Russia-Ukraine Conflict Highlights These ETFs

Domestic and international market ETFs have come under pressure as investors try to assess the economic impact of Russia’s invasion of Ukraine and the resulting sanctions.

Though markets rallied to end the week of Feb. 25, broad market ETFs including the SPDR S&P 500 ETF Trust (SPY), the iShares MSCI EAFE ETF (EFA) and the Vanguard FTSE Emerging Markets ETF (VWO) have fallen anywhere from 4% to nearly 9% so far year-to-date.

Though overall markets have trended down for much of the past two weeks, certain areas of the market have gained on the recent news and could see a continuation of the trend if the conflict continues to escalate.

Energy Prices Surge

Energy prices have jumped in the wake of the invasion, with Brent crude trading over $100 a barrel for the first time since 2014. Oil ETFs, including those that track commodity futures as well as related equities, have jumped on this price appreciation.

The iShares U.S. Oil Equipment & Services ETF (IEZ), which tracks a cap-weighted index of domestic companies that are suppliers of equipment and services to oil fields and offshore platforms, is up nearly 30% since the beginning of the year.

The iShares U.S. Oil & Gas Exploration & Production ETF (IEO), which tracks equities of companies involved in the oil and gas exploration and production space, hasn’t gained quite as much, but still remains up over 23% so far this year.

Meanwhile, the United States Oil Fund LP (USO) and the largest oil-related ETF, at $2.7 billion in assets under management, has gained 24% this year. The ETF predominantly holds short-term futures on WTI crude oil.

Clean Energy Jumps Too

High oil prices have also caused renewable energy ETFs to surge, as the case continues to build for transitioning away from reliance on fossil fuels. Clean energy ETFs struggled to start the year, continuing a trend that began last February. However, the events of the past week have boosted returns.

The more expensive oil becomes, the more compelling renewable energy sources become from a cost standpoint, so it’s no surprise that clean-energy-related ETFs have gotten a boost on surging oil prices.

Although ETFs such as the iShares Global Clean Energy ETF (ICLN), the Invesco Solar ETF (TAN) and the Invesco WilderHill Clean Energy ETF (PBW) are still in negative territory for the year, these ETFs could see continued gains if oil prices remain elevated.

Defense Stocks Rocket

As countries such as Germany plan to ramp up defense spending in response, aerospace and defense ETFs have rocketed higher.

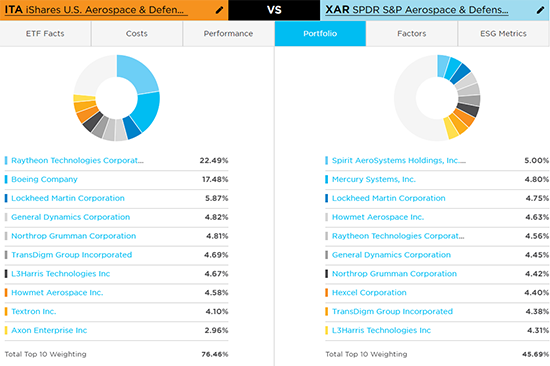

TheiShares U.S. Aerospace & Defense ETF (ITA)has the most assets under management within this category, at$2.6 billion. This ETF tracks a cap-weighted index of U.S. manufacturers, assemblers and distributors of airplane and defense equipment.

TheSPDR S&P Aerospace & Defense ETF (XAR)tracks a similar basket of stocksbut uses an equal-weighted methodology instead. Seven top holdings overlap between the two portfolios.

Courtesy of FactSet

(For a larger view, click on the image above)

As seen within theETF comparison tool, these different weighting methodologies result in drastically different weightings.Nearly a quarter of ITA is held within Raytheon Technologies stock, and 76% of the portfolio is held within the top 10.

Meanwhile, XAR’s top holding is only 5% of the portfolio, with only 46% of the portfolio held within the top 10 holdings.

Compared to ITA and XAR, theInvesco Aerospace & Defense ETF (PPA)takes a slightly broader view of the aerospace & defense space. This ETF has 53 holdings versus the 32 within XAR and the 33 within ITA. Like ITA, PPA uses a market-cap-weighting methodology, but caps securities at 10% upon rebalance.

Focus On Cybersecurity

Cybersecurity ETFs have also risen over the past week, breaking away from the tech-heavy Invesco QQQ Trust (QQQ) after trending down for much of the year with a high degree of correlation.

Russian President Vladimir Putin has threatened countries that come to Ukraine’s aid, creating rising cyberwarfare risk. As more sanctions pile up against the country, this risk only grows.

Ukraine’s banks and government websites have already come under fire from mass-distributed denial-of-service attacks, bringing some websites offline. Though Russia denies responsibility, many are attributing the series of attacks to it.

Alex Gordon, director of ETF Sales at ETF Managers Group, explained that the fundamental backdrop for cybersecurity companies was already strong prior to Russia’s invasion of Ukraine.

“The growth of the industry was already expected to be up 20% year-over-year, even before the situation arose,” he said. “Companies are starting to examine their internal defense mechanisms. That may require more spending and expanding IT budgets.”

However, the current conflict brings an even sharper focus to ETFs such as the ETFMG Prime Cyber Security ETF (HACK), the First Trust NASDAQ Cybersecurity ETF (CIBR) and the Global X Cybersecurity ETF (BUG).

Contact Jessica Ferringer at jessica.ferringer@etf.com or follow her on Twitter

Recommended Stories