Saba Capital Management, L.P. Bolsters Position in BlackRock Health Sciences Trust II

Introduction to the Transaction

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its investment portfolio with a significant addition of shares in BlackRock Health Sciences Trust II (NYSE:BMEZ). This strategic move underscores the firm's confidence in BMEZ's market potential and aligns with its investment philosophy. The transaction details reveal a calculated approach to bolstering Saba Capital's position in the health sciences sector.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

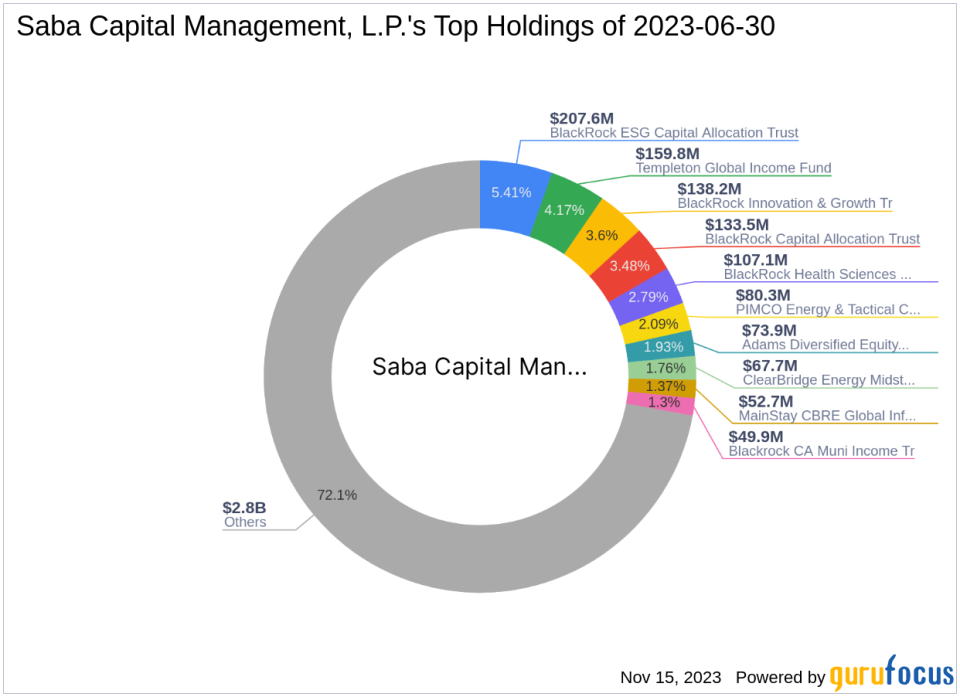

Based in New York, Saba Capital Management, L.P. (Trades, Portfolio) is a firm that has carved a niche for itself with a distinct investment philosophy focused on delivering long-term value. The firm's top holdings, which include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and BlackRock Health Sciences Trust II (NYSE:BMEZ), reflect a diversified approach with a strong inclination towards Financial Services and Technology sectors. With an equity portfolio valued at $3.84 billion, Saba Capital Management is a key player in the investment landscape.

BlackRock Health Sciences Trust II (NYSE:BMEZ) Overview

BlackRock Health Sciences Trust II operates as a closed-end management investment company with a clear objective to deliver total return through a mix of current income and long-term capital appreciation. Investing primarily in equity securities of health sciences companies, BMEZ is a significant entity in the asset management industry. With a market capitalization of $1.47 billion, BMEZ is positioned to capitalize on the growth of the health sciences sector.

Transaction Specifics

The transaction, dated November 14, 2023, saw Saba Capital Management, L.P. (Trades, Portfolio) adding 336,498 shares of BMEZ at a trade price of $13.67. This addition has increased the firm's total shareholding to 13,006,375, marking a 4.63% position in its portfolio and a 12.04% holding in BMEZ. The trade impact on the portfolio was recorded at 0.12%, indicating a strategic yet measured enhancement of Saba Capital's investment in BMEZ.

