Saba Capital Management, L.P. Reduces Stake in Miller/Howard High Income Equity Fund

On August 14, 2023, Saba Capital Management, L.P., a New York-based investment firm, executed a significant transaction involving the Miller/Howard High Income Equity Fund (NYSE:HIE). The firm reduced its stake in HIE by 543,257 shares, a move that had a -0.15% impact on its portfolio. This article provides an in-depth analysis of the transaction, the profiles of the involved parties, and the potential implications for investors.

Details of the Transaction

The transaction was executed at a trade price of $10.25 per share, leaving Saba Capital Management, L.P. with a total of 2,349,620 shares in HIE. This represents a 12.57% stake in the company and a 0.63% position in the firm's portfolio. The transaction resulted in an 18.78% reduction in the firm's holdings in HIE.

Profile of Saba Capital Management, L.P.

Saba Capital Management, L.P., located at 405 Lexington Avenue, New York, NY 10174, is a renowned investment firm with a diverse portfolio. The firm's top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), BlackRock Health Sciences Trust II (NYSE:BMEZ), BlackRock Innovation & Growth Tr (NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust (NYSE:ECAT). The firm's equity stands at $3.84 billion, with a strong focus on the Financial Services and Technology sectors.

Overview of Miller/Howard High Income Equity Fund

Miller/Howard High Income Equity Fund (NYSE:HIE) is a US-based, closed-end, diversified management investment company. The company's primary objective is to seek a high level of current income with a secondary objective of capital appreciation. The company operates in a single segment and has a market capitalization of $187.28 million. The stock's current price stands at $10.02, with a PE percentage of 46.82. However, due to insufficient data, the GF valuation cannot be evaluated.

Analysis of the Traded Stock

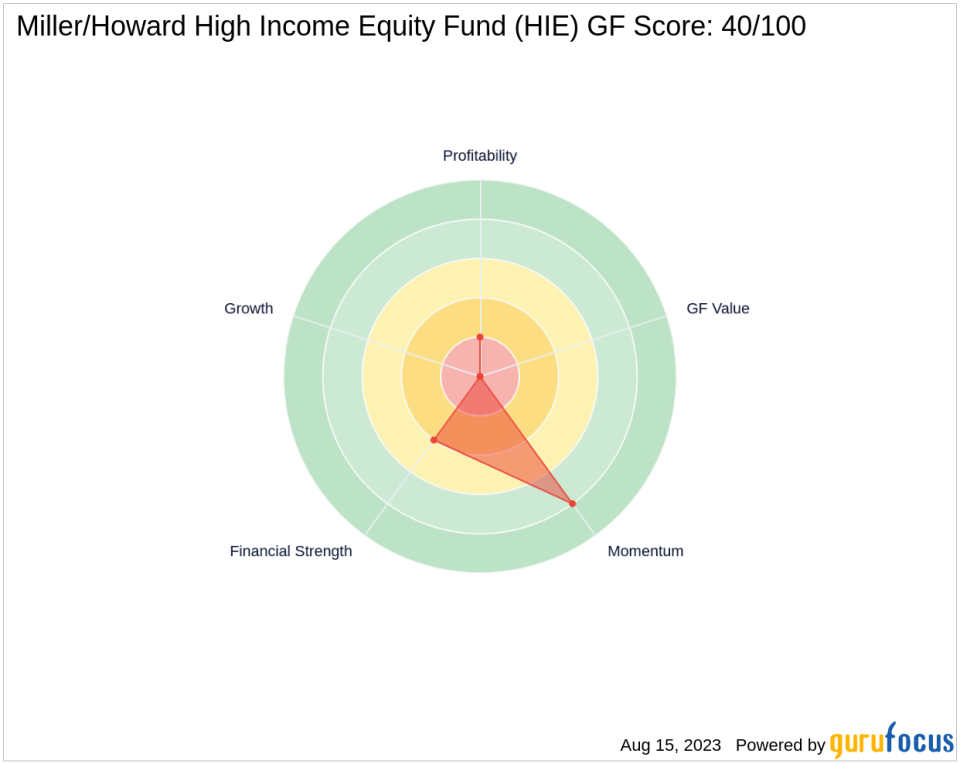

The traded stock, HIE, has a GF Score of 40/100, indicating a poor future performance potential. The stock's Financial Strength is ranked 4/10, while its Profitability Rank stands at 2/10. The Growth Rank is 0/10, indicating no growth data available. The stock's Piotroski F-Score is 5, suggesting an average financial health. The Altman Z score is 0.00, indicating potential bankruptcy risk. The stock's cash to debt ratio is 0.01, ranking it 1434th in the industry.

Performance of the Traded Stock

Over the past three years, HIE has experienced a revenue growth of -15.80% and an earning growth of -17.70%. The stock's RSI 14 Day stands at 51.99, ranking it 1174th, while its Momentum Index 6 - 1 Month is -9.82, ranking it 1213th. The stock's year-to-date price change ratio is -3.92%, and its price change since its Initial Public Offering (IPO) is -26.7%.

Conclusion

In conclusion, Saba Capital Management, L.P.'s recent transaction involving HIE has significant implications for both the firm and the traded company. The reduction in the firm's stake in HIE may reflect a strategic shift in its investment philosophy. On the other hand, the transaction could impact HIE's stock performance and market perception. Investors are advised to closely monitor these developments and make informed decisions accordingly.

This article first appeared on GuruFocus.