Saba Capital Management, L.P. Acquires Stake in PIMCO Energy & Tactical Credit Opportunities

On September 27, 2023, Saba Capital Management, L.P. (Trades, Portfolio), a renowned investment firm, added 6756358 shares of PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX) to its portfolio. This article provides an in-depth analysis of the transaction, the profiles of the involved parties, and the potential implications for value investors.

Details of the Transaction

The transaction took place on September 27, 2023, with Saba Capital Management, L.P. (Trades, Portfolio) adding 6756358 shares of NRGX to its portfolio at a trade price of $18.7 per share. This addition had an impact of 0.08 on the firm's portfolio, making NRGX account for 3.29% of the firm's total holdings. Following this transaction, Saba Capital Management, L.P. (Trades, Portfolio) now holds a 15.11% stake in NRGX.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

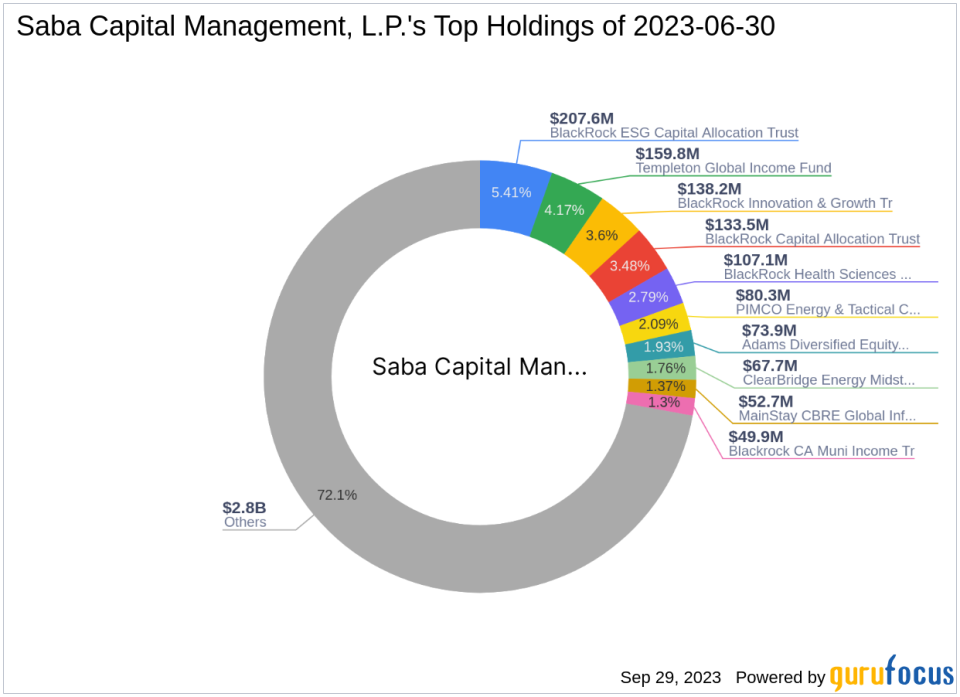

Saba Capital Management, L.P. (Trades, Portfolio), located at 405 Lexington Avenue, New York, NY 10174, is a well-established investment firm. The firm's investment philosophy is centered around a disciplined approach to value investing. It currently holds 624 stocks in its portfolio, with a total equity of $3.84 billion. The firm's top holdings include Templeton Global Income Fund(NYSE:GIM), BlackRock Capital Allocation Trust(NYSE:BCAT), BlackRock Health Sciences Trust II(NYSE:BMEZ), BlackRock Innovation & Growth Tr(NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust(NYSE:ECAT). The firm's investments are primarily concentrated in the Financial Services and Technology sectors.

Overview of PIMCO Energy & Tactical Credit Opportunities

PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX) is a non-diversified, limited term closed-end management investment company based in the USA. The company's primary investment objective is to seek total return, with a secondary objective to provide high current income. As of September 29, 2023, the company has a market capitalization of $886.987 million and its stock is trading at $19.84 per share. The company's PE ratio stands at 4.81.

