Saba Capital Management, L.P. Bolsters Portfolio with Nuveen Real Asset Income and Growth Fund ...

Introduction to the Transaction

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its investment portfolio by adding shares of Nuveen Real Asset Income and Growth Fund (NYSE:JRI). This strategic move signifies the firm's confidence in JRI's potential for income and long-term capital appreciation. The transaction involved the acquisition of 2,266,809 shares, reflecting a notable commitment to the fund known for its investments in real asset-related companies.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Based in New York, Saba Capital Management, L.P. (Trades, Portfolio) is a well-established firm with a keen focus on value investing. The firm's investment philosophy is centered around identifying undervalued assets and employing a disciplined approach to capitalizing on market inefficiencies. With a diverse portfolio of 624 stocks, Saba Capital Management, L.P. (Trades, Portfolio) has a significant presence in the financial services and technology sectors. The firm's top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and others, showcasing a strategic mix of income-generating assets.

Overview of Nuveen Real Asset Income and Growth Fund

Nuveen Real Asset Income and Growth Fund operates as a closed-end fund in the United States, aiming to deliver high current income and long-term capital appreciation. JRI's investment strategy is to allocate a majority of its managed assets across a range of equity and debt securities issued by real asset-related companies globally. With a market capitalization of approximately $299.94 million, JRI is a significant player in the asset management industry segment.

Transaction Specifics

The transaction took place on November 8, 2023, with Saba Capital Management, L.P. (Trades, Portfolio) adding 870,274 shares to its existing stake in JRI at a trade price of $10.55 per share. This addition has increased the firm's total shareholding to 2,266,809, accounting for 0.62% of its portfolio and representing an 8.27% ownership in JRI. The trade had a 0.24% impact on the firm's portfolio.

Performance Metrics of JRI

Since the trade, JRI's stock price has seen an uptick to $10.94, marking a 3.7% gain. However, the year-to-date performance indicates a 7.68% decline, and the stock has decreased by 38.26% since its IPO. These figures suggest a mixed performance, with recent gains potentially signaling a turnaround.

Saba Capital Management, L.P. (Trades, Portfolio)'s Top Holdings and Sectors

Saba Capital Management, L.P. (Trades, Portfolio) has a diversified portfolio with significant investments in financial services and technology. The addition of JRI complements the firm's strategy of investing in income-generating assets, potentially offering a balance between growth and stability within its portfolio.

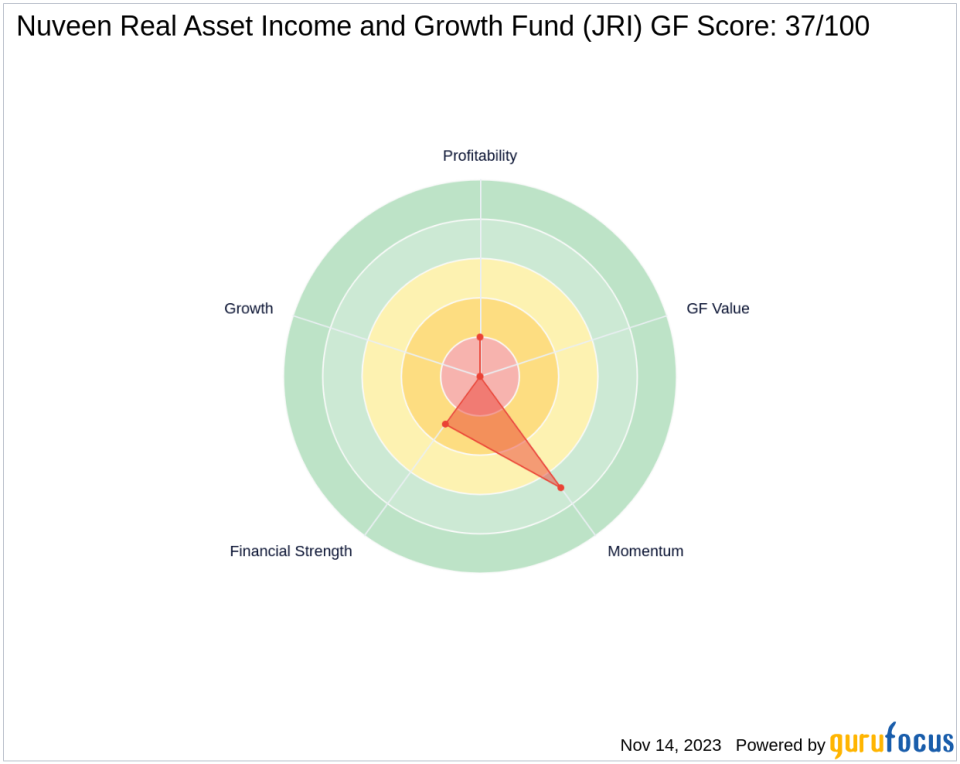

JRI's Financial Health and Market Valuation

JRI's financial health, as indicated by its Financial Strength rank of 3/10 and Profitability Rank of 2/10, suggests room for improvement. The fund's GF Score of 37/100 points to potential challenges in future performance. However, its Momentum Rank of 7/10 indicates some positive market sentiment, which could be a favorable sign for investors.

Market Reaction and Future Outlook

The market has shown a moderate response to JRI's recent performance, with RSI indicators reflecting a neutral momentum. Considering the current market conditions and Saba Capital Management, L.P. (Trades, Portfolio)'s investment thesis, JRI's stock holds potential, but its future performance will largely depend on the fund's ability to improve its financial metrics and capitalize on market opportunities.

Transaction Analysis

Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of JRI shares represents a strategic move to enhance its portfolio with a real asset income-generating fund. While JRI's financial health and market valuation present some concerns, the firm's investment could be seen as a vote of confidence in the fund's long-term prospects. As the market continues to evolve, the impact of this transaction on both the stock and the firm's portfolio will be closely monitored by investors and industry analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.