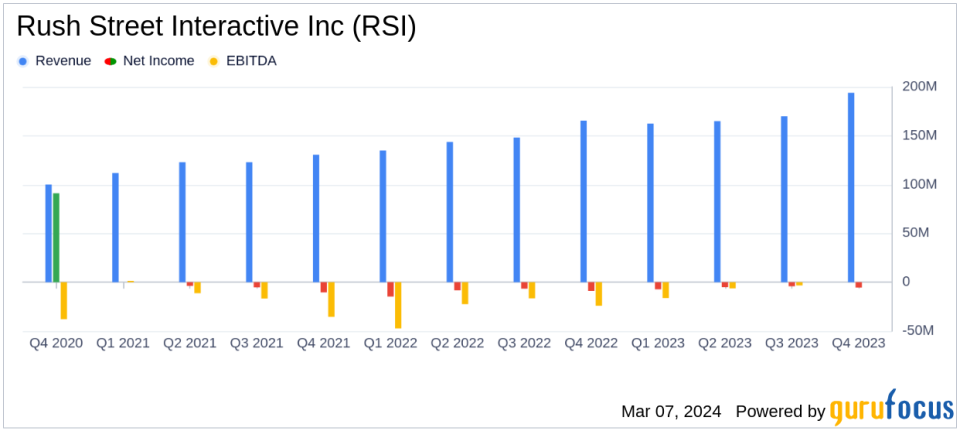

Revenue Growth: RSI reported a 17% year-over-year increase in revenue for both Q4 and the full year of 2023.

Net Loss Reduction: The company significantly reduced its net loss from $134.3 million in 2022 to $60.1 million in 2023.

Adjusted EBITDA Improvement: Adjusted EBITDA turned positive, reaching $8.2 million for the full year, a substantial improvement from the previous year's loss.

Advertising and Promotions Efficiency: RSI decreased its adjusted advertising and promotions expense by 45% in Q4 and 27% for the full year.

User Growth: Monthly Active Users (MAUs) increased in both the United States/Canada and Latin America regions.

2024 Revenue Guidance: RSI provides a revenue guidance of $770 to $830 million for the full year 2024, indicating continued growth.

Healthy Cash Position: The company reported $168 million in unrestricted cash and cash equivalents as of December 31, 2023.

On March 6, 2024, Rush Street Interactive Inc (NYSE:RSI) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading online gaming and entertainment provider, operates in the U.S. and Latin American markets, offering a variety of gaming options through its online casinos and sports betting platforms.

For the fourth quarter of 2023, RSI reported revenue of $193.9 million, marking a 17% increase compared to the same period in the previous year. The full year revenue also saw a similar increase, reaching $691.2 million. Despite these gains, the company posted a net loss of $5.5 million for the quarter and $60.1 million for the year. However, this represents a significant improvement from the net loss of $31.1 million in Q4 2022 and $134.3 million for the full year 2022.

Adjusted EBITDA for the fourth quarter was $11.5 million, a notable turnaround from the $17.3 million loss in Q4 2022. The full year adjusted EBITDA was $8.2 million, compared to a loss of $91.8 million in the previous year. This improvement reflects RSI's strategic focus on customer engagement and retention, as well as efficient cost management, particularly in advertising and promotions expenses.

Financial Highlights and Operational Efficiency

RSI's financial achievements are particularly important in the competitive online gaming and sports betting industry. The company's ability to grow revenue while simultaneously reducing net losses and improving adjusted EBITDA demonstrates operational efficiency and a strong market position. The reduction in advertising and promotions expenses, without sacrificing user growth, suggests a more effective marketing strategy and better customer acquisition costs.

The company's strong cash position, with $168 million in unrestricted cash and cash equivalents, provides a solid foundation for future growth and expansion. RSI's successful launch in Delaware and its positive outlook for the upcoming year, with revenue guidance projecting up to 16% growth, further underscore the company's robust financial health and strategic direction.

Key Financial Metrics and Future Outlook

Key financial metrics from the income statement, such as the increase in revenue and the reduction in net loss, are critical indicators of RSI's improving financial health. The balance sheet's strong cash position underscores the company's liquidity and ability to invest in growth opportunities. The cash flow statement reflects the company's operational efficiency and ability to generate cash from its core business activities.

RSI's CEO, Richard Schwartz, commented on the company's performance, stating:

"We concluded 2023 with a fourth quarter that produced records in both revenues and adjusted EBITDA. For the year, we grew revenue to $691 million on strong customer engagement and retention. At the same time, we improved our Adjusted EBITDA by $100 million compared to the prior year. These results and the ensuing momentum have carried into strong guidance for the new year, reflecting our longstanding customer-centric principles and obsession with developing innovative and differentiated user experiences."

The company's performance analysis indicates that RSI is on a positive trajectory, with a focus on sustainable growth and market expansion. The increase in Monthly Active Users and Average Revenue per Monthly Active User in both the United States/Canada and Latin America regions suggests a growing and engaged customer base, which is crucial for long-term success in the online gaming industry.

Overall, Rush Street Interactive Inc's financial results for 2023 reflect a company that is effectively navigating the challenges of the online gaming market and positioning itself for future success. Investors and industry observers will be watching closely to see if the company can maintain this momentum and achieve its ambitious targets for 2024.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider the implications for RSI's future performance.

Explore the complete 8-K earnings release (here) from Rush Street Interactive Inc for further details.

This article first appeared on GuruFocus.