Analysis of the Stock's Performance

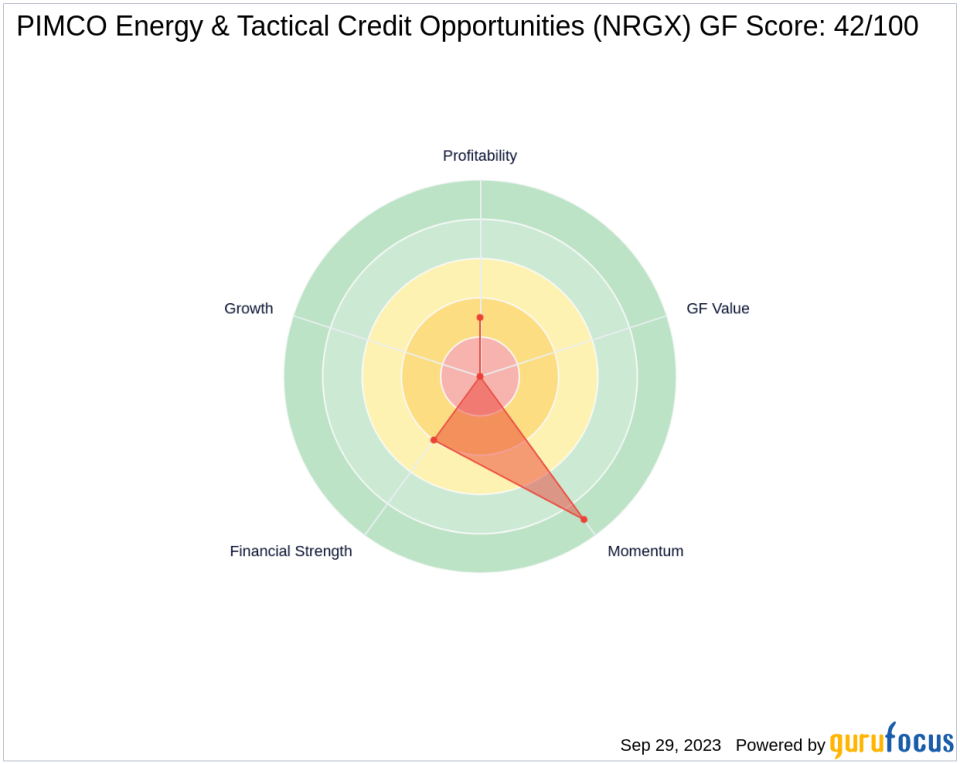

Since the transaction, NRGX's stock price has increased by 6.1%. The year-to-date price change ratio stands at 35.89. The stock's GF Score is 42/100, indicating a poor future performance potential. The stock's Balance Sheet Rank is 4/10, its Profitability Rank is 3/10, and its Growth Rank is 0/10. The stock's Momentum Rank is 9/10, indicating strong momentum.

Evaluation of the Stock's Financial Health

NRGX's cash to debt ratio is 0.01, indicating a high level of debt. The company's ROE and ROA are 24.02 and 17.98 respectively. The company's gross margin growth, operating margin growth, revenue growth over 3 years, EBITDA growth over 3 years, and earning growth over 3 years are all not applicable due to insufficient data.

Analysis of the Stock's Momentum

The stock's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 94.49, 88.11, and 83.02 respectively, indicating strong upward momentum. The stock's Momentum Index 6 - 1 Month and Momentum Index 12 - 1 Month are 21.26 and 24.72 respectively.

Conclusion

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of NRGX shares represents a significant addition to its portfolio. Despite NRGX's poor growth and profitability ranks, the stock's strong momentum and the firm's substantial stake in the company suggest potential for future gains. However, investors should exercise caution due to NRGX's high debt levels and low GF Score. As always, it is recommended to conduct thorough research and consider various factors before making investment decisions.

This article first appeared on GuruFocus.