Saba Capital Management, L.P. Boosts Stake in ClearBridge Energy Midstream Opportunity Fund Inc

On September 25, 2023, Saba Capital Management, L.P. (Trades, Portfolio) increased its holdings in ClearBridge Energy Midstream Opportunity Fund Inc (NYSE:EMO) by adding 28,389 shares. The transaction was executed at a price of $32.65 per share, bringing the firm's total holdings in EMO to 2,543,688 shares. This acquisition represents a 1.13% change in shares and has a 0.02% impact on the firm's portfolio. The firm now holds a 19.89% stake in EMO, making up 2.17% of its total portfolio.

About Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), a New York-based investment firm, is known for its strategic investment philosophy. The firm currently holds 624 stocks in its portfolio, with a total equity of $3.84 billion. Its top holdings include Templeton Global Income Fund(NYSE:GIM), BlackRock Capital Allocation Trust(NYSE:BCAT), BlackRock Health Sciences Trust II(NYSE:BMEZ), BlackRock Innovation & Growth Tr(NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust(NYSE:ECAT). The firm's investments are primarily concentrated in the Financial Services and Technology sectors.

ClearBridge Energy Midstream Opportunity Fund Inc: A Brief Overview

ClearBridge Energy Midstream Opportunity Fund Inc (NYSE:EMO), a US-based company, made its initial public offering on June 10, 2011. The company operates as a non-diversified, closed-end management investment company, aiming to provide long-term investors with a high level of total return, with an emphasis on cash distributions. The company operates in a single segment and has a market capitalization of $418.272 million. The current stock price stands at $32.71.

Performance and Financial Health of EMO

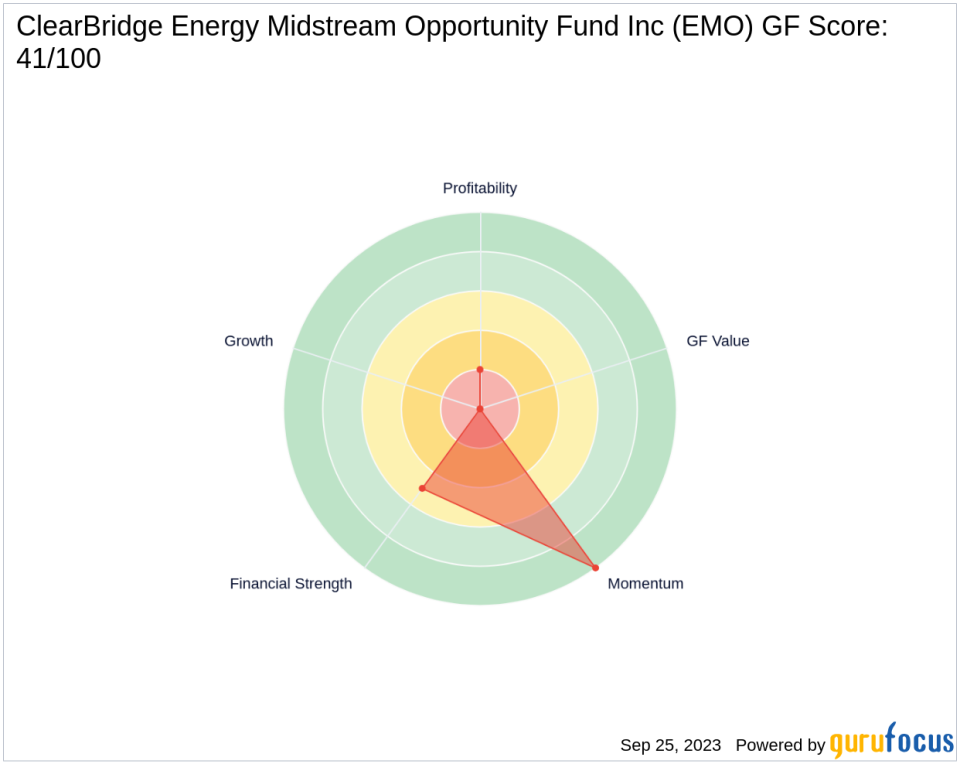

EMO's performance since its IPO has seen a decrease of 65.4%, while its year-to-date performance shows an increase of 18.56%. The company's GF Score stands at 41/100, indicating a poor future performance potential. In terms of financial health, EMO's balance sheet rank is 5/10, and its profitability rank is 2/10. The company's Piotroski F-Score is 4, indicating a weak financial situation.

EMO's Momentum and Predictability

EMO's momentum rank is 10/10, indicating strong momentum in the stock's price. The company's RSI 14 Day stands at 58.25, and its Momentum Index 6 - 1 Month is 18.03. However, the company's predictability rank is not available, indicating uncertainty in its future performance.

Conclusion

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of EMO shares represents a significant addition to its portfolio. Despite EMO's weak financial health and poor future performance potential, the firm's decision to increase its stake may be based on the stock's strong momentum. However, the lack of predictability in EMO's performance adds an element of risk to this investment. As always, investors are advised to conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.