Saba Capital Management, L.P. Boosts Stake in PIMCO Energy & Tactical Credit Opportunities

On August 14, 2023, Saba Capital Management, L.P., a renowned investment firm, increased its holdings in PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX). This article provides an in-depth analysis of the transaction, the profiles of the firm and the traded company, and the performance of the traded stock.

Details of the Transaction

The transaction saw Saba Capital Management, L.P. add 72,335 shares of NRGX to its portfolio at a trade price of $17.16 per share. This move increased the firm's total holdings in NRGX to 5,914,735 shares, representing 13.23% of the guru's holdings in the traded stock and 2.65% of the guru's portfolio. The trade had a minor impact of 0.03% on the portfolio.

Profile of the Firm: Saba Capital Management, L.P.

Saba Capital Management, L.P., located at 405 Lexington Avenue, New York, NY 10174, is a prominent investment firm with a portfolio of 624 stocks. The firm's top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), BlackRock Health Sciences Trust II (NYSE:BMEZ), BlackRock Innovation & Growth Tr (NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust (NYSE:ECAT). The firm's equity stands at $3.84 billion, with a strong focus on the Financial Services and Technology sectors.

Overview of the Traded Stock: PIMCO Energy & Tactical Credit Opportunities

PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX) is a non-diversified, limited term closed-end management investment company based in the USA. The company operates in a single segment and has a market capitalization of $755.995 million. As of the date of the transaction, the stock was trading at $16.91, with a PE percentage of 5.02. However, due to insufficient data, the GF Valuation could not be evaluated.

Performance of the Traded Stock

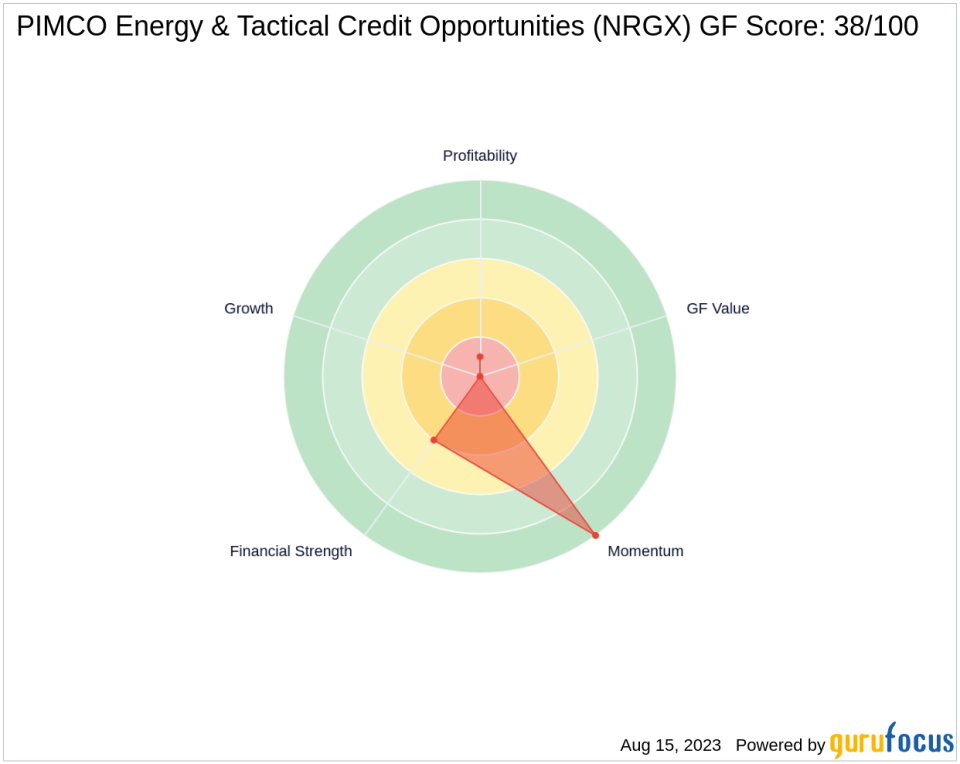

Since its IPO, NRGX has seen a price change of -15.45%. However, the stock has gained 15.82% year-to-date. The stock's GF Score stands at 38/100, indicating poor future performance potential. The stock's Financial Strength is ranked 4/10, while its Profitability Rank is 1/10. The stock's Growth Rank is 0/10, indicating the lack of growth data.

Financial Health of the Traded Stock

NRGX's poor financial health is reflected in its low Piotroski F-Score of 2, indicating financial instability. However, the company does not have enough data to compute Altman Z score and interest coverage. Despite this, the company's ROE and ROA stand at 20.87 and 15.03, respectively.

Transaction Analysis

The recent transaction by Saba Capital Management, L.P. indicates a strong belief in the potential of NRGX, despite its current financial instability and poor growth rank. The addition of NRGX shares to the firm's portfolio could diversify its holdings and potentially yield significant returns if NRGX's performance improves in the future.

All data and rankings are accurate as of August 16, 2023.

This article first appeared on GuruFocus.