Saba Capital Management, L.P. Bolsters Portfolio with Pioneer Municipal High Income Trust ...

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its portfolio with the addition of shares in Pioneer Municipal High Income Trust (NYSE:MHI). On November 9, 2023, the firm acquired 2,842,443 shares of MHI at a trade price of $7.57 per share. This transaction has increased the firm's position in the stock to 12.48%, representing a 0.56% ratio of the traded stock in the firm's portfolio. The trade has a negligible impact on the portfolio, but it signifies a strategic addition by the firm.

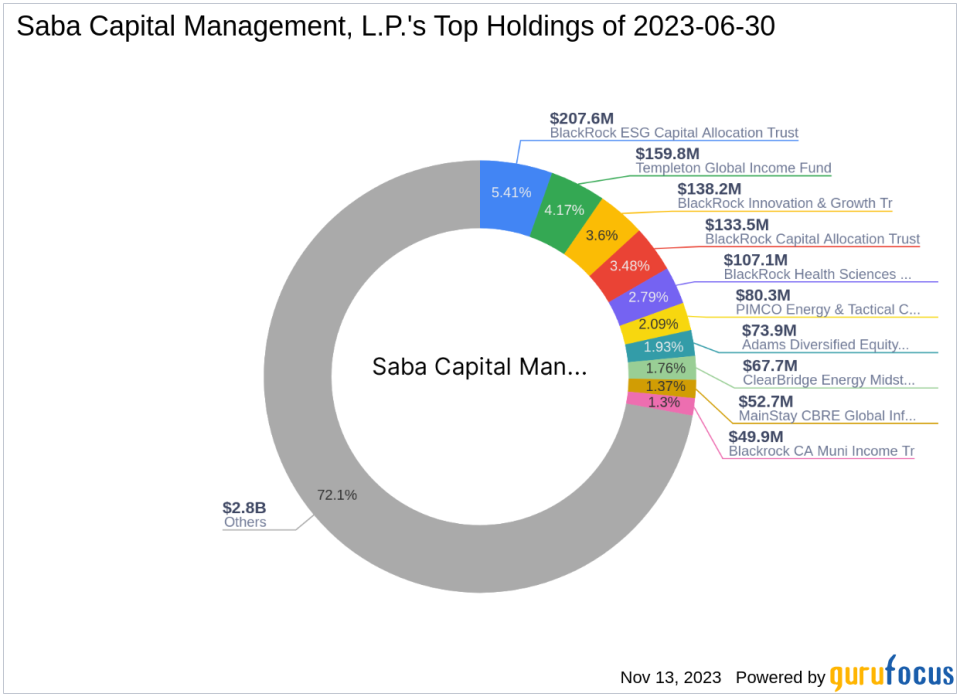

Insight into Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), headquartered at 405 Lexington Avenue, New York, NY, is known for its distinctive investment philosophy that focuses on value investing. The firm manages an equity portfolio worth $3.84 billion, with a significant presence in the Financial Services and Technology sectors. Among its top holdings are Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and BlackRock Health Sciences Trust II (NYSE:BMEZ).

Overview of Pioneer Municipal High Income Trust

Pioneer Municipal High Income Trust, trading under the symbol MHI in the USA, is a diversified, closed-end management investment company. The trust aims to provide a high level of current income exempt from regular federal income tax and seeks capital appreciation. It invests across various sectors, including health, education, and utilities. With a market capitalization of $176.026 million, MHI's stock is currently priced at $7.73, which is significantly undervalued according to the GF Value of $40.05.

Trade Impact and Position Size

The recent acquisition by Saba Capital Management, L.P. (Trades, Portfolio) has a moderate impact on its portfolio, given the trade's position size. The addition of 600 shares has slightly increased the firm's stake in MHI, reflecting a calculated move to capitalize on the stock's potential. With the stock's price to GF Value ratio at 0.19, the firm's investment could be poised for significant growth if the market corrects to the GF Value.

