Saba Capital Management, L.P. Reduces Stake in Kayne Anderson NextGen Energy and Infrastructure Inc

Overview of Saba Capital Management's Recent Trade

On November 7, 2023, Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, executed a significant transaction involving Kayne Anderson NextGen Energy and Infrastructure Inc (NYSE:KMF). The firm decided to reduce its holdings in KMF by 1,519,401 shares, resulting in a 33.08% change in its position. This trade impacted the firm's portfolio by -0.27%, with the shares being traded at a price of $6.88. Post-transaction, Saba Capital Management holds 3,073,599 shares of KMF, which constitutes 0.55% of its portfolio and represents a 7.66% ownership in the traded company.

Insight into Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), based at 405 Lexington Avenue, New York, NY, is a firm with a robust investment philosophy that manages an equity portfolio worth $3.84 billion. The firm's top holdings include a diverse range of assets such as Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and others within the Financial Services and Technology sectors. With 624 stocks in its portfolio, Saba Capital Management is a significant player in the investment landscape.

Portfolio Composition of Saba Capital Management

Saba Capital Management's portfolio is well-diversified, with top holdings that span across various sectors. The firm's recent transaction has altered its position in Kayne Anderson NextGen Energy and Infrastructure Inc, yet KMF still remains a notable holding, accounting for 0.55% of the firm's total portfolio and 7.66% of KMF's outstanding shares.

Company Overview of Kayne Anderson NextGen Energy and Infrastructure Inc

Kayne Anderson NextGen Energy and Infrastructure Inc, trading under the symbol KMF in the USA since its IPO on November 24, 2010, is a non-diversified, closed-end fund. The company focuses on delivering a high level of total return with an emphasis on cash distributions. KMF primarily invests in securities of Energy Companies and Infrastructure Companies, including public MLPs, midstream C-corporations, and energy-related debt.

Financial and Market Analysis of KMF

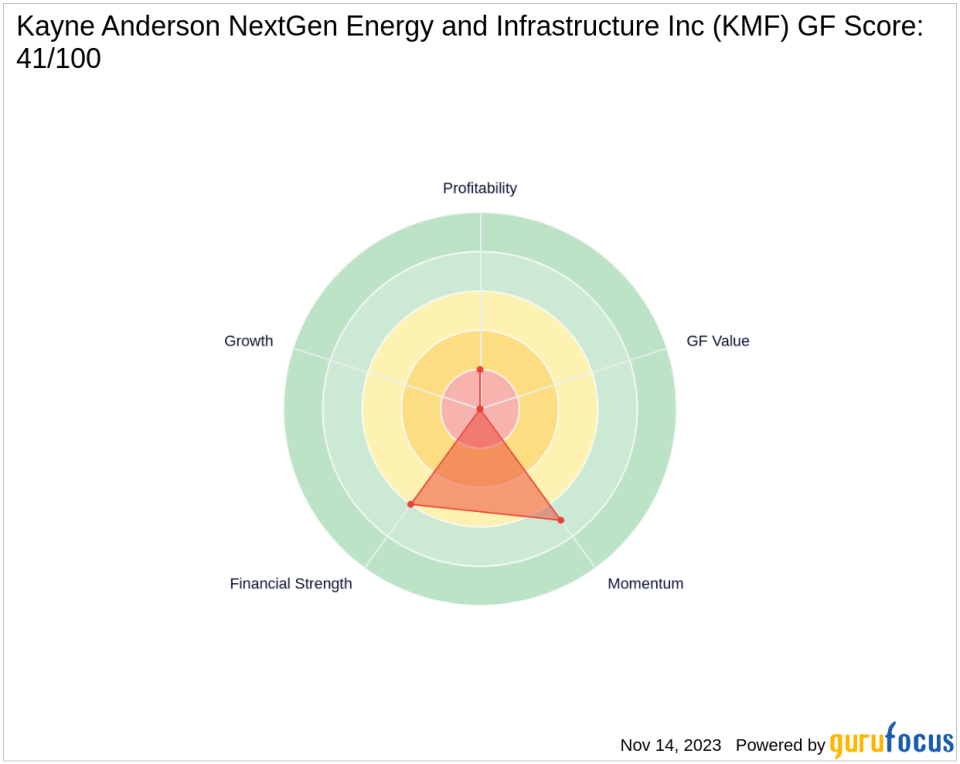

As of the latest data, Kayne Anderson NextGen Energy and Infrastructure Inc has a market capitalization of $316.931 million, with a current stock price of $6.715. The company's performance metrics, such as the PE percentage, are not applicable as the company is at a loss. The GF Score for KMF stands at 41/100, indicating poor future performance potential.

Stock Performance and Valuation Metrics

Since its IPO, KMF's stock price has decreased by 73.14%, with a year-to-date decline of 6.87%. Following the transaction by Saba Capital Management, the stock experienced a slight decrease of 2.4%. Valuation metrics such as the GF Value are not available, indicating that the current value cannot be evaluated.

Impact and Rationale Behind Saba Capital Management's Trade

The reduction in KMF shares by Saba Capital Management has a moderate impact on its portfolio, decreasing its exposure to the energy and infrastructure sector. While the specific rationale behind the firm's decision is not publicly disclosed, it could be influenced by the stock's performance metrics, market conditions, or a strategic shift in investment focus.

Market Reaction and Future Outlook for KMF

The market's reaction to the transaction has been relatively muted, with KMF's RSI indicators showing a neutral to slightly oversold condition. The stock's future outlook, based on financial ranks and growth metrics, remains cautious given its low GF Score and the absence of positive growth indicators. Investors will be watching closely for any changes in the company's strategy or market dynamics that could influence its performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.