Saba Capital Management, L.P. Bolsters Position in BlackRock Capital Allocation Trust

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its portfolio by adding shares of BlackRock Capital Allocation Trust (NYSE:BCAT). On November 10, 2023, the firm acquired an additional 8,722 shares of BCAT at a trade price of $14.54. This transaction has increased Saba Capital Management's total holdings in BCAT to 11,389,765 shares, signifying a substantial investment in the asset management company.

Insight into Saba Capital Management

Saba Capital Management, L.P. (Trades, Portfolio) is recognized in the market for its expertise and strategic investment decisions. Operating from its headquarters at 405 Lexington Avenue, New York, the firm has developed a robust investment philosophy that has guided its operations. With a diverse portfolio comprising 624 stocks, Saba Capital Management has a significant equity of $3.84 billion. The firm's top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and other notable funds within the financial services and technology sectors.

Overview of BlackRock Capital Allocation Trust

BlackRock Capital Allocation Trust, trading under the symbol BCAT, is a USA-based non-diversified, closed-end management investment company. Since its IPO on September 25, 2020, BCAT has aimed to deliver total return and income through a mix of current income, current gains, and long-term capital appreciation. With a market capitalization of $1.58 billion, BCAT's recent stock performance shows a current stock price of $14.65, a PE Ratio of 10.68, and a year-to-date price change ratio of 4.34%.

Impact of the Recent Trade on Saba Capital's Portfolio

The recent acquisition of BCAT shares by Saba Capital Management has not only increased the firm's total shareholding but also its influence within BCAT's shareholder structure. The trade impact on the firm's portfolio is currently at 0%, with the position size in BCAT now standing at 4.32%. Saba Capital Management holds a significant 10.53% of BCAT's outstanding shares, underscoring the importance of BCAT within its investment strategy.

Significance of BCAT in Saba Capital Management's Holdings

BCAT represents a key component of Saba Capital Management's portfolio, with the firm's current holding percentage indicating a strong conviction in the stock's potential. The firm's position in BCAT is one of its top holdings, reflecting its strategic importance and the potential impact on the firm's overall performance.

Financial and Market Performance of BCAT

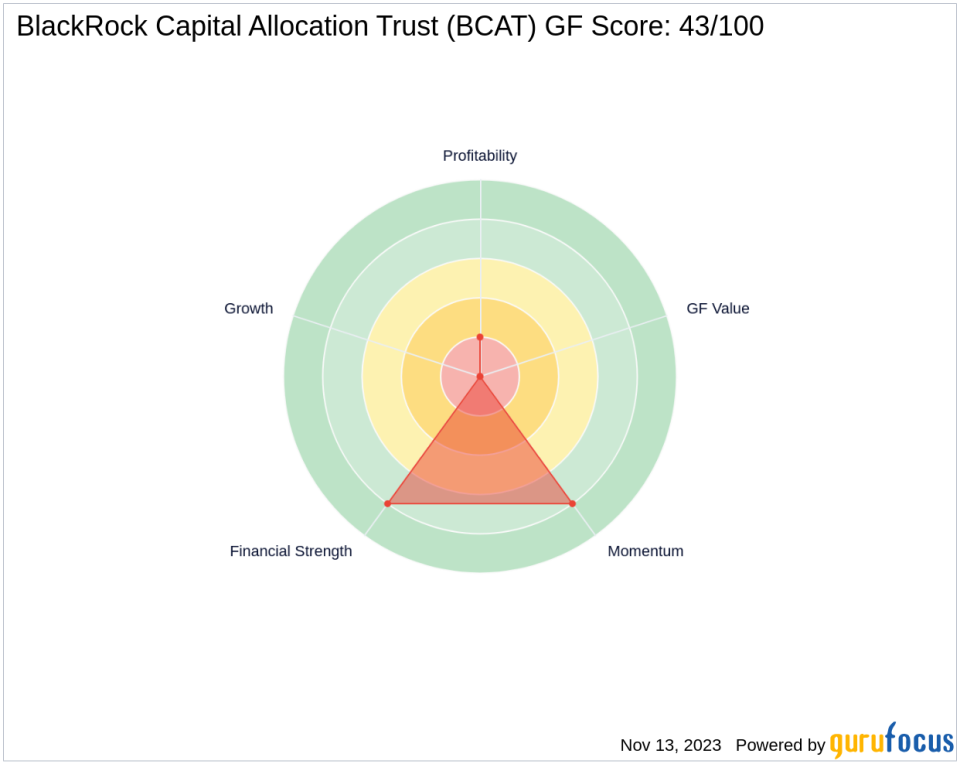

BCAT's financial health is robust, with a Cash to Debt ratio of 148.19, placing it at rank 644 in this metric. However, the company's GF Score of 43/100 suggests that there may be concerns regarding its future performance potential. The stock's Financial Strength is commendable at 8/10, but its Profitability Rank is low at 2/10, indicating challenges in maintaining profitability.

Valuation and Market Position of BCAT

Without sufficient data to calculate the GF Value, BCAT's valuation cannot be fully assessed against historical and industry benchmarks. Nevertheless, the stock's current price is slightly above the trade price, with a gain percentage of 0.76% since the transaction date. This marginal increase suggests a stable market position post-acquisition.

Concluding Analysis of Saba Capital's Strategic Move

Saba Capital Management's recent addition of BCAT shares to its portfolio reflects a strategic move that aligns with the firm's investment philosophy. Despite the lack of GF Value data, the firm's significant holding in BCAT and the stock's stable price post-trade indicate a positive outlook for this investment. The transaction's influence on both the stock and Saba Capital's portfolio will be closely monitored by investors seeking to gauge the potential long-term benefits of this acquisition.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.