Ryerson Holding (RYI) to Report Q2 Earnings: What's in the Offing?

Ryerson Holding Corporation RYI is slated to report second-quarter 2023 results after the closing bell on Jul 31.

The company has a trailing four-quarter negative earnings surprise of roughly 72.3%, on average. Its second-quarter results are expected to reflect favorable demand and prices.

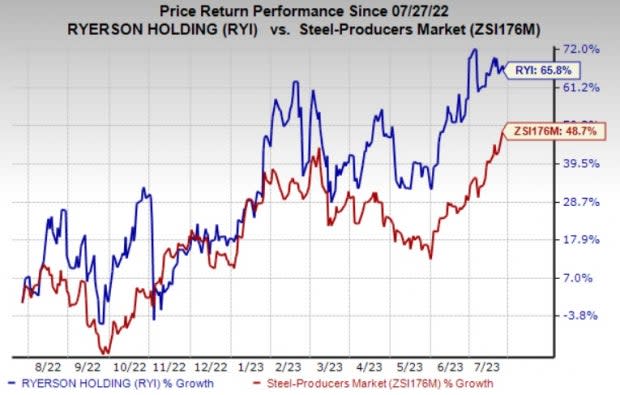

The stock is up 65.8% in the past year compared with the industry’s 48.7% rise.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What Do the Estimates Say?

Ryerson Holding, in its first-quarter call, said that it expects second-quarter revenues in the range of $1.40-$1.44 billion. It also sees earnings per share in the range of $1.28-$1.36.

Some Factors at Play

Ryerson Holding is expected to have benefited from a positive demand environment in the June quarter. It is seeing strong customer order backlogs. The company saw higher sequential shipment volumes in most end markets in the first quarter, especially commercial ground transportation, food processing & agricultural equipment and industrial machinery. Healthy demand is likely to have supported its shipment volumes in the second quarter.

The company is expected to have witnessed some weakness in nickel and aluminum prices in the second quarter. This is likely to have been offset by sequentially higher carbon pricing. Higher steel prices are expected to have supported RYI’s average selling prices in the quarter to be reported. The company expects average selling price to be flat to up 1% sequentially in the second quarter.

Ryerson Holding Corporation Price and EPS Surprise

Ryerson Holding Corporation price-eps-surprise | Ryerson Holding Corporation Quote

Zacks Model

Our proven model does not conclusively predict an earnings beat for Ryerson Holding this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for Ryerson Holding is 0.00%. The Zacks Consensus Estimate for second-quarter earnings is currently pegged at $1.33. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Ryerson Holding currently carries a Zacks Rank #1.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider, as our model shows these have the right combination of elements to post an earnings beat this quarter:

Ecolab Inc. ECL, slated to release earnings on Aug 1, has an Earnings ESP of +0.50% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks Rank #1 stocks here.

The Zacks Consensus Estimate for earnings for ECL for the second quarter is pegged at a profit of $1.21.

Axalta Coating Systems Ltd. AXTA, which is slated to release its earnings on Aug 1, has an Earnings ESP of +6.02%.

The consensus estimate for AXTA’s earnings for the second quarter is currently pegged at 39 cents. It currently carries a Zacks Rank #2.

Livent Corporation LTHM, scheduled to release earnings on Aug 3, has an Earnings ESP of +2.58% and carries a Zacks Rank #1.

The consensus estimate for LTHM’s earnings for the second quarter is currently pegged at 46 cents.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Ryerson Holding Corporation (RYI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Livent Corporation (LTHM) : Free Stock Analysis Report