Ryder System Inc (R) Navigates Tough Freight Market, Posts Mixed 2023 Results

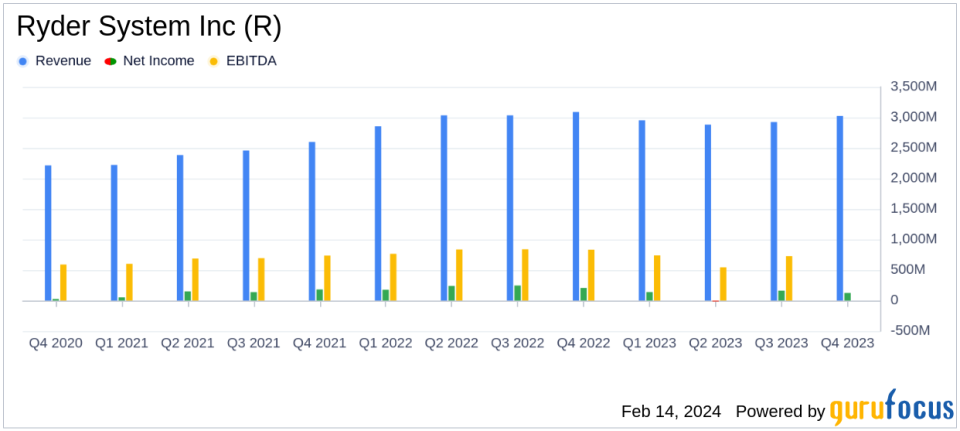

Total Revenue: $11.8 billion in 2023, a slight decrease from $12.0 billion in the previous year.

Operating Revenue: Increased by 2% to $9.5 billion in 2023.

GAAP EPS: $8.73 for 2023, down from $16.96 in the prior year, including a non-cash UK exit currency translation charge.

Comparable EPS: $12.95 in 2023, compared to $16.37 in the prior year.

Adjusted ROE: 19% for 2023, a decrease from 29% in the previous year.

Free Cash Flow: Negative $54 million in 2023, a notable shift from $921 million in 2022.

2024 Outlook: Anticipates ROE of 15% - 16.5%, with comparable EPS of $11.50 - $12.50.

Ryder System Inc (NYSE:R) released its 8-K filing on February 14, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leader in supply chain, dedicated transportation, and fleet management solutions, faced a challenging freight environment that impacted its earnings, particularly in used vehicle sales and rental. Despite these challenges, Ryder's Supply Chain Solutions (SCS) segment showed improved results, contributing to the company's resilience.

Ryder operates across three business segments: Fleet Management Solutions (FMS), Supply Chain Solutions (SCS), and Dedicated Transportation Solutions (DTS). Each segment plays a crucial role in Ryder's overall strategy to provide comprehensive transportation and logistics services to its customers.

The company reported a decrease in total revenue to $11.8 billion in 2023 from $12.0 billion in the previous year, with operating revenue seeing a 2% increase to $9.5 billion. GAAP EPS from continuing operations was $8.73, including a non-cash UK exit currency translation charge, down from $16.96 in the prior year. The comparable EPS (non-GAAP) from continuing operations was $12.95, reflecting weaker market conditions in used vehicle sales and rental, but was partially offset by improved results in the DTS and SCS segments.

The adjusted return on equity (ROE) for 2023 was 19%, a decrease from 29% in the previous year, indicating a lower profitability relative to shareholders' equity. The full-year net cash provided by operating activities from continuing operations remained stable at $2.4 billion, but the company experienced a significant shift in free cash flow, which turned negative at $54 million compared to $921 million in 2022.

For the full-year 2024 outlook, Ryder anticipates an ROE of 15% to 16.5% and a comparable EPS (non-GAAP) of $11.50 to $12.50. The company expects operating revenue (non-GAAP) to increase by approximately 13%, including recent acquisitions. However, it projects free cash flow (non-GAAP) to be negative between $275 million and $375 million.

Ryder's CEO, Robert Sanchez, commented on the company's performance, stating:

"Ryder delivered strong results in the fourth quarter and throughout 2023 reflecting continued execution of our balanced growth strategy. While the freight environment remained challenging, the transformative actions weve taken to de-risk the model, enhance returns, and drive profitable growth have meaningfully improved business model resilience."

The FMS segment experienced a 7% decrease in total revenue and a 4% decrease in operating revenue, primarily due to lower rental demand and lower used vehicle sales results. The SCS segment, however, saw a 4% increase in total revenue and a 10% increase in operating revenue, driven by organic growth and the acquisition of Impact Fulfillment Services, LLC. The DTS segment's total revenue decreased by 3%, but operating revenue grew by 1%, reflecting inflationary cost recovery.

Looking ahead, Ryder's CFO, John Diez, provided insights into the company's 2024 expectations:

"In 2024, we expect to generate ROE in the mid-teens, in line with our target during trough used vehicle sales and rental market conditions. Historically the first quarter has been our lowest earnings quarter, and in 2024 we expect that it will also represent the most challenging year over year comparison because of where we are in the cycle."

Value investors may find Ryder's commitment to a balanced growth strategy and its ability to generate stable cash flows from operations appealing, despite the current challenges in the freight market. The company's strategic acquisitions and focus on growing its contractual lease, dedicated, and supply chain businesses at targeted returns could position it well for future growth as market conditions improve.

For more detailed financial information and future updates on Ryder System Inc (NYSE:R), investors and interested parties are encouraged to visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Ryder System Inc for further details.

This article first appeared on GuruFocus.