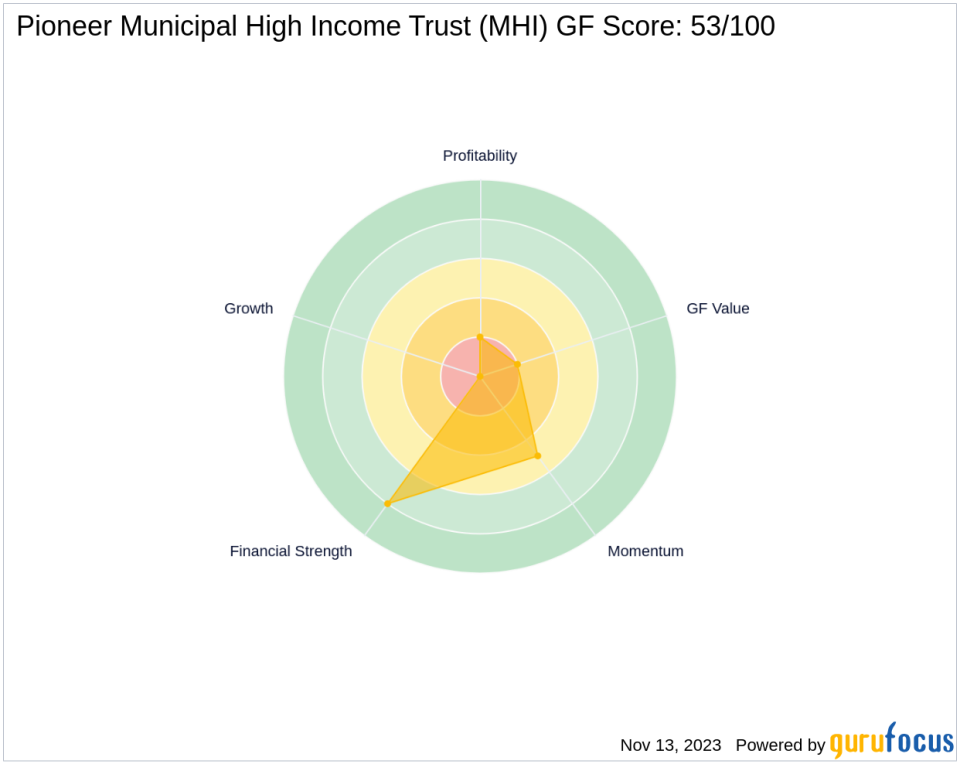

Financial Health and Performance Metrics

Pioneer Municipal High Income Trust's financial health and performance metrics present a mixed picture. The trust has a GF Score of 53/100, indicating poor future performance potential. Its Financial Strength is rated 8/10, while the Profitability Rank is low at 2/10. The trust's Growth Rank and GF Value Rank are not applicable, indicating no enough data to calculate these metrics. However, the trust has a strong Piotroski F-Score of 7, suggesting good financial health.

Market Performance and Valuation

Since the trade, MHI's stock has seen a 2.11% increase in price, although it has experienced a significant decline of 48.47% since its IPO. The year-to-date performance also shows a decrease of 10.94%. Despite these figures, the stock's valuation based on the GF Value suggests it is significantly undervalued, which could attract value investors looking for potential bargains.

Investment Considerations

Saba Capital Management, L.P. (Trades, Portfolio)'s decision to add MHI to its portfolio may be based on the stock's undervaluation and the firm's confidence in its financial health, as indicated by the high Financial Strength and Piotroski F-Score. However, potential investors should be aware of the risks, including the trust's low Profitability Rank and the overall market's perception of the asset management industry.

Closing Summary

The recent trade by Saba Capital Management, L.P. (Trades, Portfolio) marks a strategic addition to its diverse portfolio. While the impact on the firm's portfolio is currently minimal, the potential for growth based on MHI's undervaluation could be significant. Value investors may find this transaction an interesting point of analysis when considering their own investment strategies in the municipal bond sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.