Saba Capital Management, L.P. Increases Stake in Pioneer Municipal High Income Trust

Introduction to the Transaction

On October 3, 2023, Saba Capital Management, L.P. (Trades, Portfolio), a New York-based investment firm, added 1,873,368 shares of Pioneer Municipal High Income Trust (NYSE:MHI) to its portfolio. The transaction was executed at a price of $7.17 per share, bringing the firm's total holdings in MHI to 2,373,132 shares. This acquisition represents a 374.85% increase in the firm's stake in MHI, impacting its portfolio by 0.35%. The firm now holds a 10.42% stake in MHI, making it a significant position in its portfolio.

Profile of the Guru

Saba Capital Management, L.P. (Trades, Portfolio), located at 405 Lexington Avenue, New York, NY 10174, is an investment firm with a diverse portfolio of 624 stocks. The firm's equity stands at $3.84 billion, with its top holdings in Templeton Global Income Fund(NYSE:GIM), BlackRock Capital Allocation Trust(NYSE:BCAT), BlackRock Health Sciences Trust II(NYSE:BMEZ), BlackRock Innovation & Growth Tr(NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust(NYSE:ECAT). The firm's investment philosophy is primarily focused on the Financial Services and Technology sectors.

Overview of the Traded Stock

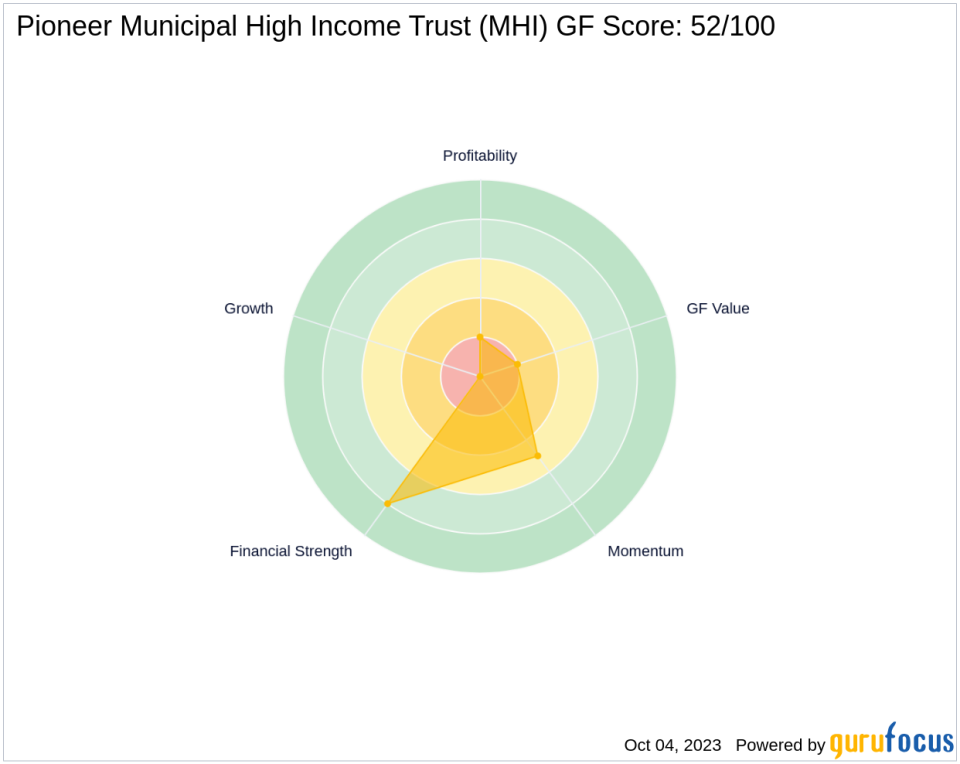

Pioneer Municipal High Income Trust (NYSE:MHI) is a diversified, closed-end management investment company based in the USA. The company's primary objective is to seek a high level of current income exempt from regular federal income tax and capital appreciation. MHI operates in a single segment and has a market capitalization of $163.271 million. The stock is currently trading at $7.17, significantly undervalued according to the GF-Score, which stands at 52/100.

Analysis of the Stock's Performance

Since its IPO, MHI has experienced a -52.2% change in price. The stock's year-to-date performance stands at -17.4%. MHI's financial strength is ranked 8/10, while its profitability rank is 2/10. The company's growth rank is 0/10, indicating no significant growth in recent years. The GF Value Rank of the stock is 2/10, and its momentum rank is 5/10.

Financial Health of the Stock

MHI's financial health is reflected in its Piotroski F-Score of 7 and an Altman Z score of 0.00. The company's cash to debt rank is 1, indicating a weak financial position. MHI operates in the Asset Management industry and has a return on equity (ROE) of -2.15 and a return on assets (ROA) of -1.33. The company's gross margin growth and operating margin growth are both 0.00, indicating no significant growth in these areas in recent years.

Stock's Momentum and Predictability

MHI's momentum is reflected in its RSI 5 Day of 2.52, RSI 9 Day of 6.17, and RSI 14 Day of 9.86. The stock's momentum index 6 - 1 Month is -9.74, and its momentum index 12 - 1 Month is -5.12. The RSI 14 Day rank of the stock is 57, and its momentum index 6 - 1 Month rank is 1367. The predictability rank of the stock is not available.

Conclusion

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of MHI shares represents a significant addition to its portfolio. Despite MHI's weak financial performance and lack of growth, the stock is significantly undervalued according to the GF-Score. This transaction could potentially offer value investors an opportunity to invest in a stock with a high level of current income exempt from regular federal income tax. However, investors should also consider the stock's weak financial health and lack of momentum before making investment decisions.

This article first appeared on GuruFocus.