Saba Capital Management, L.P. Bolsters Portfolio with ClearBridge Energy MLP Total Return Fund ...

Introduction to the Transaction

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its investment portfolio by adding shares of ClearBridge Energy MLP Total Return Fund (NYSE:CTR). On November 10, 2023, the firm executed an addition of 1,626 shares to its holdings, bringing the total share count to 1,049,130. This transaction has increased Saba Capital Management's position in CTR to 0.86% of its portfolio, representing a 15.23% ownership in the traded stock.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Based in New York, Saba Capital Management, L.P. (Trades, Portfolio) is a firm with a keen focus on value investing, seeking opportunities across various sectors. With an equity portfolio of $3.84 billion, the firm's top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and BlackRock Health Sciences Trust II (NYSE:BMEZ), among others. The firm's investment strategy is heavily weighted towards the Financial Services and Technology sectors.

ClearBridge Energy MLP Total Return Fund (NYSE:CTR) Overview

CTR operates as a non-diversified, closed-end management investment company in the United States. Its primary objective is to deliver a high level of total return, combining cash distributions and capital appreciation. With a market capitalization of $218.796 million and a current stock price of $31.77, CTR is a notable player in the Asset Management industry.

Financial Analysis of CTR

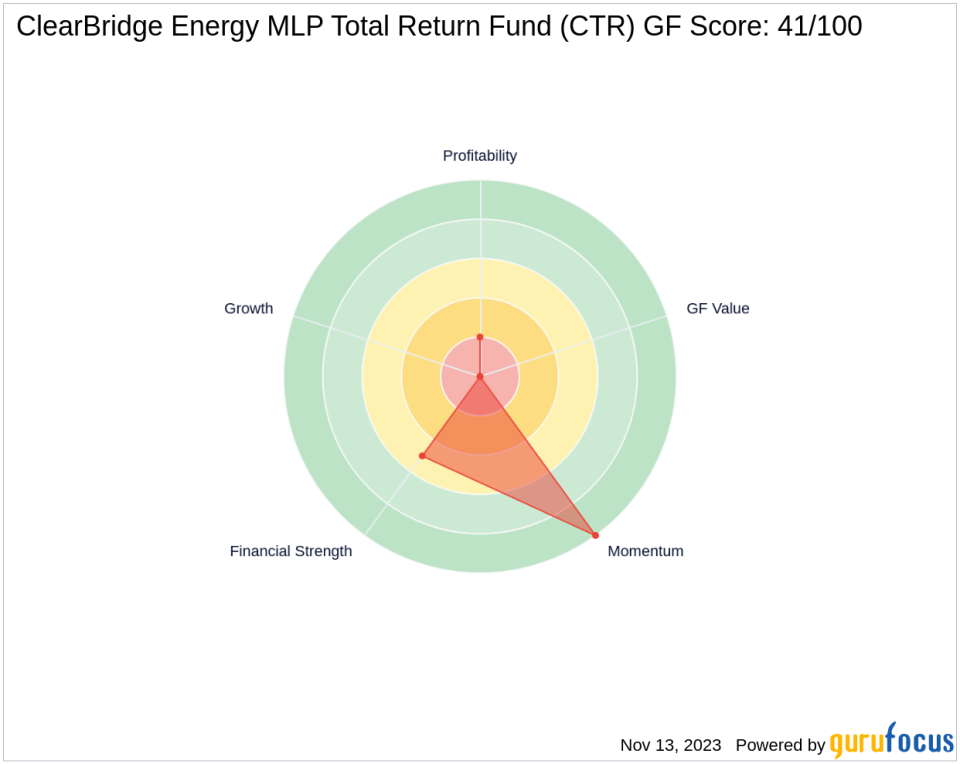

CTR's financial health is a mixed bag, with a GF Score of 41/100, indicating potential challenges in future performance. The company's balance sheet receives a rank of 5/10, while its Profitability Rank is lower at 2/10. Growth prospects are not promising, with a Growth Rank of 0/10, and the lack of a GF Value Rank suggests that the intrinsic value cannot be effectively assessed.

Stock Performance Metrics

CTR's stock performance has been volatile, with a year-to-date increase of 15.49% but a significant drop of 68.62% since its IPO. The stock's momentum is strong, reflected in a Momentum Rank of 10/10. Recent RSI figures show a neutral trend with a 14-day RSI of 46.60.

Impact of the Trade on Saba Capital Management's Portfolio

The recent acquisition of CTR shares by Saba Capital Management, L.P. (Trades, Portfolio) is a strategic move that slightly increases the firm's exposure to the energy sector. The position size, while not substantial, is a calculated addition to the firm's diverse portfolio, indicating a belief in CTR's potential for total return.

Market Reaction and Future Outlook

Since the transaction, CTR's stock has seen a modest gain of 1.21%. However, without a clear GF Value, it is challenging to predict the future performance of CTR. Investors will need to consider other metrics and market conditions to gauge the stock's potential.

Comparative Analysis

When compared to its industry peers, CTR's performance and valuation metrics present a nuanced picture. The firm's negative ROE and ROA, coupled with a lack of growth in key financial areas, suggest that CTR may not be as attractive an investment as some of its competitors. However, the firm's strong momentum could appeal to investors looking for short-term gains in a volatile market.

In conclusion, Saba Capital Management's recent addition of CTR shares is a tactical decision that aligns with the firm's investment philosophy. While CTR's financial health and growth prospects raise questions, its stock performance and Saba Capital Management's commitment to the company indicate a belief in its potential for return. Investors will watch closely to see how this investment plays out in the dynamic energy sector landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.