Saba Capital Management, L.P. Acquires Stake in PIMCO Energy & Tactical Credit Opportunities

On August 31, 2023, Saba Capital Management, L.P. added 44,640 shares of PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX) to its portfolio. The transaction, which saw the firm's total holdings in NRGX rise to 6,176,860 shares, had a 0.02% impact on the portfolio. The shares were acquired at a price of $17.09 each, bringing the firm's stake in NRGX to 13.82% of the company's equity and 2.75% of the firm's portfolio.

About Saba Capital Management, L.P.

Saba Capital Management, L.P., a New York-based investment firm, manages a diverse portfolio of 624 stocks. The firm's top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), BlackRock Health Sciences Trust II (NYSE:BMEZ), BlackRock Innovation & Growth Tr (NYSE:BIGZ), and BlackRock ESG Capital Allocation Trust (NYSE:ECAT). The firm's equity stands at $3.84 billion, with a strong focus on the Financial Services and Technology sectors.

Overview of PIMCO Energy & Tactical Credit Opportunities

PIMCO Energy & Tactical Credit Opportunities (NYSE:NRGX), a non-diversified, limited term closed-end management investment company based in the USA, operates in a single segment. The company's market cap stands at $780.133 million, with a current stock price of $17.4499. The stock's PE percentage is 5.18, indicating that the company is profitable. However, due to insufficient data, the GF Valuation cannot be evaluated.

Performance of PIMCO Energy & Tactical Credit Opportunities

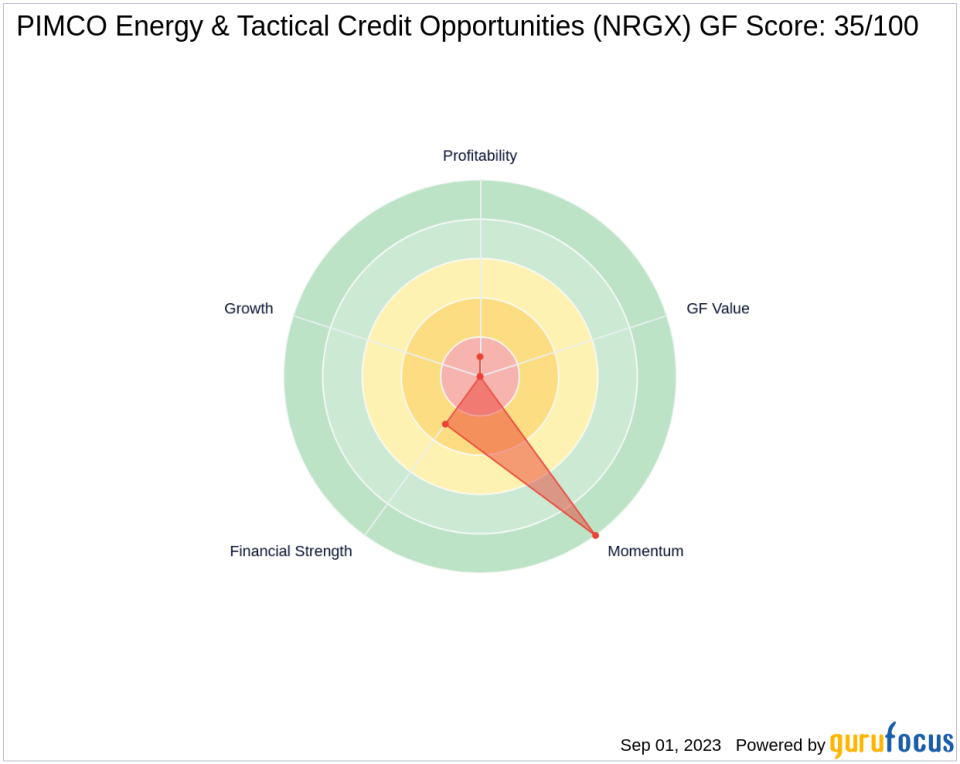

Since the transaction, NRGX's stock has gained 2.11%. However, since its IPO, the stock has declined by 12.75%. Year-to-date, the stock has gained 19.52%. The stock's GF Score is 35/100, indicating poor future performance potential. The stock's Financial Strength is ranked 3/10, its Profitability Rank is 1/10, and its Growth Rank is 0/10. The stock's Piotroski F-Score is 2, indicating poor financial health.

Industry Position and Momentum of PIMCO Energy & Tactical Credit Opportunities

In the Asset Management industry, NRGX has an ROE of 20.87 and an ROA of 15.03. The company's 3-year revenue growth is 51.80. The stock's RSI 5 Day is 67.24, RSI 9 Day is 63.32, and RSI 14 Day is 63.30. The stock's Momentum Index 6 - 1 Month is 9.05, and its Momentum Index 12 - 1 Month is 10.34.

Conclusion

The acquisition of NRGX shares by Saba Capital Management, L.P. represents a significant addition to the firm's portfolio. Despite the stock's poor GF Score and low profitability rank, the firm's investment could be driven by other factors such as the company's position in the Asset Management industry and its 3-year revenue growth. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article first appeared on GuruFocus.