Saba Capital Management, L.P. Bolsters Portfolio with Invesco Trust For Investment Grade New ...

Introduction to the Transaction

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its portfolio by adding shares of Invesco Trust For Investment Grade New York Municipals (NYSE:VTN). This move signifies a strategic investment by the firm into the municipal bond market, specifically targeting tax-exempt income. The transaction involved the acquisition of 2,208,214 shares at a price of $9.44 per share, reflecting the firm's confidence in VTN's potential for providing steady tax-free income to investors.

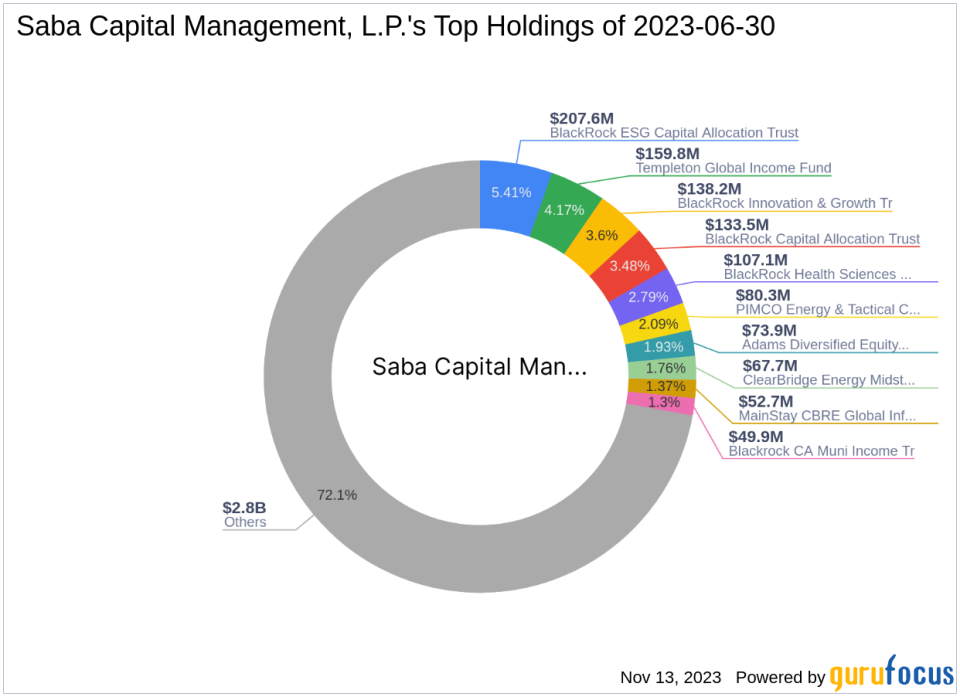

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Based in New York, Saba Capital Management, L.P. (Trades, Portfolio) is a firm known for its expertise in credit and event-driven strategies. The firm's investment philosophy revolves around deep value investing, often in instruments that are overlooked or undervalued by the market. With top holdings in various funds such as Templeton Global Income Fund (NYSE:GIM) and BlackRock Capital Allocation Trust (NYSE:BCAT), Saba Capital Management has a diverse portfolio with a significant emphasis on financial services and technology sectors. The firm manages an equity portfolio worth approximately $3.84 billion, showcasing its substantial influence in the investment community.

Overview of Invesco Trust For Investment Grade New York Municipals

Invesco Trust For Investment Grade New York Municipals is a closed-end management investment company focusing on providing its shareholders with high levels of current income exempt from federal, New York State, and New York City income taxes. With a market capitalization of $184.062 million, VTN operates within the asset management industry, a sector known for its potential to generate stable income streams for investors.

Transaction Specifics

The transaction took place on November 10, 2023, with Saba Capital Management, L.P. (Trades, Portfolio) adding 57,938 shares to its existing holdings in VTN. This trade has a minor impact of 0.01% on the firm's portfolio, yet it increases the firm's position in VTN to a significant 11.34%. The current stock price of $9.45 slightly exceeds the trade price, indicating a marginal gain since the acquisition.

