Ryder (R) Touches 52-Week High: What's Driving the Stock?

Shares of Ryder System, Inc. R scaled a 52-week high of $104.21 in the trading session on Sep 18, 2023, before closing a tad lower at $103.43.

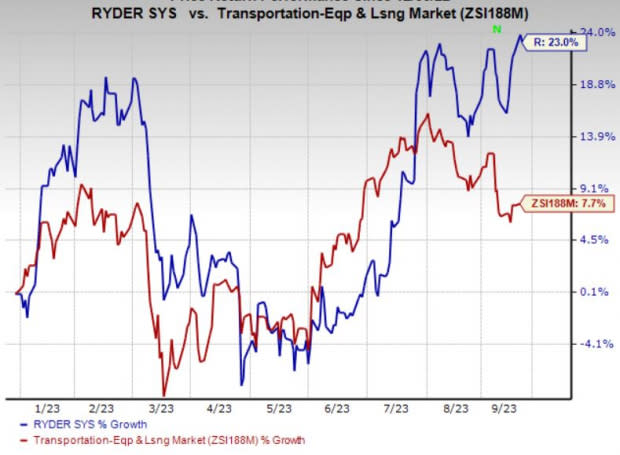

The company’s shares gained 23.8% so far this year compared with the 7.7% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Let’s find out the factors supporting the uptick.

Ryder’s 2023 outlook is encouraging. While releasing its second-quarter 2023 result, management lifted its earnings per share (EPS) outlook for 2023, which is driven by the successful execution of its strategic, operational and financial plan. Adjusted EPS for the year is now estimated to be between $12.20 and $12.70 (prior view: $11.30-$12.05).

For 2023, management anticipates operating revenues to increase 2%. Net cash from operating activities is projected to be $2.5 billion (prior view: $2.4 billion). Adjusted ROE (return on equity) is still suggested in the range of 17-19% (prior view: 16-18%).

Ryder’s measures to reward its shareholders through dividends and share buybacks are also appreciated. In July 2023, Ryder announced a 14.5% hike in its quarterly dividend, taking the total to 71 cents per share (annualized $2.84). The company is also active on the buyback front. In February 2023, Ryder’s board approved a new 2-million share discretionary repurchase program. The management is now authorized to buyback up to 2 million shares of common stock at its discretion from Feb 10, 2023, through Feb 10, 2025 (two years).

The positive sentiment surrounding the stock is evident from the Zacks Consensus Estimate for current-year earnings, which has been revised upward over the past 60 days.

Zacks Rank and Other Stocks to Consider

Currently, Ryder carries a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks from the Zacks Transportation sector are GATX Corporation (GATX) and SkyWest, Inc. (SKYW). Each of these companies presently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GATX has an expected earnings growth rate of 14.33% for the current year. GATX delivered a trailing four-quarter earnings surprise of 17.30%, on average.

The Zacks Consensus Estimate for GATX’s current-year earnings has improved 2.1% over the past 90 days. Shares of GATX have gained 6% year to date.

SkyWest's fleet-modernization efforts are commendable.A fall in operating expenses is a tailwind for SkyWest. In second-quarter 2023, the metric dipped 2.4% to $693.8 million due to a decline in operating costs. Low operating expenses boost bottom-line results. Shares of SKYW have surged 163.6% year to date.

SKYW delivered a trailing four-quarter earnings surprise of 31.51%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ryder System, Inc. (R) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report