Saba Capital Management, L.P. Bolsters Position in BlackRock Innovation & Growth Tr

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its investment portfolio with a significant addition of shares in BlackRock Innovation & Growth Trust (NYSE:BIGZ). On November 14, 2023, the firm acquired 891,548 shares of BIGZ at a trade price of $6.95, increasing its total holdings to 34,815,956 shares. This transaction has made a notable impact on the firm's portfolio, with a trade impact of 0.16% and the position in BIGZ now representing 6.3% of Saba Capital's holdings and 15.34% of BIGZ's available shares.

Insight into Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), headquartered at 405 Lexington Avenue, New York, NY, is known for its strategic investment decisions and a keen focus on value. The firm's investment philosophy is centered around identifying undervalued assets and employing a variety of strategies to realize their potential. With top holdings that include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and BlackRock Health Sciences Trust II (NYSE:BMEZ), Saba Capital has a diverse portfolio. The firm's equity stands at $3.84 billion, with a strong inclination towards the Financial Services and Technology sectors.

About BlackRock Innovation & Growth Tr

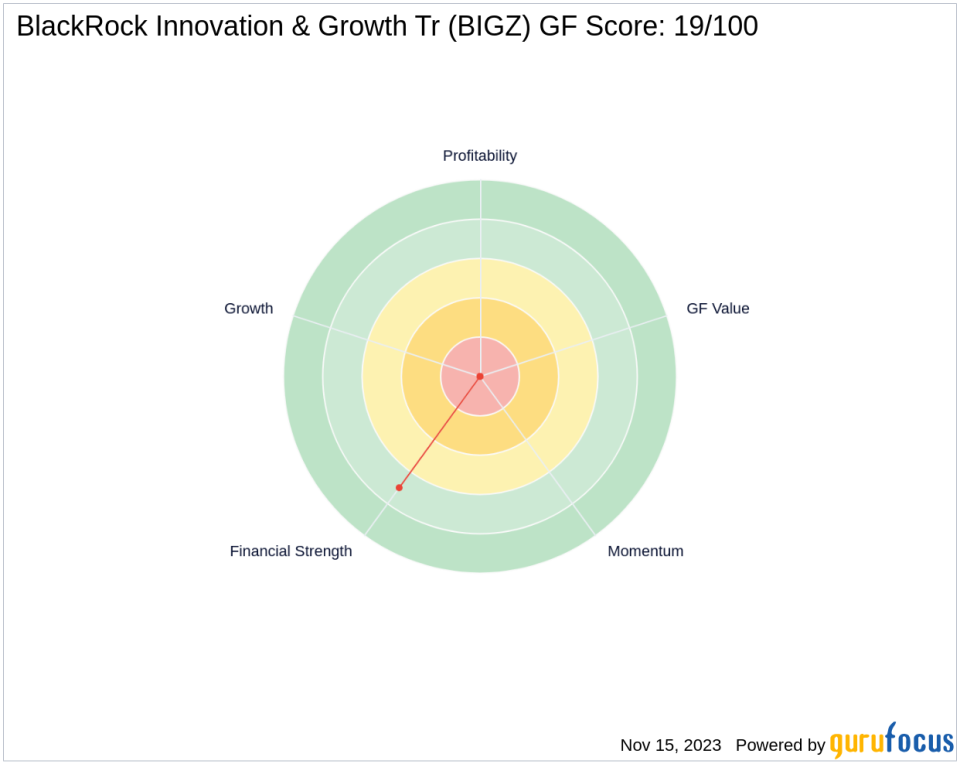

BlackRock Innovation & Growth Tr (NYSE:BIGZ) is a non-diversified, closed-end management investment company based in the USA. Since its IPO on March 26, 2021, BIGZ has aimed to deliver total return and income through a mix of current income, gains, and long-term capital appreciation. With a market capitalization of $1.61 billion and a current stock price of $7.10, BIGZ operates within the single segment of asset management. However, the stock's performance metrics, such as a GF Score of 19/100, indicate potential challenges ahead.

Trade Impact Analysis

The recent acquisition by Saba Capital Management, L.P. (Trades, Portfolio) has not only increased its stake in BIGZ but also reflects the firm's confidence in the stock's future performance. Despite BIGZ's current GF Score suggesting a lower potential for future performance, Saba Capital's increased position could signal an anticipation of positive developments for the company. The trade has resulted in a 2.63% change in shares, with the stock price experiencing a 2.16% gain since the transaction and a 3.35% year-to-date increase.

Financial Health and Performance Metrics

BIGZ's financial health and performance metrics present a mixed picture. The company's Financial Strength, as indicated by its Balance Sheet Rank of 7/10, suggests a relatively stable financial position. However, the absence of data for Profitability Rank, Growth Rank, and GF Value Rank, coupled with a GF Score of 19/100, points to potential concerns regarding its profitability and growth prospects. The stock's Momentum Rank and RSI indicators, with a 14-day RSI of 63.01, also reflect a cautious outlook for investors.

Market Performance and Valuation

Comparing BIGZ's current stock price to its historical performance reveals a significant drop of 49.82% since its IPO. The stock's valuation cannot be evaluated due to the lack of a GF Value, which is essential for determining the intrinsic value of a stock. Nonetheless, the slight uptick in stock price since the trade date suggests a cautious optimism among investors.

Investment Considerations

For value investors considering BIGZ, the lack of a GF Value and the low GF Score may raise questions about the stock's valuation and long-term performance potential. However, the firm's substantial investment and the stock's recent momentum, as indicated by RSI indicators, could be factors worth monitoring. The stock's RSI over 5, 9, and 14 days shows varying degrees of buying pressure, which could influence investment decisions.

Conclusion

The recent trade by Saba Capital Management, L.P. (Trades, Portfolio) in BlackRock Innovation & Growth Tr underscores the firm's strategic approach to portfolio management. While the financial metrics of BIGZ present a cautious outlook, the firm's increased stake could be indicative of a contrarian view or a belief in the stock's untapped potential. Value investors should weigh these factors carefully, considering both the risks and the possibilities that BIGZ presents in the current market landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.