Saba Capital Management, L.P. Boosts Stake in PIMCO Energy & Tactical Credit Opportunities

On September 13, 2023, Saba Capital Management, L.P. (Trades, Portfolio), a New York-based investment firm, increased its holdings in PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX). The firm added 70,785 shares at a price of $16.85 per share, bringing its total holdings to 6,463,809 shares. This transaction represents a 1.11% change in shares and has a 0.03% impact on the firm's portfolio. The firm now holds a 14.46% stake in NRGX, making it a significant player in the company's financial landscape.

About Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio) is a prominent investment firm located at 405 Lexington Avenue, New York. The firm manages a diverse portfolio of 624 stocks, with a total equity of $3.84 billion. Its top holdings include Templeton Global Income Fund(NYSE:GIM), BlackRock Capital Allocation Trust(NYSE:BCAT), BlackRock Health Sciences Trust II(NYSE:BMEZ), BlackRock Innovation & Growth Tr(NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust(NYSE:ECAT). The firm primarily focuses on the Financial Services and Technology sectors.

Overview of PIMCO Energy & Tactical Credit Opportunities

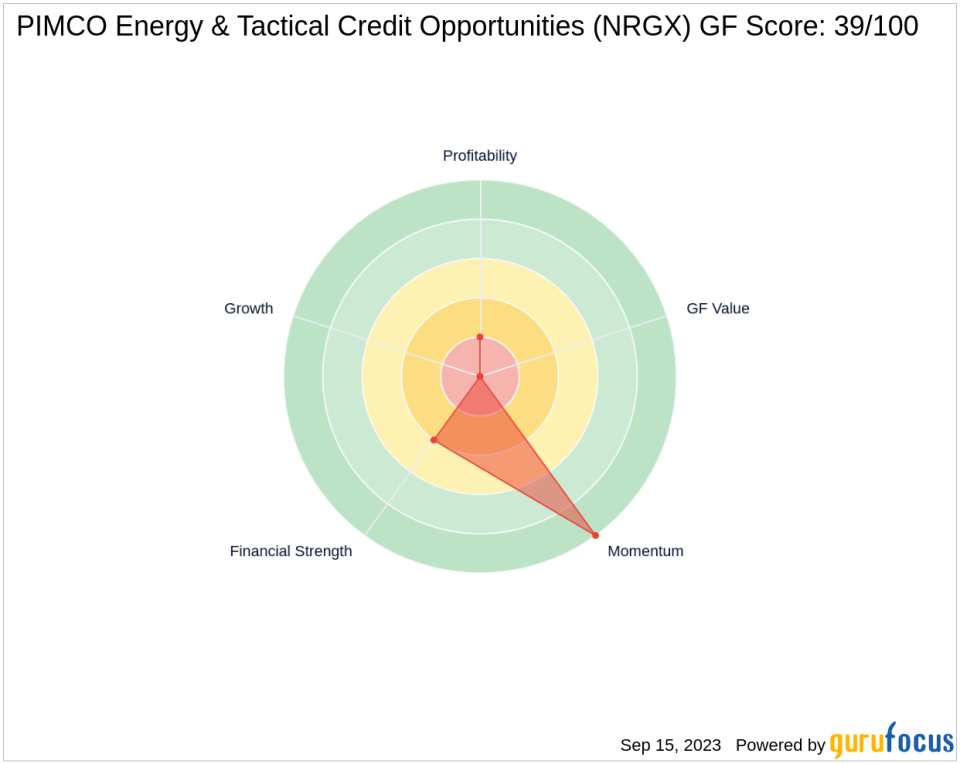

PIMCO Energy & Tactical Credit Opportunities is a non-diversified, limited term closed-end management investment company based in the USA. The company operates in a single segment and has a market capitalization of $768.513 million. The company's stock is currently priced at $17.19, with a PE Percentage of 4.17. The stock has seen a year-to-date price change ratio of 17.74% and a price change since its IPO of -14.05%. The company's GF Score is 39/100, indicating poor future performance potential.

Financial Health and Stock Performance of PIMCO Energy & Tactical Credit Opportunities

PIMCO Energy & Tactical Credit Opportunities has a Balance Sheet Rank of 4/10, a Profitability Rank of 2/10, and a Growth Rank of 0/10. The company's Cash to Debt ratio is 0.01, ranking it 1415th in the industry. The company's ROE and ROA are 24.02 and 17.98, respectively, with ranks of 117 and 109. The company's Piotroski F-Score is 7, indicating a healthy financial situation.

PIMCO Energy & Tactical Credit Opportunities' Position in the Asset Management Industry

In the Asset Management industry, PIMCO Energy & Tactical Credit Opportunities has an RSI 5 Day of 60.73, RSI 9 Day of 56.76, and RSI 14 Day of 57.11. The company's Momentum Index 6 - 1 Month is 19.33, and its Momentum Index 12 - 1 Month is 11.50. These figures indicate a strong momentum in the company's stock performance.

Conclusion

The recent transaction by Saba Capital Management, L.P. (Trades, Portfolio) in PIMCO Energy & Tactical Credit Opportunities represents a significant investment in the company. Despite the company's low GF Score and ranks in financial strength, profitability, and growth, the firm's investment suggests confidence in the company's future performance. As of September 15, 2023, the transaction has resulted in a 2.02% gain in the stock's price, indicating a positive short-term impact on the stock and the firm's portfolio.

This article first appeared on GuruFocus.