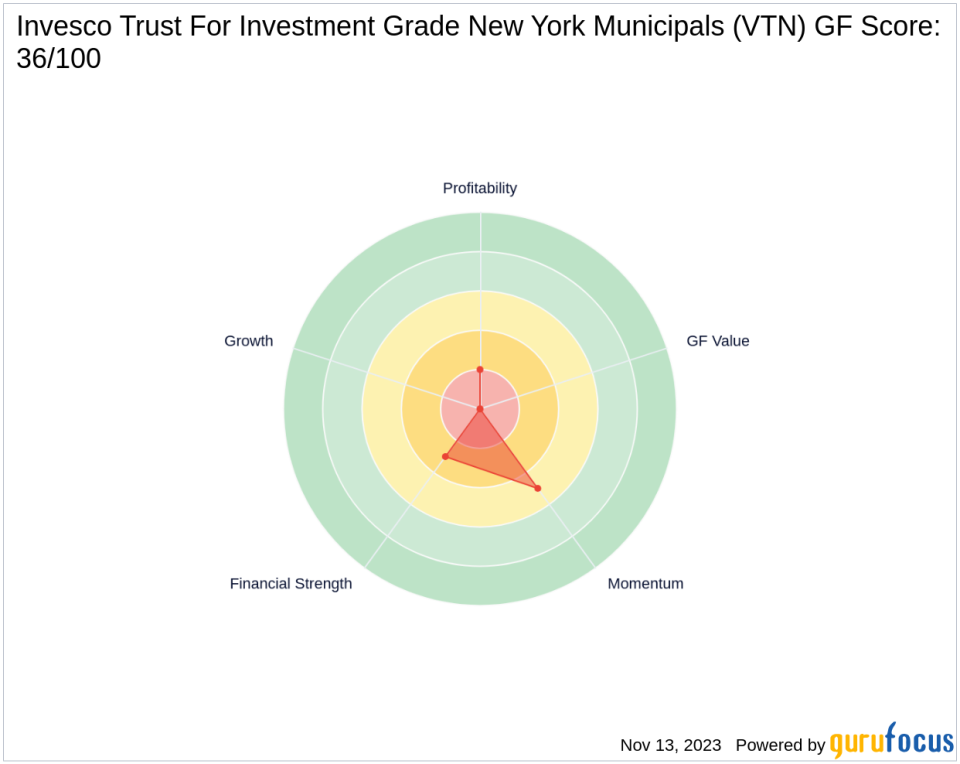

Stock Performance and Valuation

VTN's stock price has experienced a year-to-date decline of 6.71%, with a significant drop of 36.49% since its IPO. The stock's GF Score stands at 36 out of 100, suggesting poor future performance potential. The stock's financial health indicators, such as the Financial Strength and Profitability Rank, are also less than ideal, with scores of 3/10 and 2/10, respectively.

Market Reaction and Future Outlook

Despite the lackluster performance metrics, VTN's stock has shown recent momentum, with RSI indicators suggesting a potential short-term uptick. The 5-day RSI stands at a high 89.56, while the 14-day RSI is at 71.15, indicating that the stock may be overbought at the moment. However, the firm's investment in VTN aligns with its strategy of seeking value in underappreciated assets, and the tax-exempt income offered by VTN could be attractive in the current market environment.

Comparative Analysis

When compared to industry averages, VTN's financial ratios and ranks do not stand out. The firm's investment in VTN, however, may be driven by factors beyond immediate financial metrics, such as the potential for stable, tax-free income and the opportunity to capitalize on market inefficiencies.

Closing Summary

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)'s recent acquisition of shares in Invesco Trust For Investment Grade New York Municipals is a calculated addition to its diverse portfolio. While VTN's stock performance and valuation metrics may not be compelling at first glance, the firm's investment strategy and the stock's tax-exempt income potential could offer value to discerning investors. As the market continues to evolve, this transaction may prove to be a strategic move by Saba Capital Management, L.P. (Trades, Portfolio) in the long run.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.