Ryman Hospitality Properties Inc Reports Record Revenue and Net Income for Q4 and Full Year 2023

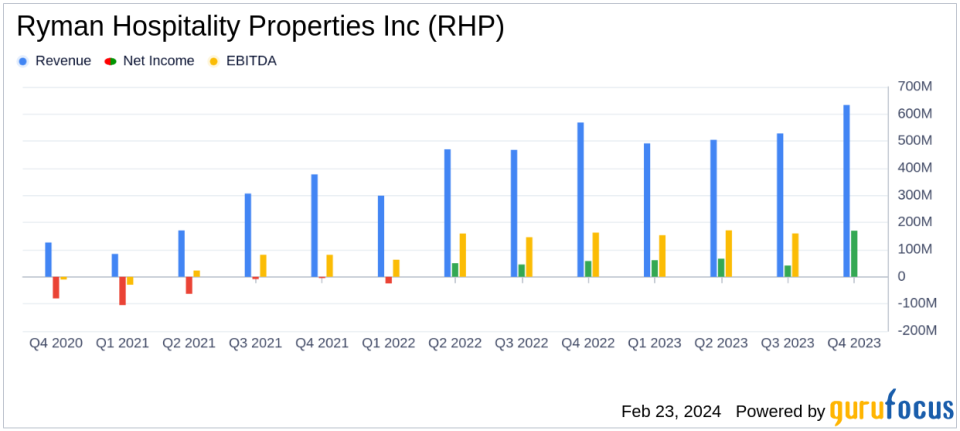

Net Income: Q4 net income soared to $169.9 million, a 176.8% increase year-over-year.

Revenue: Record consolidated revenue of $633.1 million in Q4, up 11.3% from the previous year.

Dividends: Declared Q1 2024 cash dividend of $1.10 per share, with a plan to distribute minimum dividends of $4.40 per share for 2024.

Bookings: Over 1.2 million same-store Gross Definite Room Nights booked in Q4 at a record ADR, signaling robust future demand.

Adjusted EBITDAre: Achieved a record $690.7 million for the full year, reflecting a 24.3% increase over the prior year.

Operating Margin: Full year operating income margin improved to 21.0%, a 2.9 percentage point increase from 2022.

Balance Sheet: Strong liquidity with $591.8 million in unrestricted cash and significant borrowing capacity.

On February 22, 2024, Ryman Hospitality Properties Inc (NYSE:RHP) released its 8-K filing, detailing a robust performance for both the fourth quarter and the full year of 2023. The company, a leading lodging and hospitality real estate investment trust, specializes in group-oriented, destination hotel assets in urban and resort markets. Its portfolio includes notable properties such as the Gaylord Opryland and the JW Marriott San Antonio Hill Country Resort & Spa.

RHP's impressive fourth quarter was highlighted by a record net income of $169.9 million, a significant increase from the $61.4 million reported in the same period last year. This surge was partly due to a $112.5 million deferred tax benefit recognized for the release of income tax valuation allowance. The company also reported an all-time high consolidated revenue of $633.1 million for the quarter, an 11.3% increase year-over-year, driven by strong performance in both the Hospitality and Entertainment segments.

Financial Performance and Strategic Developments

The Hospitality segment, which is the primary revenue driver, reported a 12.5% increase in revenue for the quarter, reaching $545.2 million. The same-store Hospitality segment, excluding the recently acquired JW Marriott Hill Country, saw a 3.8% increase in revenue to $503.1 million. This segment's success was attributed to record total revenue per available room (RevPAR) and average daily rate (ADR), indicating strong pricing power and demand.

The Entertainment segment also had a standout year with operating income reaching $20.6 million for the quarter. This success is expected to continue with the opening of Ole Red Las Vegas and the reimagination of the Wildhorse Saloon into Category 10, in collaboration with country music star Luke Combs.

RHP's balance sheet remains robust, with total debt standing at $3.4 billion, net of unamortized deferred financing costs, and unrestricted cash of $591.8 million as of December 31, 2023. The company's liquidity is further supported by significant borrowing capacity, with no amounts drawn under the Companys revolving credit facility and $745.4 million of aggregate borrowing availability.

Outlook and Dividend Update

Looking ahead, RHP is reiterating its 2024 business performance outlook, with no updates provided before the next quarter's earnings release. The company has declared a first quarter 2024 cash dividend of $1.10 per share of common stock, payable on April 15, 2024, to stockholders of record as of March 29, 2024. This is in line with the company's policy to distribute minimum dividends of 100% of REIT taxable income annually, with a plan to distribute aggregate minimum dividends for 2024 of $4.40 per share in cash.

Mark Fioravanti, President and CEO, expressed confidence in the company's momentum and strength across both Hospitality and Entertainment segments. He highlighted the company's strategic investments and the value proposition that continues to attract strong demand and pricing power.

For value investors and potential GuruFocus.com members, RHP's latest earnings report underscores the company's ability to generate significant revenue growth, maintain a strong balance sheet, and provide attractive shareholder returns through dividends. The company's strategic capital investments and robust booking trends suggest a positive outlook for sustained growth and profitability.

For more detailed financial information and the full earnings report, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Ryman Hospitality Properties Inc for further details.

This article first appeared on GuruFocus.