Saba Capital Management L.P. Bolsters Stake in BlackRock Health Sciences Trust II

Introduction to the Transaction

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently increased its investment in BlackRock Health Sciences Trust II (NYSE:BMEZ). On November 10, 2023, the firm executed an addition to its position, purchasing 321,319 shares. This transaction impacted the firm's portfolio by 0.11% and was conducted at a trade price of $13.47 per share. Following this acquisition, Saba Capital Management now holds a total of 12,669,877 shares in BMEZ, which represents a significant position size of 4.45% in the firm's portfolio and 11.73% of the company's outstanding shares.

Profile of Saba Capital Management

Saba Capital Management, L.P. (Trades, Portfolio), headquartered at 405 Lexington Avenue, New York, NY, is known for its strategic investment philosophy. With an equity under management amounting to $3.84 billion, the firm has a diverse portfolio, including top holdings such as Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and BlackRock Health Sciences Trust II (NYSE:BMEZ). The firm's investment approach is reflected in its significant positions within the Financial Services and Technology sectors.

Overview of BlackRock Health Sciences Trust II (NYSE:BMEZ)

BlackRock Health Sciences Trust II is a USA-based closed-end management investment company with a clear objective to deliver total return through a combination of current income and long-term capital appreciation. BMEZ primarily invests in equity securities of energy and natural resources companies, as well as equity derivatives with exposure to the industry. With a market capitalization of $1.45 billion, BMEZ is a significant player in the asset management industry.

Analysis of the Trade's Significance

The recent trade by Saba Capital Management underscores the firm's confidence in BMEZ's potential. The addition of over 321,000 shares is a strategic move that enhances the firm's influence in BMEZ's future. This trade not only increases Saba Capital Management's stake in BMEZ but also reflects a calculated decision to capitalize on the trust's market position and investment strategy.

Market Performance of BMEZ

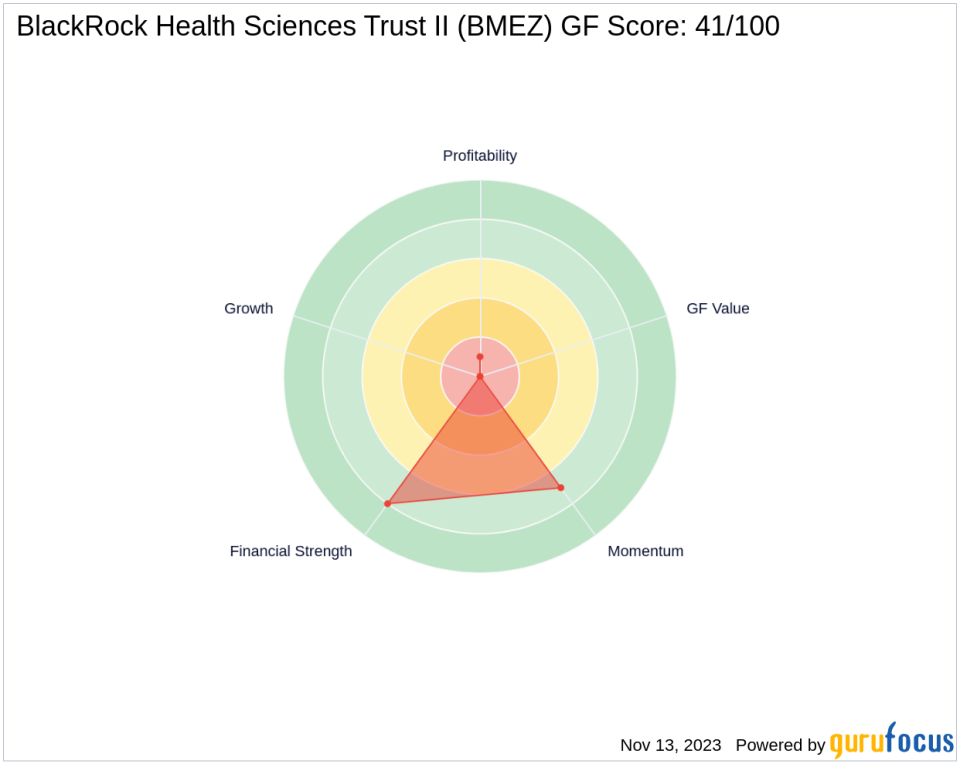

As of the latest data, BMEZ's stock price stands at $13.46, closely aligned with the trade price of $13.47. The stock has experienced a slight decline of 0.07% since the transaction date. BMEZ's market performance metrics, such as a PE Percentage of 27.53% and a GF Score of 41/100, indicate a mixed outlook, with the GF Score suggesting potential challenges ahead in terms of future performance. The stock's market capitalization and current price reflect a company that is navigating through a complex market environment.

Saba Capital Management's Top Holdings and Sectors

The firm's top holdings, including GIM, BCAT, BMEZ, BlackRock Innovation & Growth Tr (NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust (NYSE:ECAT), showcase a strategic focus on income-generating assets and growth opportunities. Saba Capital Management's investment portfolio is heavily weighted towards the Financial Services and Technology sectors, indicating a preference for industries that are both dynamic and potentially lucrative.

BMEZ's Financial Health and Market Position

BMEZ's financial health is reflected in its Balance Sheet Rank of 8/10 and a Profitability Rank of 1/10. These rankings suggest a strong financial foundation but raise concerns about profitability. The trust's ROE and ROA rankings of 441 and 311, respectively, further highlight areas where improvement is needed to enhance its market position.

BMEZ's Stock Performance Indicators

Performance indicators such as the RSI (Relative Strength Index) and Momentum Index provide insights into BMEZ's stock behavior. With an RSI 14 Day of 39.63 and a Momentum Index 6 - 1 Month of -12.83, BMEZ is showing signs of potential undervaluation, which could be an attractive entry point for investors. However, the lack of data for GF Value Rank and historical growth metrics indicates that a comprehensive valuation is challenging, necessitating a closer look at the trust's fundamentals and market trends.

Conclusion: The Impact of Saba Capital Management's Trade

The recent acquisition by Saba Capital Management, L.P. (Trades, Portfolio) has not only increased its stake in BlackRock Health Sciences Trust II but also signals a strategic move that could influence the trust's trajectory. While BMEZ's financial health appears robust, its profitability and growth metrics suggest areas for potential improvement. Investors will be watching closely to see how this trade impacts both Saba Capital Management's portfolio and BMEZ's market performance in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.