Saba Capital Management, L.P. Increases Stake in BlackRock Innovation & Growth Tr

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its portfolio by acquiring additional shares in BlackRock Innovation & Growth Tr (NYSE:BIGZ). This article provides an in-depth analysis of the transaction, the profiles of both the firm and the traded company, and the potential implications of this move on their respective financial outlooks.

Details of the Transaction

The transaction took place on October 3, 2023, with Saba Capital Management, L.P. (Trades, Portfolio) adding 392,557 shares of BlackRock Innovation & Growth Tr to its portfolio. The shares were traded at a price of $6.88 each. This addition had a 0.07% impact on the firm's portfolio, increasing its total holdings of the traded stock to 23,626,511 shares. Following the transaction, BlackRock Innovation & Growth Tr now constitutes 4.24% of the firm's portfolio, with the firm holding a 10.41% stake in the traded stock.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), located at 405 Lexington Avenue, New York, NY 10174, is a renowned investment firm with a diverse portfolio of 624 stocks. The firm's top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), BlackRock Health Sciences Trust II (NYSE:BMEZ), BlackRock Innovation & Growth Tr (NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust (NYSE:ECAT). The firm's total equity stands at $3.84 billion, with a strong focus on the Financial Services and Technology sectors.

Overview of BlackRock Innovation & Growth Tr

BlackRock Innovation & Growth Tr (NYSE:BIGZ), based in the USA, is a non-diversified, closed-end management investment company. The company's primary objective is to provide total return and income through a combination of current income, current gains, and long-term capital appreciation. The company, which operates in a single segment, went public on March 26, 2021. As of October 4, 2023, the company's market capitalization stands at $1.53 billion, with its stock currently priced at $6.76.

Financial Analysis of BlackRock Innovation & Growth Tr

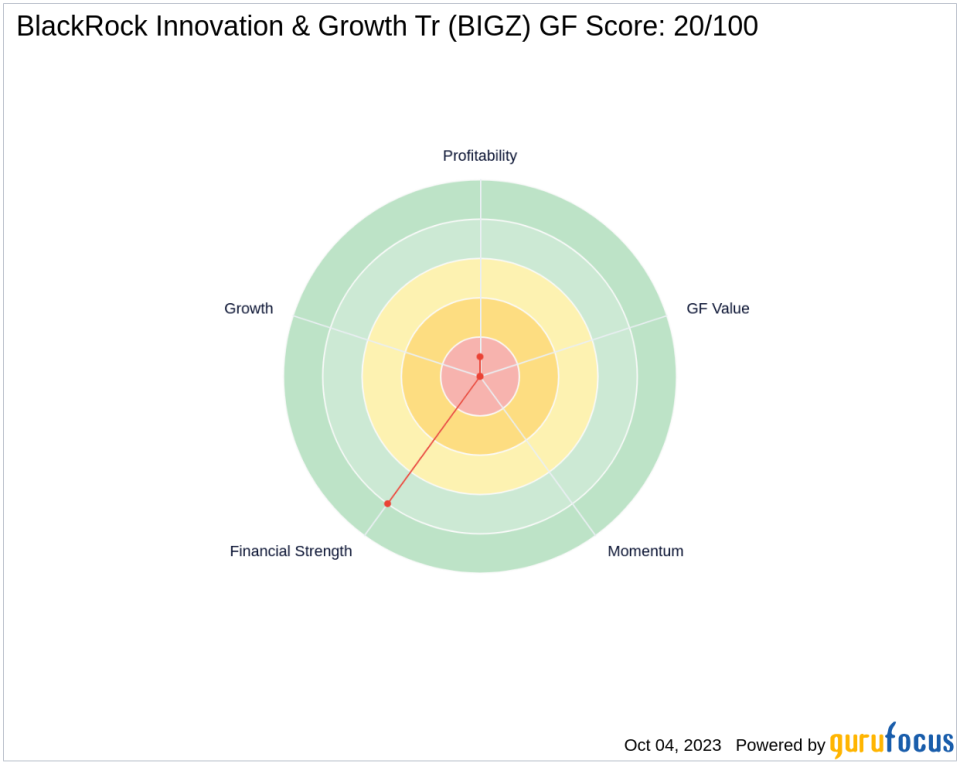

BlackRock Innovation & Growth Tr's financial performance can be evaluated using various metrics. The company's PE Percentage stands at 0.00, indicating that it is currently at a loss. The company's GF Score is 20/100, suggesting a poor future performance potential. The company's Financial Strength is ranked 8/10, while its Profitability Rank is 1/10. The company's Growth Rank and GF Value Rank are both 0/10, indicating no growth and no value according to GuruFocus evaluation. The company's Momentum Rank is also 0/10, suggesting no momentum in the stock's price.

Conclusion

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of additional shares in BlackRock Innovation & Growth Tr is a significant move that further diversifies its portfolio. Despite the traded company's current financial performance, the firm's increased stake could potentially influence the stock's future performance. However, investors should conduct their own thorough research and analysis before making any investment decisions.

This article first appeared on GuruFocus.