Saba Capital Management, L.P. Bolsters Portfolio with Eaton Vance New York Municipal Bond Fund ...

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its investment portfolio by adding shares of Eaton Vance New York Municipal Bond Fund (ENX). On November 10, 2023, the firm acquired 2,971,854 shares of ENX at a trade price of $8.71. This transaction has increased the firm's position in the fund to 0.68% of its portfolio, representing a 16.55% ownership of the traded stock. Despite the modest trade impact, this addition signifies a strategic move by Saba Capital Management, L.P. (Trades, Portfolio) to diversify its holdings in the financial sector.

Insight into Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), headquartered at 405 Lexington Avenue, New York, NY, is known for its keen investment philosophy that focuses on value investing. With a diverse portfolio comprising 624 stocks, the firm has a significant equity of $3.84 billion. Its top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and several other prominent funds. The firm's investment strategy is heavily weighted towards the Financial Services and Technology sectors, indicating a preference for industries with high growth potential.

Eaton Vance New York Municipal Bond Fund (ENX) at a Glance

Eaton Vance New York Municipal Bond Fund, trading under the symbol ENX in the United States, has been publicly available since its IPO on August 28, 2002. The fund's primary business involves managing investment funds and providing advisory services to affluent individuals and institutions. With a focus on tax-exempt income, ENX operates as a non-diversified, closed-end investment company. Currently, the fund's market capitalization stands at $155.366 million, with a stock price of $8.65, reflecting a slight decrease since the recent transaction by Saba Capital Management, L.P. (Trades, Portfolio)

Trade Impact and Position Analysis

The recent acquisition of ENX shares by Saba Capital Management, L.P. (Trades, Portfolio) has a dual significance. Firstly, it showcases the firm's confidence in the municipal bond market, particularly within New York. Secondly, the trade's position size and share change, albeit small, may indicate a strategic entry point or a long-term investment approach. With a 0.02% trade change and an additional 577 shares, the firm is positioning itself for potential income generation and tax advantages that municipal bonds offer.

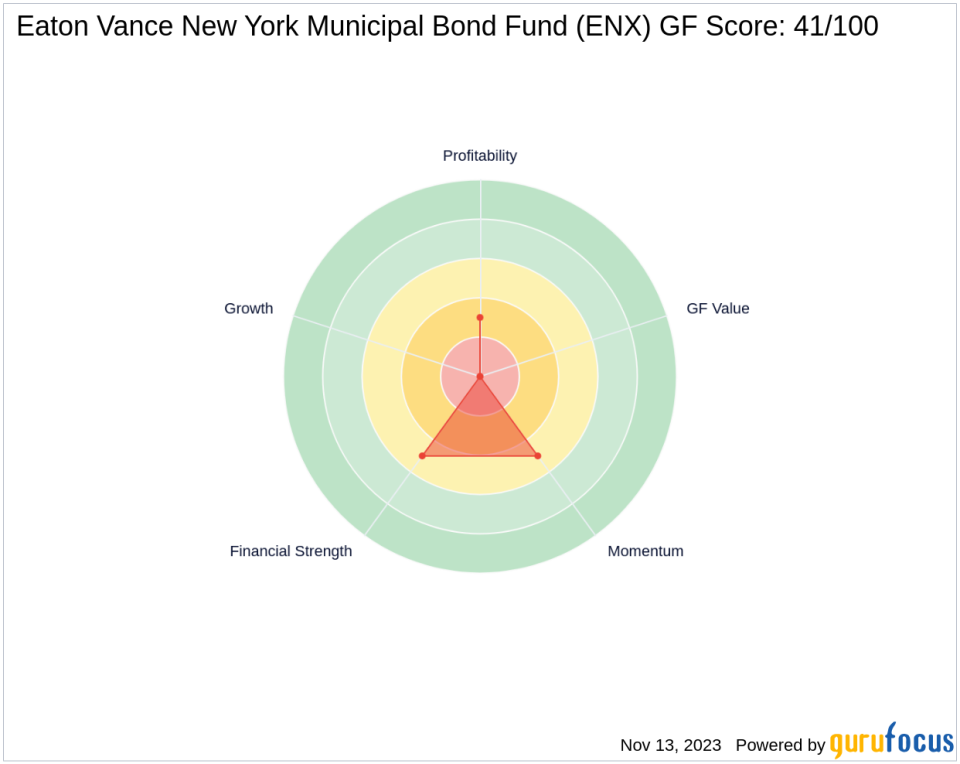

Financial Health and Performance Metrics of ENX

Eaton Vance New York Municipal Bond Fund's financial health and performance metrics present a mixed picture. The fund's Return on Equity (ROE) and Return on Assets (ROA) stand at -6.21% and -3.74%, respectively, placing it lower in the rankings. The Financial Strength and Profitability Rank are also moderate, with scores of 5/10 and 3/10. However, the GF Score of 41/100 suggests that there may be challenges ahead for the fund in terms of future performance potential.

Market Performance and Valuation of ENX

ENX's stock price performance has seen a year-to-date decline of 4.53%, with a significant drop of 42.33% since its IPO. The lack of available data for GF Value and GF Value Rank makes it challenging to evaluate the fund's current valuation. However, the Momentum Rank of 5/10 indicates a neutral position in terms of market trends.

Concluding Thoughts on Saba Capital Management, L.P. (Trades, Portfolio)'s Trade

The acquisition of Eaton Vance New York Municipal Bond Fund shares by Saba Capital Management, L.P. (Trades, Portfolio) is a calculated addition to the firm's already diverse portfolio. While the immediate impact of the trade may seem minimal, it aligns with the firm's investment strategy and could potentially yield long-term benefits. As investors and market watchers observe ENX's performance, the fund's fit within Saba Capital's investment philosophy will become more evident over time.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.