Saba Capital Management, L.P. Bolsters Position in Nuveen New Jersey Quality Municipal Income Fund

Introduction to the Transaction

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently expanded its portfolio with a significant addition of shares in the Nuveen New Jersey Quality Municipal Income Fund (NYSE:NXJ). On November 10, 2023, the firm executed an addition of 131,575 shares in NXJ, at a trade price of $10.83 per share. This transaction has increased Saba Capital Management's total holdings in NXJ to 4,496,561 shares, marking a notable trade impact of 0.04% and positioning the firm's stake at 10.90% of their total shares.

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), headquartered at 405 Lexington Avenue, New York, NY, is known for its strategic investment philosophy that focuses on value and special situations. With a diverse portfolio comprising 624 stocks, the firm's top holdings include Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and BlackRock Health Sciences Trust II (NYSE:BMEZ), among others. The firm's equity stands at $3.84 billion, with a strong inclination towards the Financial Services and Technology sectors.

Nuveen New Jersey Quality Municipal Income Fund (NYSE:NXJ) Overview

The Nuveen New Jersey Quality Municipal Income Fund is a USA-based closed-end investment management company, with a focus on providing income exempt from federal and New Jersey income tax. The fund aims to enhance portfolio value by investing in underrated or undervalued tax-exempt municipal bonds. With a market capitalization of $447.721 million and a current stock price of $10.85, NXJ operates within a single segment of the asset management industry.

Analysis of the Trade Impact

The recent acquisition by Saba Capital Management, L.P. (Trades, Portfolio) has increased its position in NXJ to 1.27% of the firm's portfolio. This strategic move aligns with the firm's investment philosophy and reflects a calculated approach to capitalizing on the potential of NXJ within the municipal bond market. The trade's share change and the firm's overall strategy indicate a confidence in NXJ's future performance and a commitment to leveraging tax-exempt income opportunities.

Market Performance of NXJ

Nuveen New Jersey Quality Municipal Income Fund has experienced a slight gain of 0.18% in its stock price since the trade date, with a year-to-date change of -5.41%. Since its IPO on March 27, 2001, the stock has seen a price change of -27.67%. Despite these fluctuations, the firm's recent investment suggests a belief in the fund's resilience and potential for recovery.

Valuation and Performance Metrics

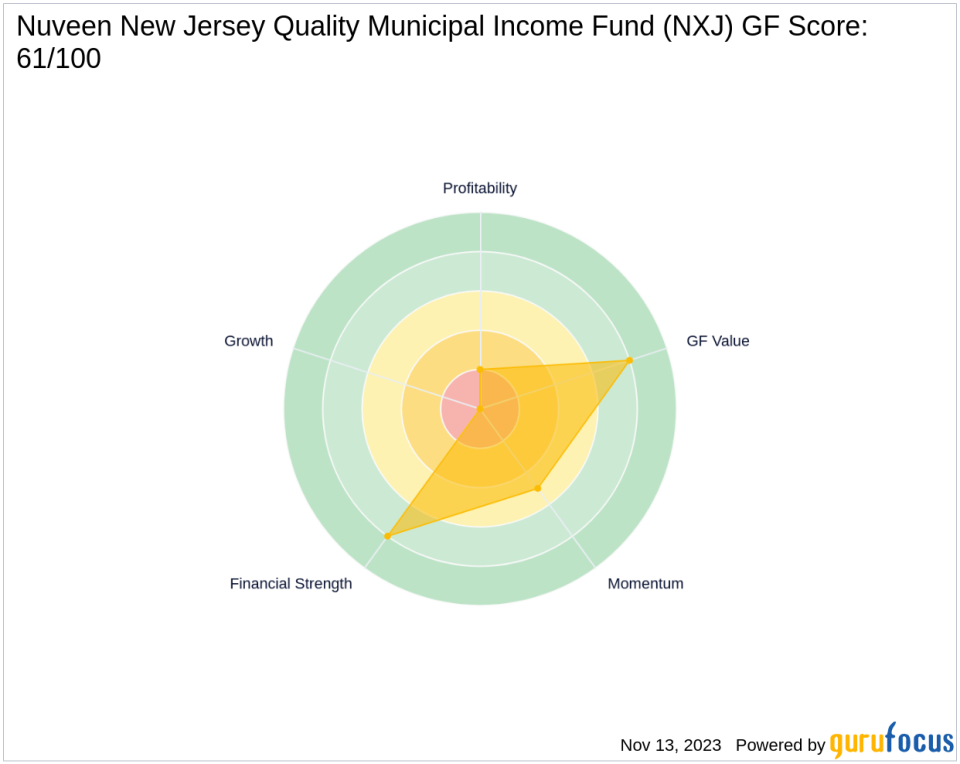

NXJ's current GF Value stands at $22.81, with a price to GF Value ratio of 0.48, indicating that the stock may be undervalued. However, the designation of "Possible Value Trap, Think Twice" suggests that investors should exercise caution. The fund's GF Score is 61/100, which points to a moderate future performance potential. Additionally, NXJ holds a GF Value Rank of 8/10, suggesting a favorable valuation compared to peers.

Financial Health and Future Prospects

The financial health of NXJ is reflected in its Balance Sheet Rank of 8/10, indicating a strong financial position. However, the Profitability Rank is low at 2/10, and the Growth Rank is not applicable, signaling challenges in profitability and growth. The Piotroski F-Score of 3 further underscores the need for improvement in financial stability. Despite these concerns, Saba Capital Management, L.P. (Trades, Portfolio)'s investment may be based on a long-term perspective and the fund's potential to navigate through current challenges.

Conclusion

Saba Capital Management, L.P. (Trades, Portfolio)'s recent trade in NXJ underscores the firm's strategic approach to value investing and its confidence in the fund's ability to provide tax-exempt income. While NXJ's financial metrics present a mixed picture, the firm's increased stake suggests a belief in the fund's intrinsic value and future prospects. Investors will be watching closely to see how this investment aligns with Saba Capital Management's broader portfolio strategy and whether NXJ can fulfill its potential in the coming years.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.