Saba Capital Management, L.P. Reduces Stake in Tortoise Energy Independence Fund, Inc.

Overview of Saba Capital Management's Recent Trade

Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, has recently adjusted its investment in Tortoise Energy Independence Fund, Inc. (NYSE:NDP). On November 7, 2023, the firm reduced its position in NDP by 25,361 shares, resulting in a 15.91% change in its holdings. This transaction had a minor impact of -0.02% on the firm's portfolio, with the trade executed at a price of $31.76 per share. Following the trade, Saba Capital Management holds a total of 133,996 shares in NDP, which represents 0.11% of its portfolio and 8.04% of the company's outstanding shares.

Insight into Saba Capital Management, L.P. (Trades, Portfolio)

Located at 405 Lexington Avenue in New York, Saba Capital Management, L.P. (Trades, Portfolio) is a firm with a strategic investment philosophy that has garnered attention in the financial services sector. With an equity portfolio valued at $3.84 billion, the firm has a diverse range of top holdings, including Templeton Global Income Fund (NYSE:GIM), BlackRock Capital Allocation Trust (NYSE:BCAT), and others in the financial services and technology sectors.

Understanding Tortoise Energy Independence Fund, Inc. (NYSE:NDP)

Tortoise Energy Independence Fund, Inc. is a non-diversified closed-end management investment company based in the USA. NDP primarily invests in North American energy companies focused on exploration and production, with a strong presence in shale reservoirs. The company's market capitalization stands at $50.73 million, and it has been navigating the volatile energy sector with a current stock price of $30.45.

Trade Impact Analysis

The recent trade by Saba Capital Management has slightly reduced its exposure to NDP, which now constitutes a modest 0.11% of its portfolio. The trade price of $31.76 is now above the current stock price of $30.45, indicating a potential calculated move by the firm as the stock has seen a -4.12% decline since the transaction date.

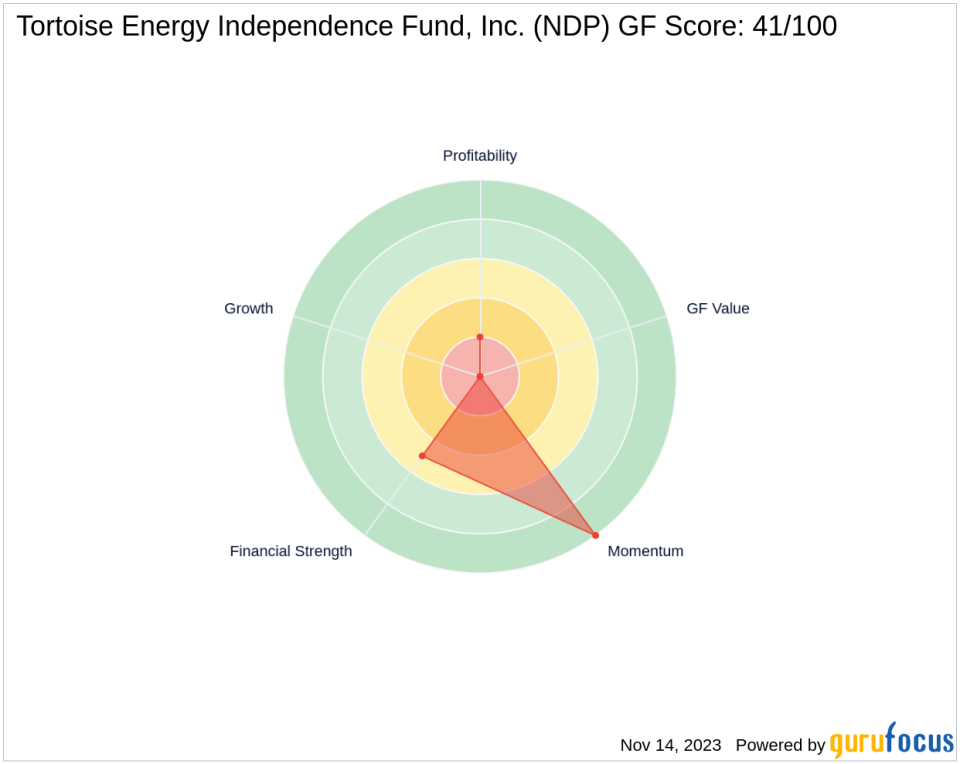

Financial Health and Performance Metrics of NDP

NDP's financial health presents a mixed picture. The company's Financial Strength is rated at 5/10, while its Profitability Rank lags at 2/10. Growth prospects are currently non-existent, with a Growth Rank of 0/10. However, the stock boasts a strong Momentum Rank of 10/10, suggesting recent market trends have been favorable.

Market Reaction and Valuation Insights

Since the trade, NDP's stock price has experienced a slight decline, and its year-to-date performance shows a modest increase of 6.1%. The lack of a GF Score and GF Value Rank indicates that there is not enough data to evaluate the stock's intrinsic value or predict its future performance accurately.

Comparative Industry Analysis

When compared to industry benchmarks, NDP's performance is underwhelming, particularly in terms of profitability and growth. The asset management industry is competitive, and NDP's current position reflects the challenges faced by investment companies in the energy sector.

Concluding Thoughts on Saba Capital Management's Trade Decision

In conclusion, Saba Capital Management's decision to reduce its stake in NDP appears to be a strategic move in response to the company's mixed financial health and uncertain growth prospects. While the firm maintains a significant position in NDP, the recent trade suggests a cautious approach to this energy sector investment. Investors will be watching closely to see how this decision plays out in the context of Saba Capital Management's broader portfolio strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.