Ryerson Holding Corp (RYI) Reports Mixed Fourth Quarter and Full Year 2023 Results Amidst ...

Net Income: Q4 net income of $25.8 million; full-year net income of $145.7 million.

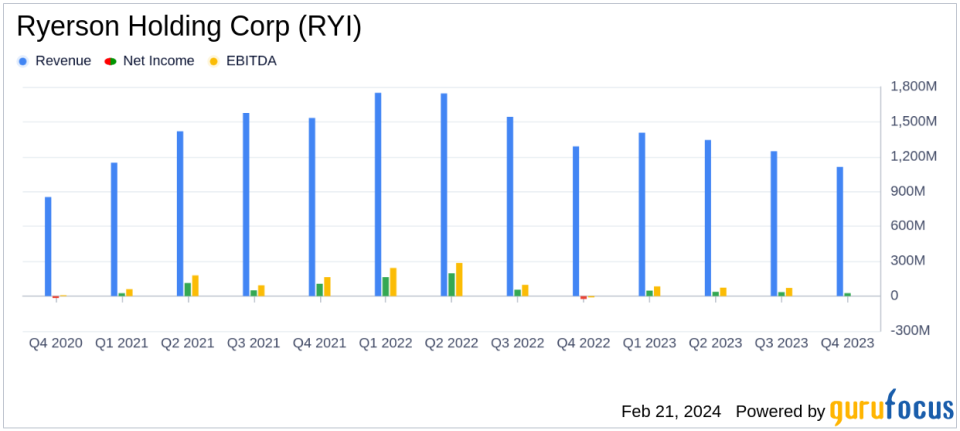

Revenue: Q4 revenue declined by 10.8% QoQ and 13.6% YoY to $1.1 billion; full-year revenue down 19.2% YoY to $5.1 billion.

Earnings Per Share (EPS): Q4 diluted EPS at $0.74; full-year diluted EPS at $4.10.

Dividends: Announced Q1 2024 dividend of $0.1875 per share, marking the tenth consecutive increase.

Acquisitions: Completed three strategic acquisitions in Q4, enhancing value-added processing capabilities.

Cash Flow: Generated strong Q4 operating cash flow of $90 million and free cash flow of $65 million.

Leverage: Maintained net leverage ratio within target range at 1.7x.

Ryerson Holding Corp (NYSE:RYI) released its 8-K filing on February 21, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, a leading value-added processor and distributor of industrial metals, faced a challenging environment characterized by slowing manufacturing activity and market corrections.

Company Overview

Ryerson operates primarily in North America, with additional facilities in China. It serves a diverse customer base, offering products in stainless steel, aluminum, carbon steel, and alloy steels. The majority of Ryerson's revenue is generated from metal product sales in the United States.

Financial Performance and Challenges

The company's fourth quarter saw net income attributable to Ryerson of $26 million and adjusted EBITDA, excluding LIFO, of $26 million. Despite a decrease in quarterly revenue to $1.1 billion, Ryerson achieved a gross margin expansion to 22.2%. However, the company faced headwinds with a year-over-year revenue decline of 19.2% to $5.1 billion and a full-year net income drop of 62.7% to $146 million. These challenges reflect broader market conditions, including a 14% decline in industry stainless volumes and a significant drop in nickel prices.

Strategic Moves and Financial Achievements

Ryerson's strategic acquisitions of Norlen Incorporated, TSA Processing, and Hudson Tool Steel Corporation in Q4 underscore its commitment to growth and value-added services. The company also continued to reward shareholders with its tenth consecutive dividend increase and share buybacks totaling $113.9 million for the full year.

Key Financial Metrics

The company's balance sheet shows a total debt of $436.5 million, with net debt standing at $382.2 million as of December 31, 2023. The net leverage ratio was maintained at 1.7x, reflecting Ryerson's prudent financial management. The cash conversion cycle improved year-over-year, dropping from 91.6 days in Q4 2022 to 84.6 days in Q4 2023.

Management Commentary

Eddie Lehner, Ryersons President and CEO, commented on the company's resilience amidst market downturns, stating, "Despite moving through a counter-cyclical bottom across the majority of our commercial book of business, we continue to believe that our investments in our next-gen operating model will position us to deliver higher thru-the-cycle earnings to our shareholders with less volatility."

Analysis of Performance

Ryerson's strategic investments and cost management initiatives have positioned the company to navigate a challenging market environment effectively. The company's focus on expanding its value-added services and maintaining a strong balance sheet has enabled it to continue its dividend growth strategy and return value to shareholders through share repurchases.

For value investors, Ryerson's disciplined approach to growth and shareholder returns, coupled with its ability to generate strong cash flows, presents a compelling investment narrative. The company's outlook for the first quarter of 2024 anticipates an increase in customer shipments and a modest rise in average selling prices, suggesting potential for improved performance in the near term.

For more detailed insights and analysis, investors are encouraged to review Ryerson's full 8-K filing.

Ryerson will host a conference call to discuss the earnings report, providing an opportunity for investors to gain further clarity on the company's strategies and outlook.

Visit Ryerson's website at www.ryerson.com for more information about the company's services and operations.

Explore the complete 8-K earnings release (here) from Ryerson Holding Corp for further details.

This article first appeared on GuruFocus.