Saba Capital Management, L.P. Boosts Stake in PIMCO Energy & Tactical Credit Opportunities

On September 25, 2023, Saba Capital Management, L.P. (Trades, Portfolio), a New York-based investment firm, significantly increased its holdings in PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX). This transaction is of particular interest to value investors, as it provides insights into the investment strategies of leading market players and potential opportunities in the market.

Details of the Transaction

The firm added 48,718 shares to its holdings, representing a 0.74% change in its portfolio. The shares were purchased at a price of $17.34 each, bringing the firm's total holdings in NRGX to 6,601,842 shares. This transaction has a 2.98% impact on the firm's portfolio and represents 14.77% of NRGX's total shares.

Profile of the Guru

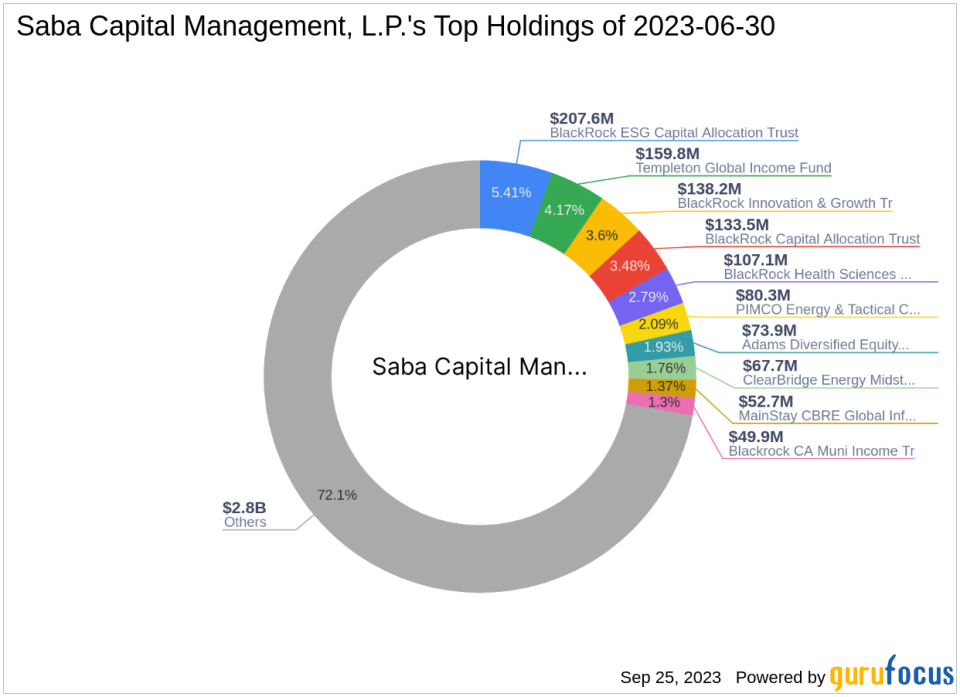

Saba Capital Management, L.P. (Trades, Portfolio), located at 405 Lexington Avenue, New York, NY 10174, is a renowned investment firm with a portfolio of 624 stocks, primarily in the Financial Services and Technology sectors. The firm's equity stands at $3.84 billion, with top holdings in Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), BlackRock Health Sciences Trust II (NYSE:BMEZ), BlackRock Innovation & Growth Tr (NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust (NYSE:ECAT).

Information about the Traded Stock

PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX) is a non-diversified, limited term closed-end management investment company based in the USA. The company's primary objective is to seek total return, with a secondary objective to provide high current income. The company's market capitalization stands at $787.737 million, and its stock price as of September 26, 2023, is $17.62. The stock's PE percentage is 4.27, indicating that the company is profitable. The stock has gained 1.61% since the transaction and has a year-to-date price change ratio of 20.68%.

Evaluation of the Stock's Financial Health

NRGX has a GF Score of 42/100, indicating a poor future performance potential. The company's financial strength is rated 4/10, and its profitability rank is 3/10. The company's growth rank is 0/10, indicating no growth. The company's GF Value Rank and Momentum Rank are also 0/10 and 9/10, respectively. The company's Piotroski F-Score is 7, indicating a healthy situation.

Overview of the Stock's Industry Performance

NRGX operates in the Asset Management industry. The company's return on equity (ROE) is 24.02%, and its return on assets (ROA) is 17.98%. However, the company's gross margin growth and operating margin growth are both 0.00%, indicating no growth in these areas.

Analysis of the Stock's Momentum

The company's RSI 5 Day is 48.45, RSI 9 Day is 50.04, and RSI 14 Day is 51.96. The company's Momentum Index 6 - 1 Month is 23.89, and its Momentum Index 12 - 1 Month is 25.17. The company's RSI 14 Day Rank is 1262, and its Momentum Index 6 - 1 Month Rank is 162.

Conclusion

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of NRGX shares represents a significant addition to its portfolio. Despite NRGX's low growth and profitability ranks, the firm's investment could be based on the stock's strong momentum and the potential for high current income. This transaction underscores the importance of comprehensive analysis in identifying potential investment opportunities.

This article first appeared on GuruFocus.