Ryder (R) Benefits From Dividends, Buyback Amid High Capex

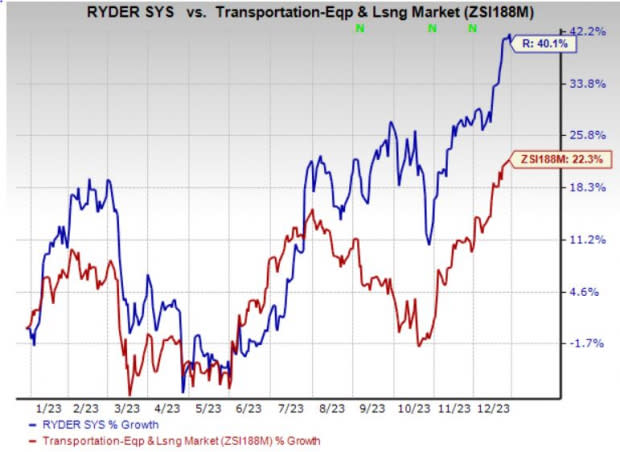

Ryder System, Inc.’s R measures to reward its shareholders are encouraging. The successful execution of its strategic, operational and financial plan drives the bright earnings outlook. The company’s shares have gained 40.1% so far this year compared with the 22.3% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Let’s find out the factors supporting the uptick.

Ryder’s encouraging 2023 earnings outlook raises optimism about the stock. While releasing its third-quarter 2023 result, management lifted its earnings per share (EPS) outlook for 2023, driven by the successful execution of Ryder's strategic, operational and financial plan. Adjusted EPS for the year is now estimated to be between $12.60 and $12.85 (prior view: $12.20 and $12.70). Adjusted ROE (return on equity) is now expected in the 18-19% band (prior view: 17-19%). R continues to expect operating revenues to increase 2% for 2023.

Ryder’s measures to reward its shareholders through dividends and share buybacks are also appreciated. In July 2023, Ryder announced a 14.5% hike in its quarterly dividend, taking the total to 71 cents per share (annualized $2.84).

The company is also active on the buyback front. In October 2023, Ryder’s board approved two new share repurchase programs. Per the first program, management is authorized to repurchase up to 2 million shares issued to employees under its employee stock plans since Aug 31, 2023, under a new anti-dilutive program (the "2023 Anti-Dilutive Program"). The second program allows management discretion to buyback up to 2 million shares of common stock over a period of two years under a new discretionary share repurchase program (the "October 2023 Discretionary Program").

Both the 2023 Anti-Dilutive Program and the October 2023 Discretionary Program are effective from Oct 12, 2023, through Oct 12, 2025.The company’s previously authorized February 2023 discretionary repurchase program was completed in September 2023, and the 2021 anti-dilutive repurchase program expired in October 2023.

During the first nine months of 2023, R repurchased shares worth $282 million and paid $96 million in the form of dividends.

On the flip side, high capex might have hurt the company’s bottom line. In the first six months of 2023, capital expenditures increased to $1.8 billion from $1.3 billion in 2022. The increase was due to higher investments in the lease fleet. For 2023, management expects capital expenditures of $3.2 billion.

Ryder’s weak liquidity position is concerning. At the end of third-quarter 2023, the company’s cash and cash equivalents were $159 million, much lower than the total debt (including the current portion) of $6,621 million. This implies that the company does not have sufficient cash to meet its current debt obligations.

Zacks Rank and Stocks to Consider

Ryder currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Transportation sector are Air Canada ACDVF and Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation WAB.

Air Canada currently sports a Zacks Rank #1 (Strong Buy). An uptick in passenger traffic is aiding ACDVF. Recently, management announced plans to launch a year-round route between Montreal and Madrid. You can see the complete list of today’s Zacks #1 Rank stocks here.

The service will commence in May 2024 as part of its expanded international summer 2024 flying schedule to cater to increased demand. The Zacks Consensus Estimate for Air Canada’s 2023 and 2024 earnings has witnessed increases of 32.6% and 41.3% in the past 60 days, respectively.

Wabtec has an expected earnings growth rate of 22.43% for the current year. WAB delivered a trailing four-quarter earnings surprise of 7.11%, on average. Wabtec carries a Zacks Rank of 2 (Buy).

The Zacks Consensus Estimate for WAB’s current-year earnings has improved 4.9% over the past 90 days. Shares of WAB have gained 26.1% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Air Canada (ACDVF) : Free Stock Analysis Report