Saba Capital Management, L.P. Boosts Stake in BlackRock Capital Allocation Trust

On October 23, 2023, Saba Capital Management, L.P. (Trades, Portfolio), a New York-based investment firm, significantly increased its holdings in BlackRock Capital Allocation Trust (NYSE:BCAT). The firm added 2,288,255 shares to its portfolio, representing a 26.15% change in shares. This transaction, priced at $13.81 per share, had a 0.82% impact on the firm's portfolio, raising its total holdings in BCAT to 11,039,716 shares. This represents 3.94% of the firm's portfolio and 10.21% of BCAT's total shares.

About Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), located at 405 Lexington Avenue, New York, NY 10174, is a renowned investment firm. The firm's portfolio consists of 624 stocks, with a total equity of $3.84 billion. Its top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), BlackRock Health Sciences Trust II (NYSE:BMEZ), BlackRock Innovation & Growth Tr (NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust (NYSE:ECAT). The firm's investments are primarily concentrated in the Financial Services and Technology sectors.

Overview of BlackRock Capital Allocation Trust

BlackRock Capital Allocation Trust (NYSE:BCAT) is a non-diversified, closed-end management investment company based in the USA. The company, which went public on September 25, 2020, aims to provide total return and income through a combination of current income, current gains, and long-term capital appreciation. As of October 24, 2023, BCAT has a market capitalization of $1.49 billion and a stock price of $13.82. The company's PE percentage stands at 10.07. However, due to insufficient data, the GF Valuation cannot be evaluated.

Financial Health and Market Performance of BCAT

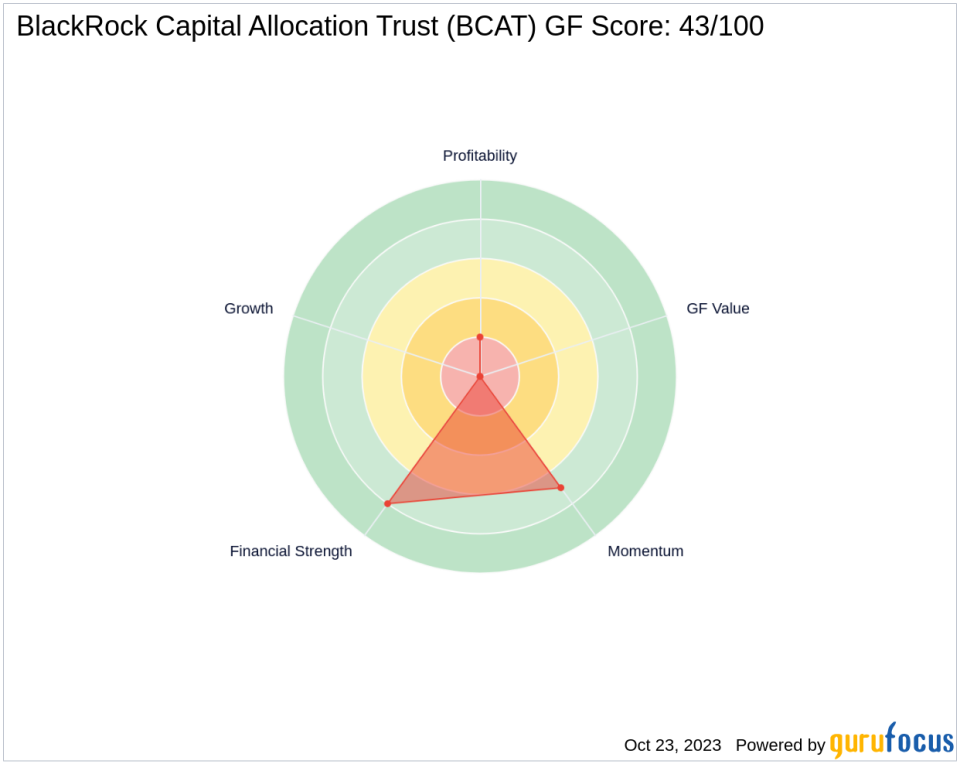

BCAT's financial health is reflected in its balance sheet rank of 8/10 and a profitability rank of 2/10. However, its growth rank is not applicable due to insufficient data. The company's cash to debt ratio is 148.19, ranking 641st in the Asset Management industry. BCAT's return on equity (ROE) and return on assets (ROA) are 7.92 and 6.94, respectively, with respective ranks of 486 and 408.

Since its IPO, BCAT's stock has declined by 31.65%. The year-to-date price change ratio is -1.57, and the price change since the transaction is 0.07%. The stock's GF Score is 43/100, indicating poor future performance potential. The stock's momentum rank is 7/10, suggesting a moderate upward trend.

Future Performance Potential of BCAT

BCAT's future performance potential can be evaluated using its Piotroski F-Score of 5 and an Altman Z score of 0.00, indicating financial stability. The stock's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 28.24, 32.59, and 34.94, respectively, suggesting a neutral market sentiment. However, the stock's predictability rank is not available due to insufficient data.

Conclusion

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of BCAT shares represents a significant addition to its portfolio. Despite BCAT's mixed financial health and market performance, the firm's increased stake suggests confidence in the stock's future potential. However, investors should conduct thorough research and consider various factors, including the company's financial health, market performance, and future performance potential, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.