Market Performance of BMEZ

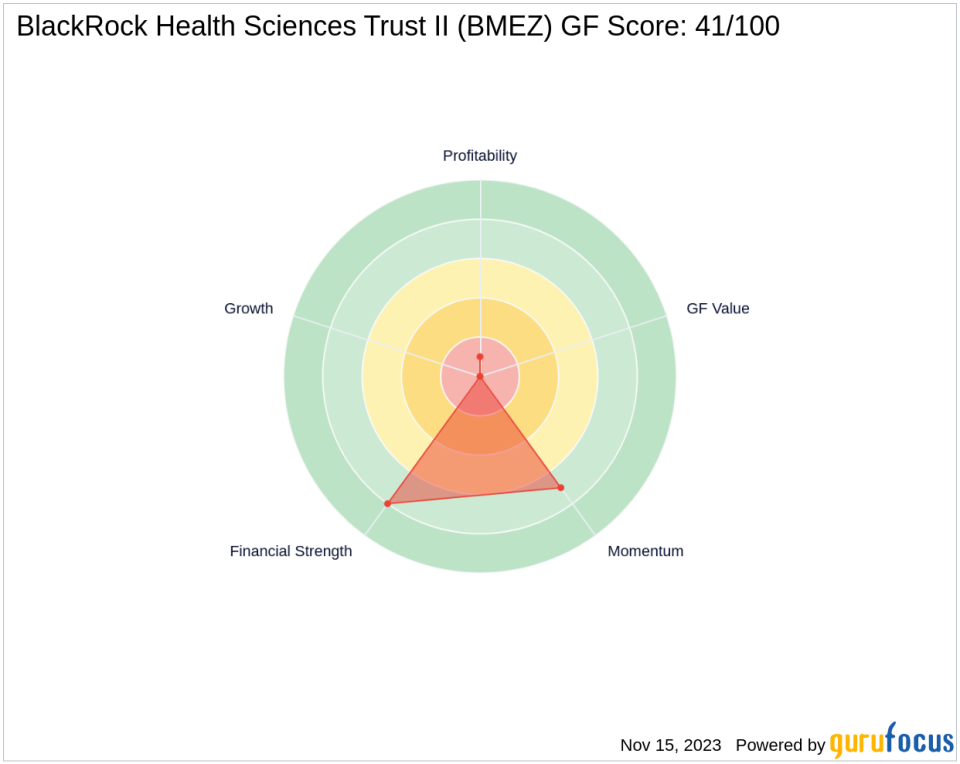

Currently, BMEZ's stock price stands at $13.59, slightly below the trade price, with a PE ratio of 27.79%. The stock has experienced a marginal decline of 0.59% since the transaction date. Year-to-date, BMEZ's performance has seen a decrease of 13.38%, while the stock has fallen 32.08% since its IPO. Despite these figures, BMEZ's GF Score of 41/100 suggests that there may be potential for future performance improvement.

Comparative Analysis

When compared to industry and sector averages, BMEZ's financial health, as indicated by its Financial Strength rank of 8/10, stands out positively. However, its Profitability Rank of 1/10 and Growth Rank of 0/10 highlight areas of concern. The stock's Momentum Rank of 7/10 suggests some short-term positive movement, despite the lack of data for GF Value Rank.

Investment Implications

The recent acquisition by Saba Capital Management, L.P. (Trades, Portfolio) is a calculated move that aligns with the firm's investment strategy. For value investors, this trade signifies a potential opportunity, given the firm's track record and the stock's financial strength. The long-term impact on Saba Capital's portfolio will depend on BMEZ's ability to navigate market challenges and capitalize on growth opportunities within the health sciences sector.

Conclusion

In summary, Saba Capital Management, L.P. (Trades, Portfolio)'s recent addition of BlackRock Health Sciences Trust II shares is a strategic decision that reflects the firm's confidence in the stock's potential. While BMEZ's current market performance shows some volatility, its financial strength and the firm's investment acumen may lead to favorable outcomes for investors who follow Saba Capital's lead.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.