Saba Capital Management, L.P. Boosts Stake in ClearBridge Energy Midstream Opportunity Fund Inc

Introduction to the Transaction

On November 3, 2023, Saba Capital Management, L.P. (Trades, Portfolio), a New York-based investment firm, increased its holdings in ClearBridge Energy Midstream Opportunity Fund Inc (NYSE:EMO). The firm added 7,905 shares at a price of $33.05 per share. This transaction has increased Saba Capital's total holdings in EMO to 2,834,605 shares, representing 2.44% of the firm's portfolio and 22.16% of EMO's total shares.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio) is a prominent investment firm located at 405 Lexington Avenue, New York. The firm manages a diverse portfolio of 624 stocks, with a total equity of $3.84 billion. Its top holdings include Templeton Global Income Fund(NYSE:GIM), BlackRock Capital Allocation Trust(NYSE:BCAT), BlackRock Health Sciences Trust II(NYSE:BMEZ), BlackRock Innovation & Growth Tr(NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust(NYSE:ECAT). The firm's investment philosophy is primarily focused on the Financial Services and Technology sectors.

Overview of ClearBridge Energy Midstream Opportunity Fund Inc

ClearBridge Energy Midstream Opportunity Fund Inc (NYSE:EMO) is a non-diversified, closed-end management investment company based in the USA. The company, which operates in a single segment, aims to provide long-term investors with a high level of total return, with an emphasis on cash distributions. EMO has a market capitalization of $418.784 million and was first listed on the stock exchange on June 10, 2011. The company's stock is currently priced at $32.75.

Analysis of ClearBridge Energy Midstream Opportunity Fund Inc's Stock

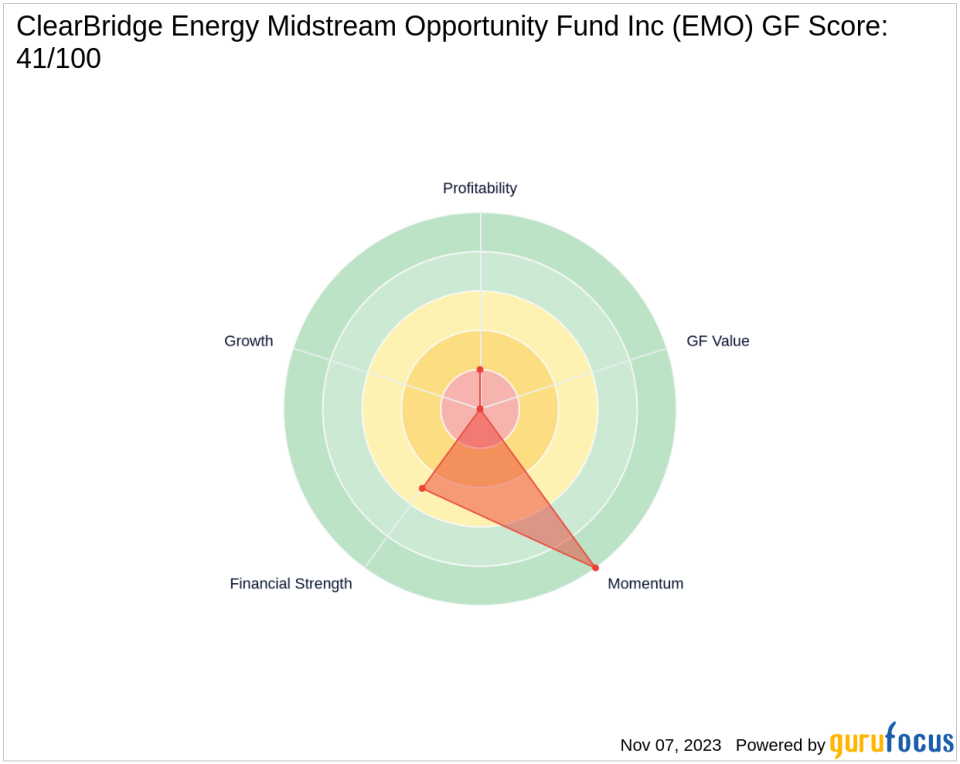

EMO's stock has a GF-Score of 41/100, indicating a poor future performance potential. The stock's Financial Strength is ranked 5/10, while its Profitability Rank is 2/10. The Growth Rank and GF Value Rank are both 0/10, indicating a lack of growth and value. However, the stock's Momentum Rank is 10/10, suggesting strong momentum.

Evaluation of ClearBridge Energy Midstream Opportunity Fund Inc's Financial Health

EMO's financial health is a mixed bag. The company's Piotroski F-Score is 4, indicating average financial health. However, its Altman Z score and cash to debt ratio are both 0.00, suggesting potential financial distress. The company's ROE and ROA are -7.94 and -5.44, respectively, indicating poor profitability. Furthermore, the company has not shown any growth in gross margin, operating margin, revenue, EBITDA, or earnings over the past three years.

Assessment of ClearBridge Energy Midstream Opportunity Fund Inc's Stock Momentum

Despite its financial health concerns, EMO's stock has shown strong momentum. The stock's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 68.47, 64.13, and 60.41, respectively, indicating strong buying pressure. The stock's Momentum Index 6 - 1 Month is 10.90, while its Momentum Index 12 - 1 Month is 0.43, suggesting a strong short-term momentum but weak long-term momentum.

Conclusion

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of EMO shares represents a significant addition to its portfolio. Despite EMO's mixed financial health and poor growth prospects, the stock's strong momentum may offer potential upside. However, investors should carefully consider the company's financial health and growth prospects before making investment decisions. As always, it is recommended to conduct thorough research and consider various factors before investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.